In an environment of ongoing macro risks, oil prices remain volatile. Investors seeking energy sector exposure but concerned about oil and gas volatility should look to midstream Master Limited Partnerships (MLPs) for income stability and more defensive energy exposure.

West Texas Intermediate oil prices crossed above $80USD a barrel for the first time this year in March, peaking at nearly $87USD a barrel. However, prices slid in the last week on macro and geopolitical risk concerns. WTI crude prices closed today down nearly $8USD from March highs according to CNBC data.

Looking Beyond Oil Commodity Exposure for Opportunity

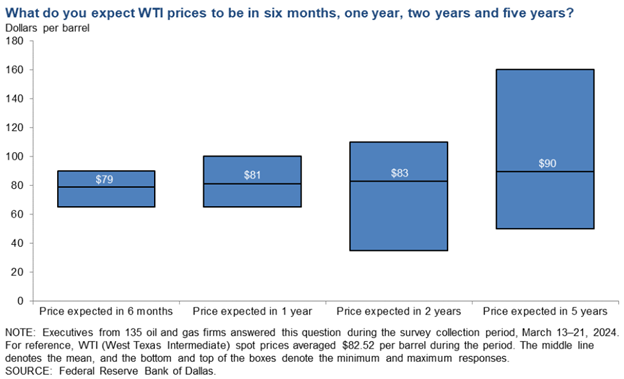

Despite pronounced price volatility in the first quarter, oil and gas firms predict relative price stability in the near term.

Image source: Dallas Fed Energy Survey

At the time of the first quarter Dallas Fed Energy Survey in March, prices sat near $82.50 a barrel.

It’s a sharp contrast to current worries surrounding oil price momentum in the larger macro environment. For energy investors concerned about oil price momentum or volatility, it’s worth looking beyond the commodity itself for opportunity.

Oil prices would need to fall substantially to disrupt production, and that level of weakness is unlikely. Exploration and production firms surveyed by the Dallas Fed between March 13-21 reported an average price of $31-$45 per barrel to cover their operating expenses for existing wells. This ranged from an average of $31 a barrel in the Permian Delaware region to $45 a barrel for non-shale U.S. outside the Permian and Oklahoma regions.

It would likely take a significant or prolonged drawdown in oil prices to impact production. For midstream MLPs, it means potential added stability in an environment of elevated oil price volatility.

Capture Income Within Energy and Reduce Volatility

Investors concerned about oil price momentum and volatility would do well to look to the midstream space. Midstream MLPs store, process, and transport oil and natural gas. Because their business is fee-based, MLPs provide less exposure to oil and gas price volatility and drawdowns. This provides added stability for income investors.

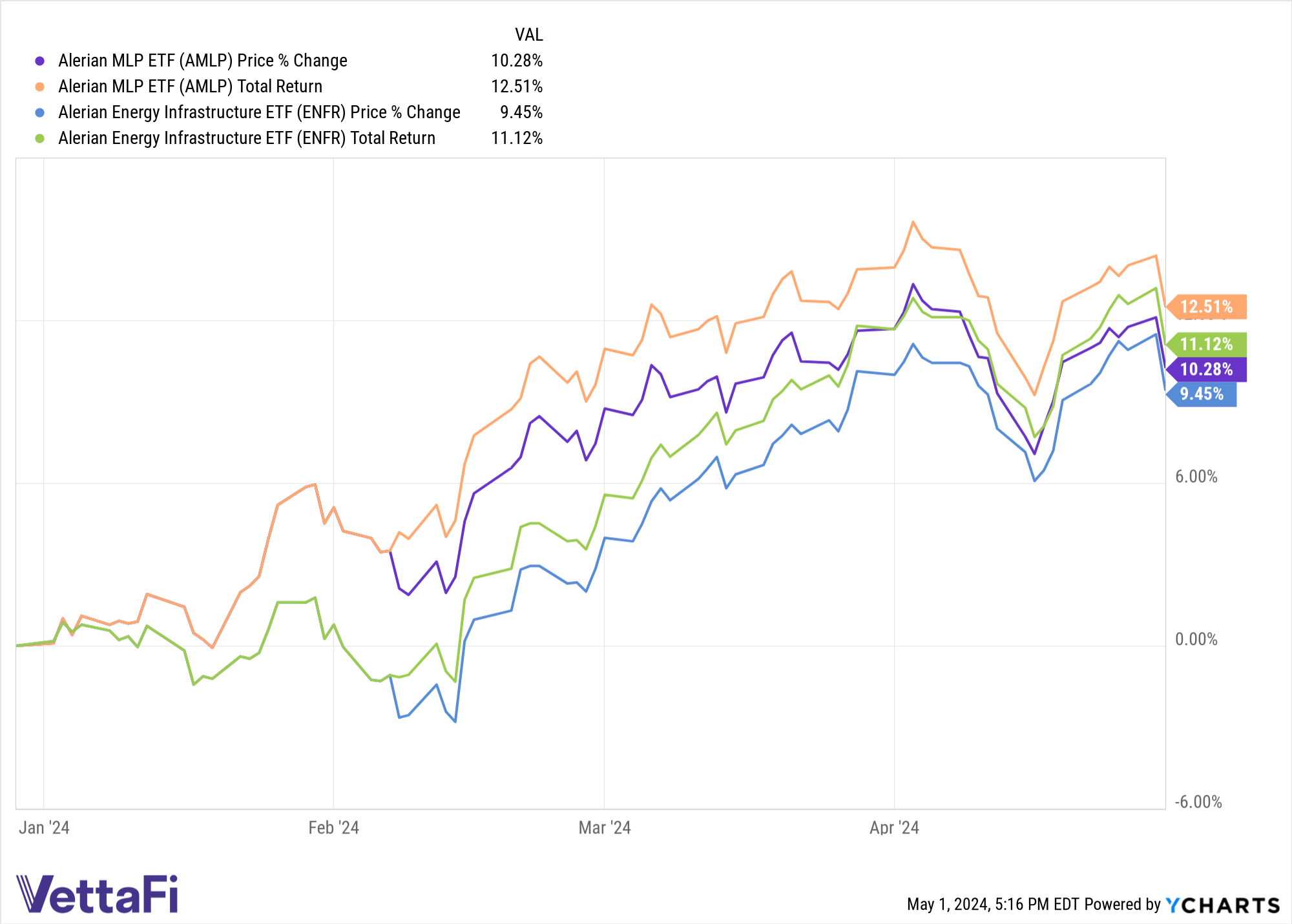

The Alerian MLP ETF (AMLP) seeks to track the performance of the Alerian MLP Infrastructure Index (AMZI). The index contains MLPs that derive most of their cash flow from midstream activities.

The Alerian Energy Infrastructure ETF (ENFR) seeks to track the performance of the Alerian Midstream Energy Select Index (AMEI). The index contains energy infrastructure MLPs and corporations within North America.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and ENFR, for which it receives an index licensing fee. However, AMLP and ENFR are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and ENFR.

For more news, information, and analysis, visit the Energy Infrastructure Channel.