The largest MLP ETF available to investors saw a jump in investor attention last month as energy prices and sentiment continued to improve.

The Alerian MLP ETF (AMLP) accreted $132 million in net flows in August, marking the second consecutive month of positive flows. The fund is a composite of energy infrastructure MLPs that earn most of their cash flow from midstream activities.

See more: “How to Use Energy Infrastructure ETFs in Portfolios”

Energy commodities saw modest price gains in August, with oil and natural gas prices up 2.24% and 5.08%, respectively.

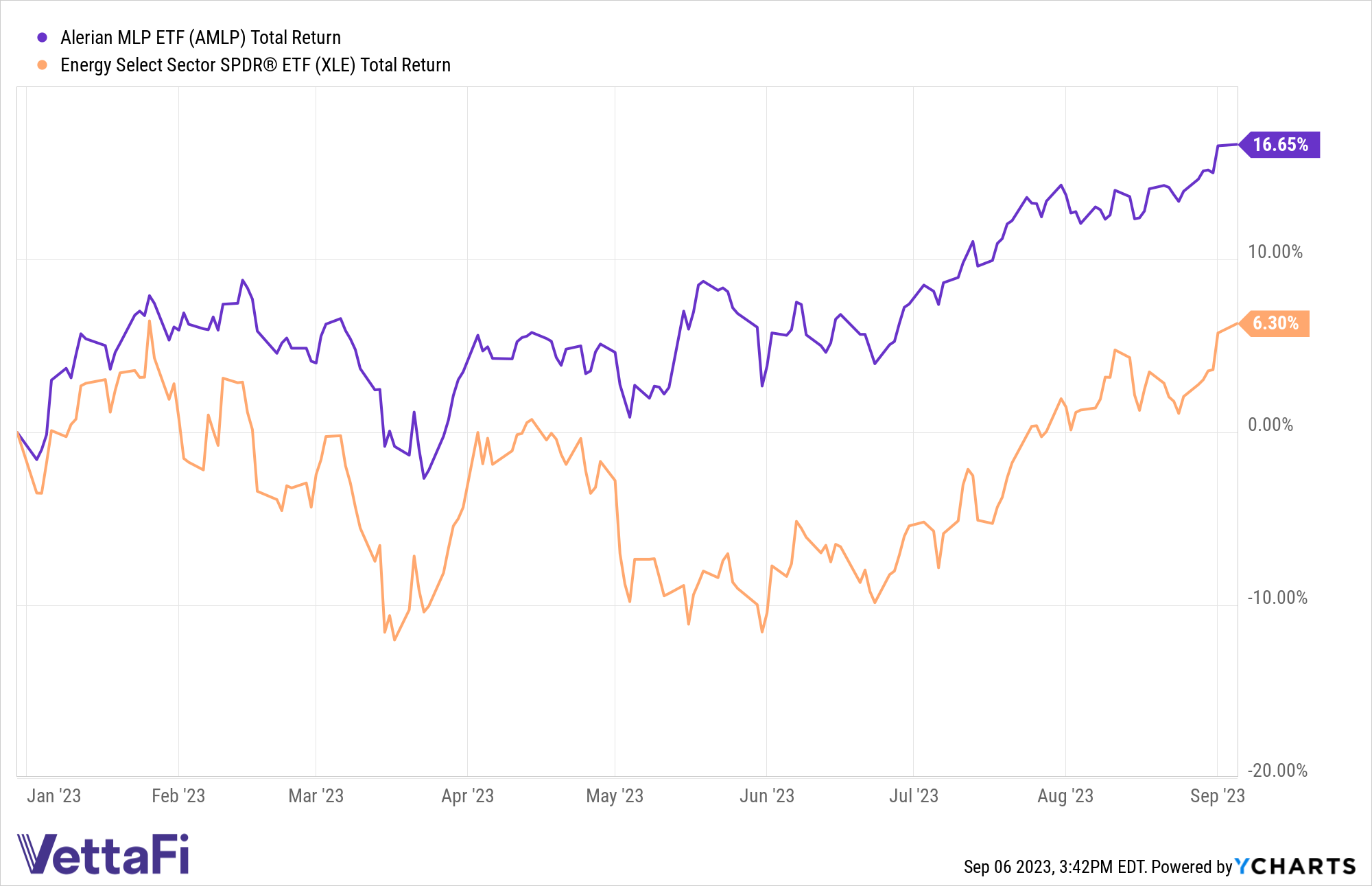

AMLP advanced 0.62% in August, slightly underperforming broader energy. However, year to date through August, AMLP is up 15.00% on a total return basis, handily outpacing broader energy indexes.

AMLP’s underlying index was yielding 7.62% as of August 31. The fund paid a third-quarter 2023 distribution of $0.83 to shareholders in mid-August.

How MLP ETFs React to Fluctuating Commodity Prices

MLPs have benefitted from having less commodity price exposure this year. MLPs are less sensitive to moves in commodity prices given their fee-based business models, which support stable cash flows.

If oil prices continue to increase, however, MLPs can benefit from improved sentiment. Conversely, MLPs are likely to hold up better than other energy sectors if oil prices decline, as has been demonstrated for much of 2023.

Energy prices have continued to strengthen in September. Saudi Arabia and Russia on Tuesday announced they would extend voluntary cuts to oil production until the end of the year, prompting a rally in oil prices. Brent, the international crude benchmark, rose above $90 a barrel for the first time since last November.

OPEC+ initially announced production decreases last October with further surprise cuts in April.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.