Summary:

- Distribution coverage measures the affordability of an MLP’s distribution by comparing distributable cash flow (DCF) to the MLP’s total payout.

- The focus on distribution coverage has diminished somewhat as other factors have allowed for confidence in MLP distributions, including solid free cash flow generation, enhanced financial flexibility, and more sustainable payout levels for some.

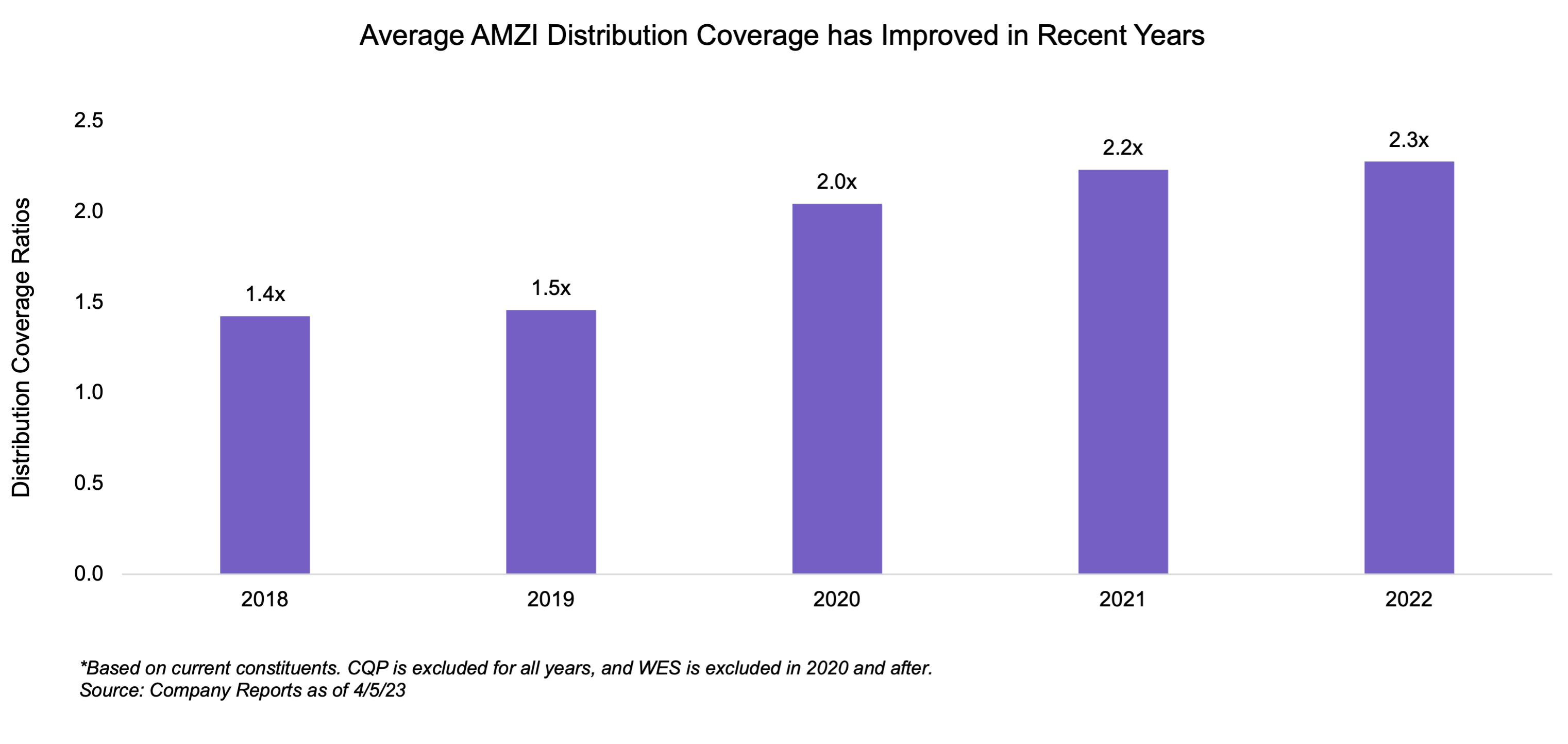

- Average distribution coverage for current AMZI constituents has improved noticeably from 1.4x in 2018 to 2.3x in 2022.

Longtime MLP investors are likely familiar with distribution coverage – an MLP-specific ratio used to measure how well MLPs can afford their payouts. In years past, distribution coverage was frequently cited with the goal of giving investors comfort around the outlook for MLP payouts. However, with improved financial flexibility, solid free cash flow generation, and six straight quarters without a dividend cut across the Alerian midstream universe, distribution coverage has become a less pressing topic. Today’s note looks at distribution coverage trends for constituents of the Alerian MLP Infrastructure Index (AMZI) over the last five years.

What is distribution coverage, and why is it less prevalent today?

Distribution coverage measures the affordability of an MLP’s distribution by comparing distributable cash flow (DCF) to the MLP’s total payout. As a non-GAAP measure, DCF calculations tend to vary by MLP, but DCF is typically derived from adding non-cash expenses to net income and subtracting cash interest expense and maintenance capital. In recent years distribution coverage has gone from a regular talking point to a less critical metric as the space has evolved.

Many MLPs still report distribution coverage each quarter, but it is easier to feel confident that MLPs can maintain or grow their distributions today than in the past. That largely stems from solid free cash flow generation in the space, which began in earnest in 2020 as capital spending fell meaningfully. Multiple AMZI constituents have been able to buy back equity in recent years – a clear indicator of excess cash flow and a complement to generous dividends. Additionally, DCF has grown as projects initiated before and after the pandemic have come online. These factors provide important context to the AMZI yield of 8.1% as of March 31.

Investors can also have greater confidence in MLP payouts given past distribution cuts from select names, which made payouts more manageable and sustainable. This has resulted in improved financial flexibility and stronger balance sheets, which also help lower the risk of cuts. Furthermore, some MLPs have deemphasized MLP-specific jargon to focus on more widely understood financial metrics like free cash flow that is more easily compared with corporations. In that vein, Western Midstream (WES) stopped reporting DCF and distribution coverage in 2020 as discussed in their 1Q20 earnings call.

How has distribution coverage for AMZI constituents changed over time?

Distribution coverage for AMZI constituents has improved markedly over the last five years. For current constituents, average distribution coverage has increased from 1.4x in 2018 to 2.3x in 2022 as shown in the chart below. Average coverage saw a step-change in 2020 as select names cut their distributions in 1H20 when pandemic-related uncertainty was particularly acute. Cash flows for the space remained largely stable during that time helped by contractual protections, but for companies that had little financial cushion, high payouts, and extended balance sheets, cuts were a sensible response in a very uncertain market environment. Of course, many companies continued to grow or maintain their payouts through the pandemic.

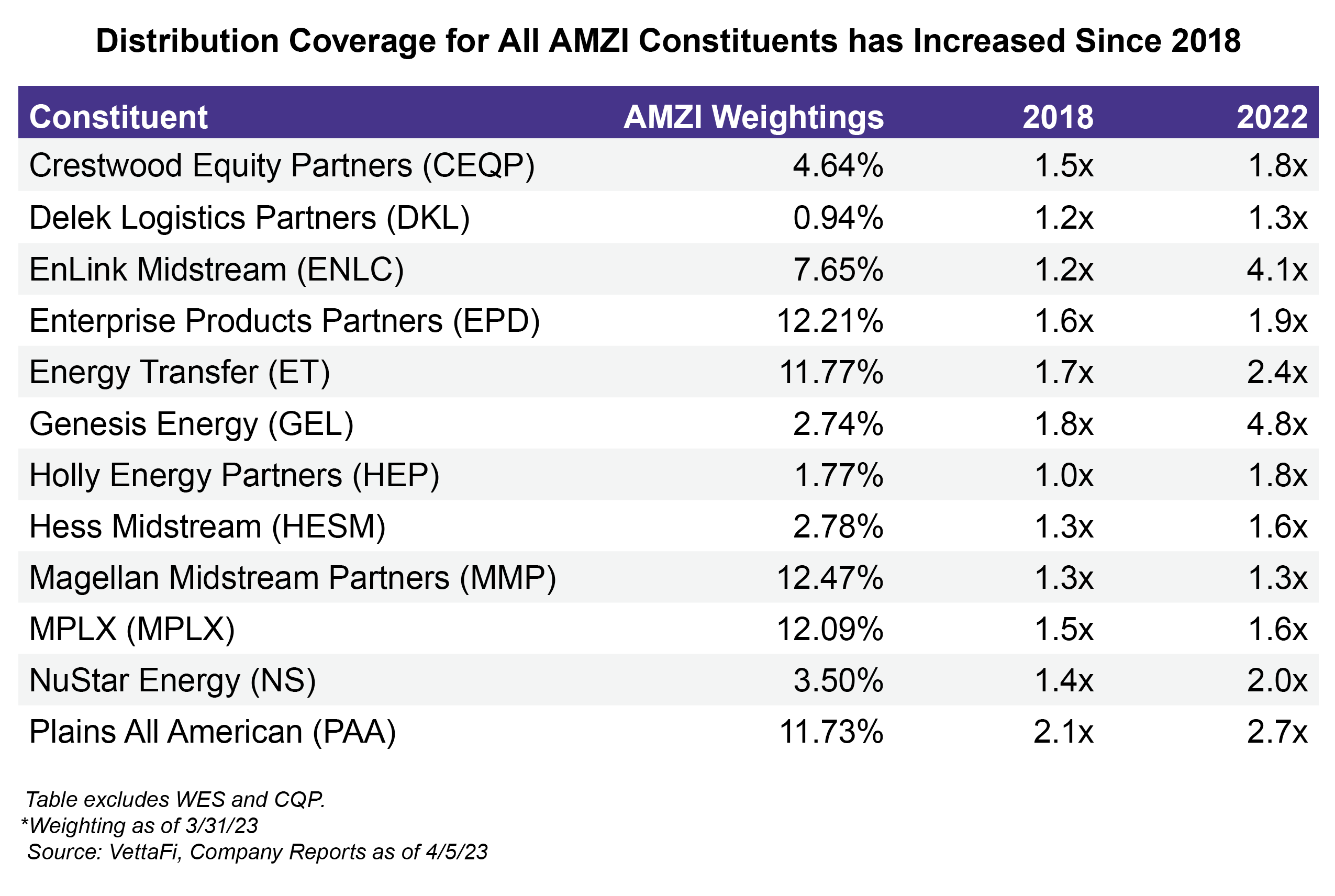

The table below shows distribution coverage for 2018 and 2022 for AMZI constituents that report DCF or coverage ratios. WES and Cheniere Energy Partners (CQP) do not report either metric and are excluded. More noticeable improvements in coverage ratios generally relate to cuts announced in 2020. Names that grew their payouts from 2018 to 2022 and did not cut during the pandemic include Crestwood Equity Partners (CEQP), Delek Logistics Partners (DKL), Enterprise Products Partners (EPD), Hess Midstream (HESM), Magellan Midstream Partners (MMP), and MPLX (MPLX). While MMP’s coverage ratio was unchanged, the remaining names saw coverage improve over this timeframe even with a higher distribution in 2022 relative to 2018.

Though not included in the table, Cheniere Energy Partners (CQP) also grew its payout over this timeframe and even added a variable component to its distribution in May 2022. Like CQP, WES has adopted a variable approach with an enhanced distribution for its first-quarter payout contingent on financial performance. A variable framework also makes distribution coverage less relevant for these names.

Bottom Line:

Distribution coverage has improved over time for AMZI constituents, but the metric is not the only justification for confidence in MLP payouts today. Strong free cash flow generation, improved financial flexibility, and a restored track record of dividend stability and growth is also encouraging for MLP investors.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB).

Please join our 30-minute LiveCast Today, at 12:30 p.m. ET as we discuss the tax efficiency of MLPs (register here).

Related Research:

4Q22 Caps a Strong Year for Midstream/MLP Buybacks

4Q22 Midstream/MLP Dividends: Growth Continues

Midstream/MLPs: Free Cash Flow Powerhouse

MLP 2Q19 Distribution Coverage and Payout Ratios Provide Peace of Mind

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and MLPB, for which it receives an index licensing fee. However, AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and MLPB.