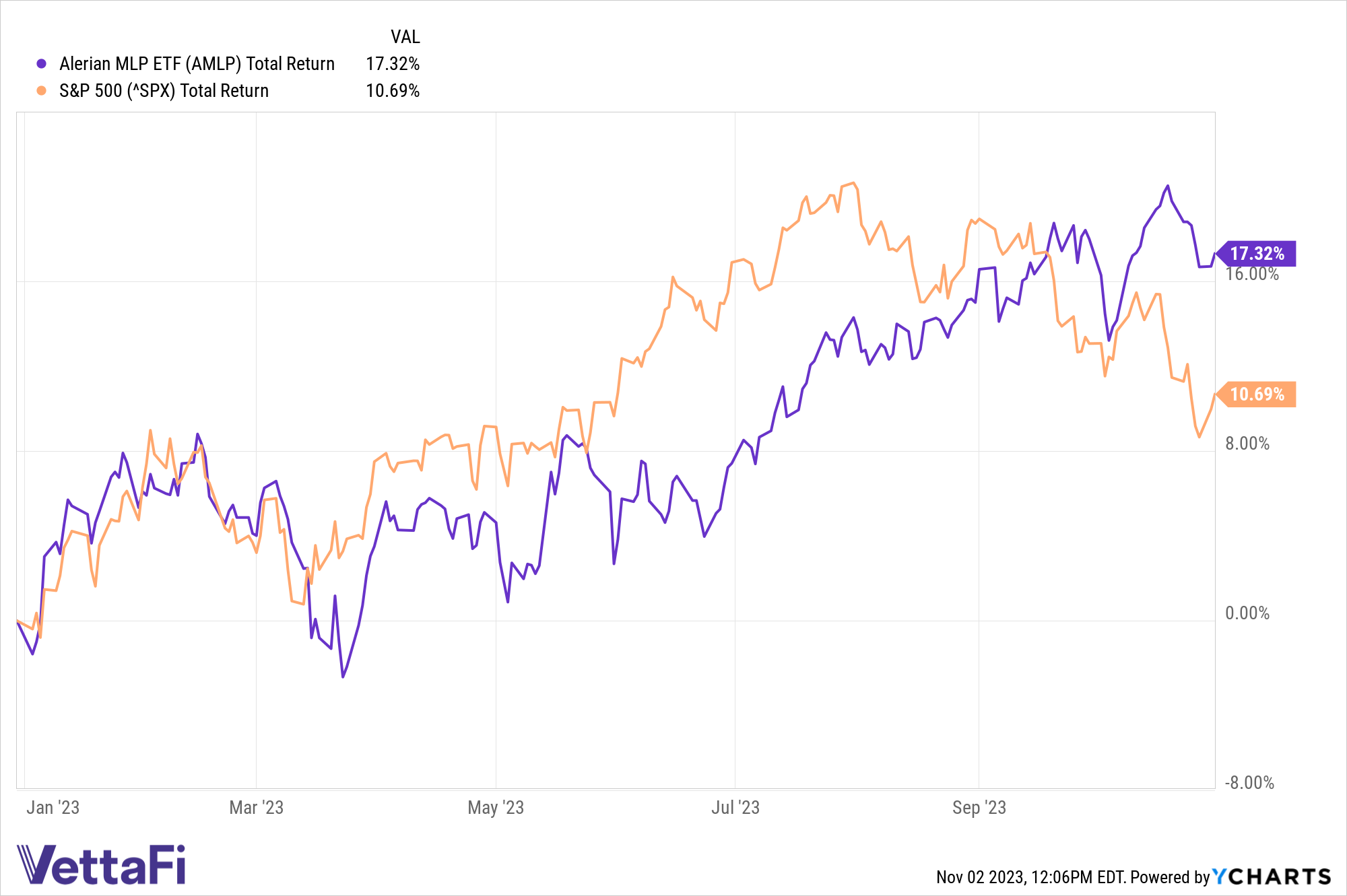

Supported by positive distribution trends and M&A activity, MLPs have impressively outperformed year-to-date through October.

Despite falling oil prices and a struggling equity market, the Alerian MLP ETF (AMLP) held relatively steady in October, declining just 0.57%. The fund handily outpaced broader energy and the S&P 500, which dropped 5.74% and 2.10%, respectively, during the month.

As volatility in both equity and commodity markets increased, energy prices were mixed. WTI oil prices fell more than 10% last month, while natural gas prices climbed over 22%, reaching a nine-month high in October.

AMLP is on track to outperform the S&P 500 in 2023, which would mark the third consecutive year of outperformance. AMLP is up 17.32% on a total return basis year-to-date through October.

MLPs are also providing more generous yields than the corporate bond benchmark as well as other equity income investments. AMLP’s underlying index was yielding 7.96% and trading slightly below its three-year average forward EV/EBITDA multiple at the end of October.

See more: “MLPs Stand Out as Rising Rates Challenge Income Plays”

Distribution Updates

Positive distribution trends have been a tailwind for MLPs this year. As third-quarter earnings are underway, all of AMLP’s holdings have announced their distributions to be paid in the fourth quarter. Five constituents increased their payouts sequentially with the rest maintaining.

See more: “Several Midstream Companies Grow Q3 Dividends”

MPLX LP (MPLX) grew its quarterly distribution by 9.7% over the prior quarter. This marks the second year in a row of approximately 10% distribution growth.

Meanwhile, Hess Midstream (HESM) and Western Midstream (WES) each increased quarterly distributions by 2.7% and 2.2%, respectively.

Finally, Delek Logistics Partners (DKL) and Energy Transfer (ET) each increased third-quarter distributions by about 1% compared to the second quarter of 2023.

AMLP saw strong flows last month. The fund accrued $72 million in October, bringing year-to-date net flows to $150 million.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.