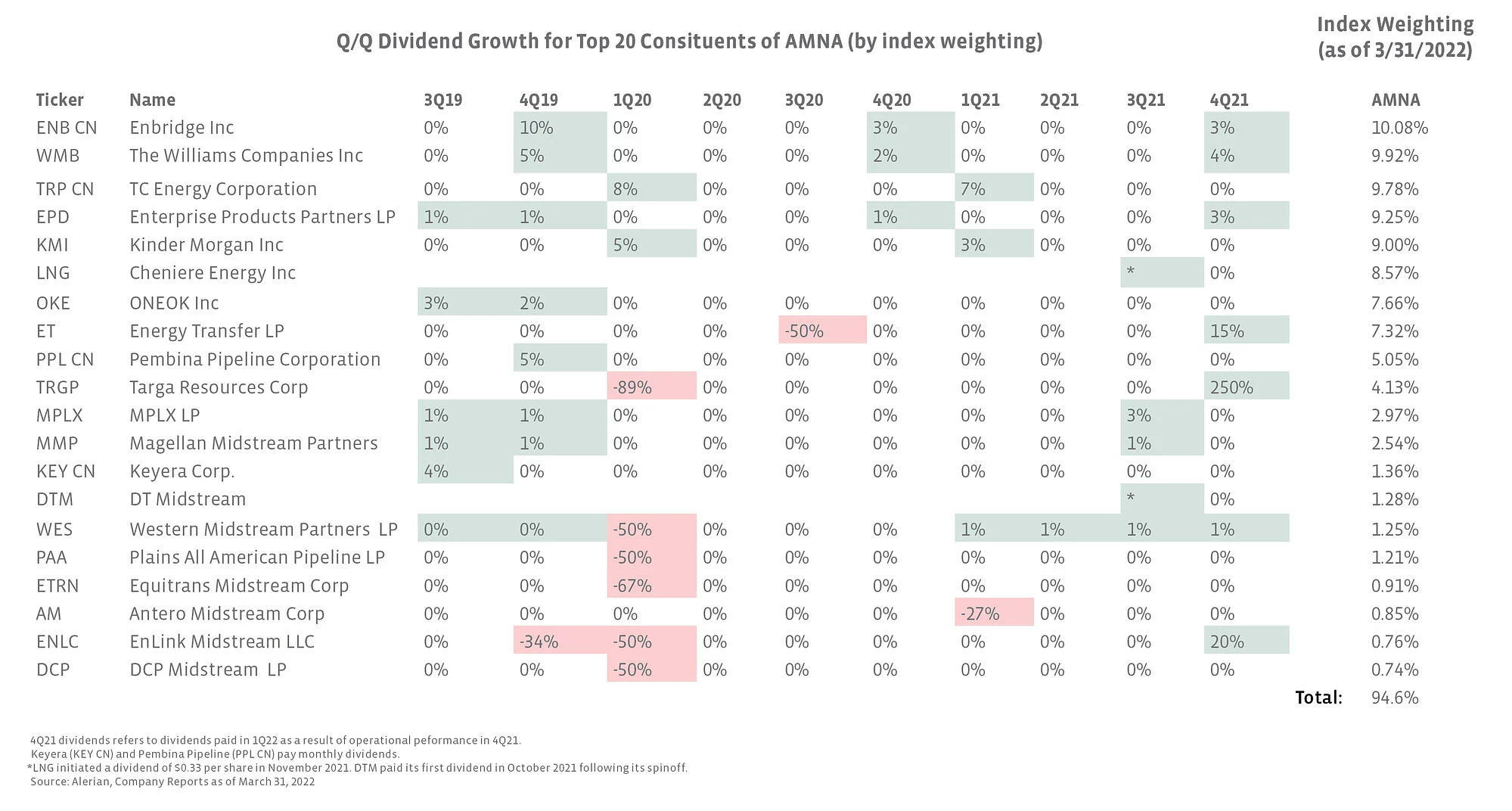

One of the key themes for the midstream and MLP space in 2022 has been the meaningful return of dividend growth. For investors that largely use the midstream space for its income, this has been a welcomed development, particularly as inflation has caused purchasing power to erode. For some names, growth has been consistent, even through periods of macro volatility as seen in 2020. Other names chose to reduce their payouts to conserve cash and shore up their balance sheets particularly in the spring of 2020 when the impact of the pandemic on energy markets was most acute. Today, consistent growers are continuing to execute, and names that cut in the past (or paused growth) are starting to grow again as balance sheets have improved and free cash flow generation has been strong. These positive trends are evident in the sequential changes to payouts shown below.

This table shows quarterly dividend changes for the top twenty names in the Alerian Midstream Energy Index (AMNA), which is Alerian’s broadest midstream benchmark of MLPs and corporations. Most cuts were concentrated in 1Q20, with Energy Transfer (ET) and Antero Midstream (AM) as exceptions. For 3Q21 and 4Q21, there has been a clear increase in the number of names growing their payouts. For example, seven of twenty names announced a sequential dividend increase for 4Q21 (the dividend paid in 1Q22 as a result of 4Q21 performance) – this compares to only three names with sequential dividend increases for 4Q20. Notably, select names that cut in the past provided double-digit percentage growth for 4Q21 off a lowered base, including ET, Targa Resources (TRGP), and EnLink Midstream (ENLC).

Looking ahead to 1Q22 payouts, growth is expected to continue. TC Energy (TRP) has already declared a 3.4% increase for its April payout. Western Midstream (WES) and Plains All American (PAA) have guided to distribution increases of 53% and 21%, respectively, for their next payouts. DCP Midstream (DCP) also expects to increase its distribution this year, targeting a 10% hike (read more).

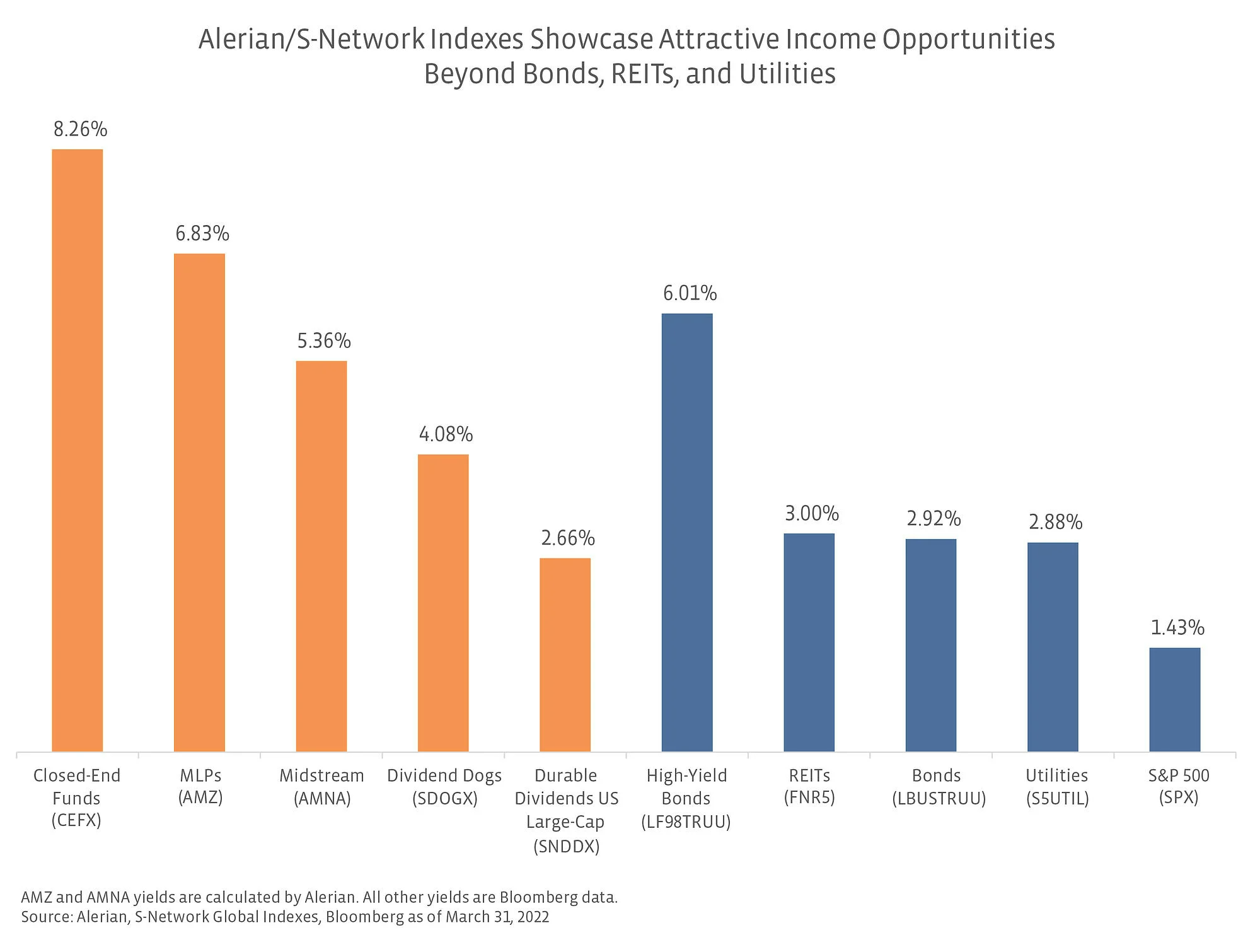

Today’s dividend growth is stemming from improved financial flexibility as companies have made progress with strengthening their balance sheets and continue to generate significant free cash flow. Alongside rising dividends, many companies have also been active with buyback programs. While midstream continues to be known for its income, the outlook for total return has improved with the more constructive macro energy backdrop and the proliferation of buyback programs. In the first quarter, the AMNA Index was up 24.0% on a total-return basis, significantly outpacing the -4.6% total return for the S&P 500.

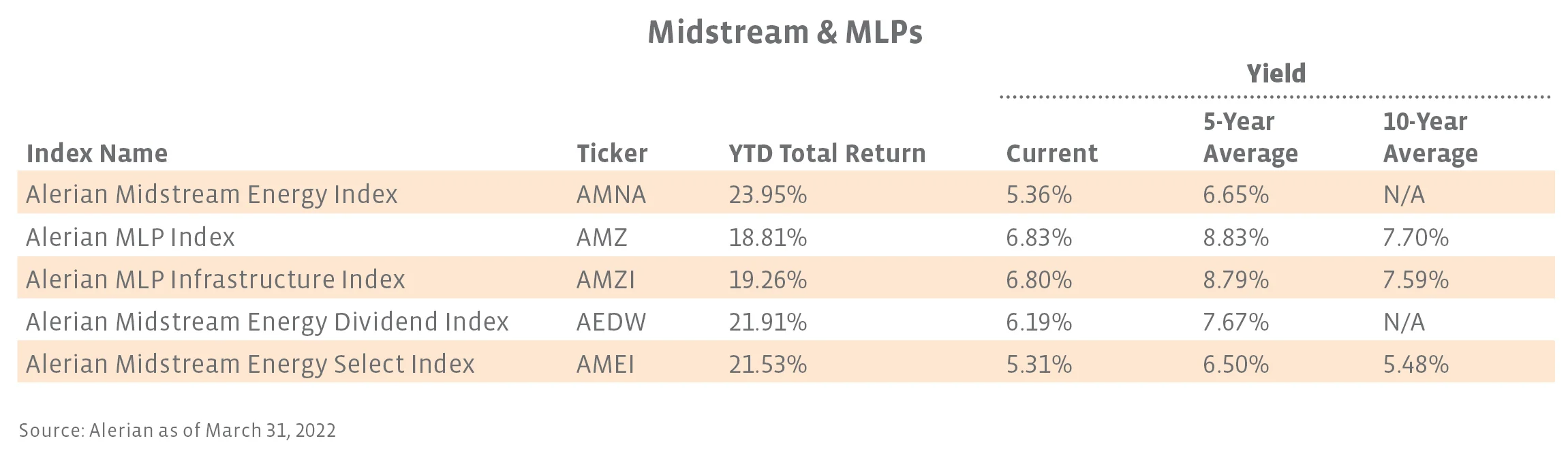

Current Yields vs. History

Midstream/MLPs offer both attractive yields and the potential for total return. Strength in energy prices stemming from geopolitical risk and inflation concerns have contributed to a strong start to 2022 for midstream/MLPs compared to other sectors. Current yields are below their historical averages.

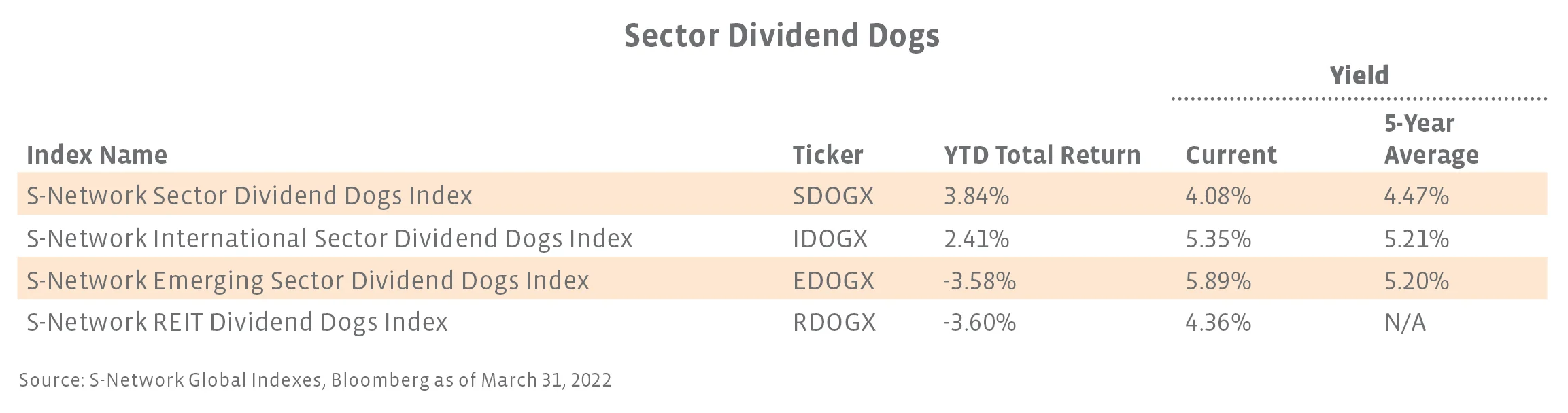

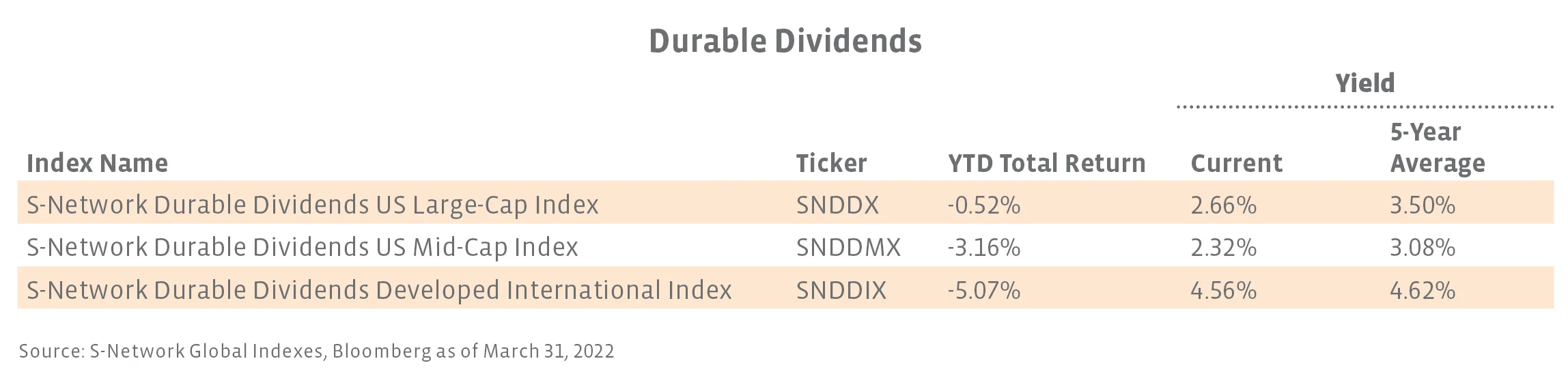

The current yield for SDOGX is below its historical average but IDOGX and EDOGX are yielding slightly above their five-year average.

Multiple screens for dividend durability, including evaluating cash flows, EBITDA, and debt-to-equity ratios, help ensure reliable income from the durable dividend indexes.

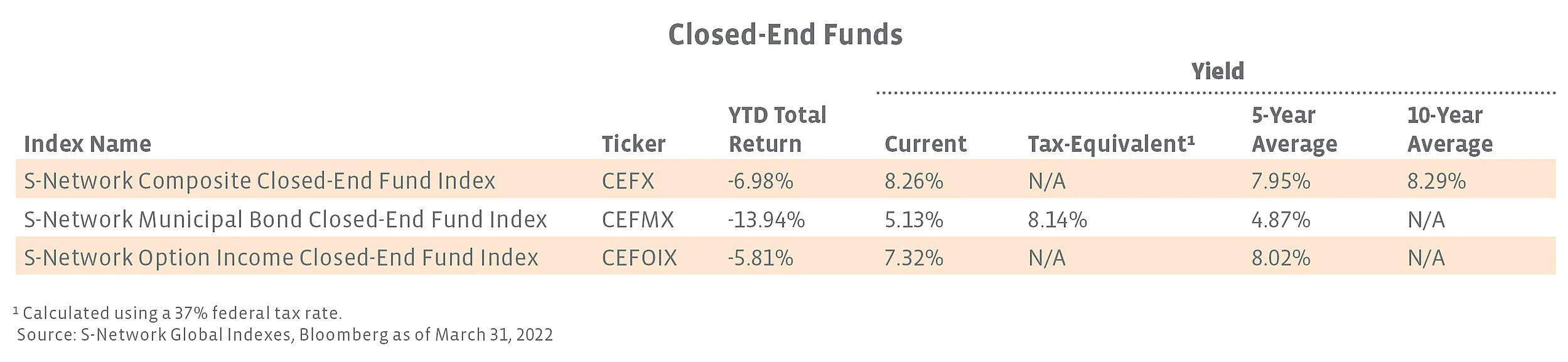

Current yields for closed-end fund indexes are mixed relative to historical averages but continue to represent a compelling income opportunity.

Related research:

4Q21 Midstream Dividends: Goodbye Cuts and Hello Growth

MLPs Leading the Way for Midstream Buybacks in 4Q21

SDOGX Fetches Higher Yields and YTD Outperformance

Income Opportunities: MLPs, CEFs, and Return of Capital

Income Opportunities: Examining Price and Total Return in 2021

Income Opportunities: Finding Income in an Inflationary Environment

Originally published by Alerian on April 7, 2022.

For more news, information, and strategy, visit the Energy Infrastructure Channel.