Summary

- Since late June, U.S. benchmark oil prices have increased by roughly $20 per barrel thanks to solid demand and incremental supply cuts from Saudi Arabia and Russia.

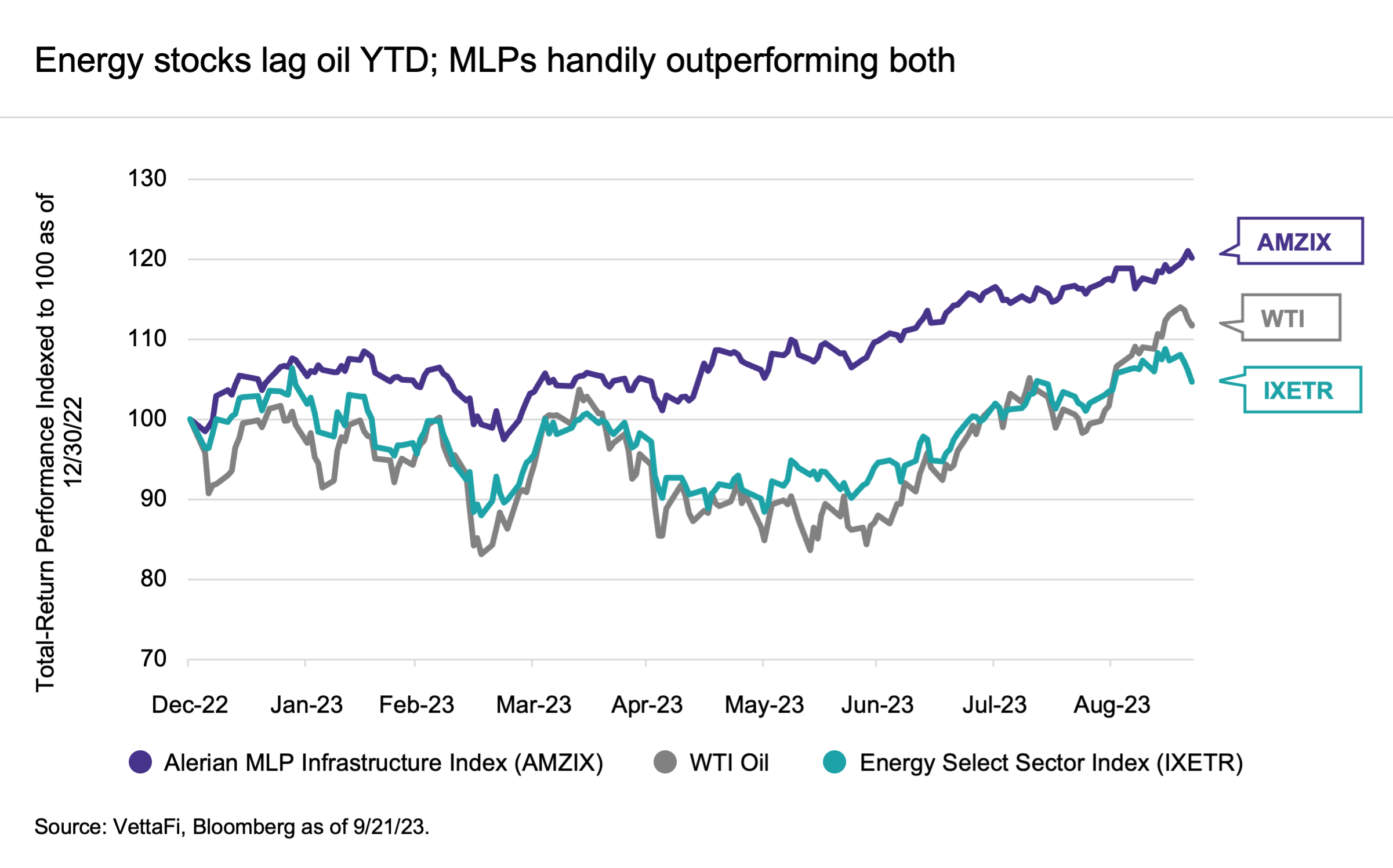

- Oil’s rally has made energy the best-performing sector over the last three months, but energy stock performance is still lagging the move in oil prices.

- While positive momentum is on energy’s side, downside risks include worsening economic conditions or risk-off sentiment.

With a rally in oil prices, energy has gone from being the worst-performing sector for much of 1H23 to being the best-performing sector over the last three months. Today’s note looks at the factors supporting higher oil prices and the outlook for energy stocks from here.

What’s Driving Oil Higher?

Since late June, West Texas Intermediate (WTI) oil prices have increased from less than $70 per barrel (bbl) to over $90/bbl. Much of that rally took place in July as the outlook for the economy started to improve (allaying demand concerns) and Saudi Arabia’s incremental 1 million barrel per day (MMBpd) cut took effect. Voluntary export reductions from Russia have also tightened the market. Earlier this month, Saudi Arabia and Russia announced they would continue their 1 MMBpd and 0.3 MMBpd cuts, respectively, through year end. The news pushed WTI to over $90/bbl in mid-September.

Meanwhile, demand has been strong with much of the growth attributed to China, jet fuel, and petrochemical feedstocks according to the International Energy Agency (IEA). Importantly, the IEA forecasts that demand for 2H23 will be 1.5 MMBpd higher than in 1H23. Higher demand and less supply can quickly tighten market fundamentals and send prices higher.

Can Energy Stocks Keep Working? Investors Think So

If oil prices continue to hold above $90/bbl or climb even higher, energy equities will likely do well. Beyond improved sentiment from higher oil prices, the space can benefit from upward earnings revisions and more shareholder-friendly returns from greater free cash flow generation. Energy is relatively insulated from higher inflation. This has been revived by the rise in oil prices. The sector is also less sensitive to what the Fed does with interest rates.

Investors certainly seem constructive. During two separate events last week, including an Equity Symposium, VettaFi asked advisors which sector they found most attractive to invest in for the rest of 2023. Energy garnered more than 40% of the 150+ responses on each webcast, followed by Information Technology at ~20%.

A popular investment case has been that energy stocks should catch up to the commodity. As shown below, oil has outpaced the broad Energy Select Sector Index (IXE) so far this year. Since the end of June, oil prices are up 26.9%. The IXE is only up around 10% through September 21. However, oil also underperformed energy equities for much of this year and then saw gains from a lower base. The stocks could certainly play catch up. It bears noting that US natural gas prices remain lackluster and the IXE significantly outpaced oil prices for 2022. The IXE was up 58.0% on a price-return basis for 2022, and oil ended the year up only 6.7%. Granted, oil was much higher at other points in 2022, and natural gas saw notable gains last year as well.

Within the energy space, performance has varied. Refiners have been among the best performers thus far in 2023. This is due to strong demand supporting their profit margins (crack spreads), particularly for diesel. The global diesel market is set to tighten further with Russia’s export ban announced last week. On the other hand, Chevron (CVX), which is the second-largest name in IXE, is down 5.4% this year on a total-return basis through September 21, which has been a drag on IXE performance.

Interestingly, the best-performing subsector in the energy space year-to-date has limited exposure to oil prices. MLPs, represented by the Alerian MLP Infrastructure Index (AMZI), have outperformed oil and broader energy all year. MLPs’ limited commodity price exposure due to fee-based business models was beneficial during 1H23. The announcement of ONEOK’s (OKE) acquisition of Magellan Midstream Partners (MMP) in May at a 22% premium certainly helped performance given MMP’s large weighting in MLP indexes. Beyond M&A tailwinds, more generous yields also help total-return performance, with the AMZI yielding 7.5% as of September 21.

What’s the Downside Risk for Oil and Energy Stocks?

While positive momentum is on energy’s side, there is still risk to the downside. For much of 2023, the overhang on oil prices was demand concerns related to a recession or disappointing trends from China. Energy also took a significant hit during the banking crisis in March (read more). Concerns around the health of the global economy or widespread risk-off sentiment as seen in March could take the wind out of energy’s sails.

Additionally, oil prices are being supported by cooperation of OPEC+, particularly Saudi Arabia and Russia. Recent history would suggest that OPEC+ is committed to supporting prices if demand weakens. On balance, OPEC+ is likely to be more of a source of upside for oil prices than downside. But a falling out among the parties would pose a risk to oil prices. The eventual unwinding of cuts could also be a potential headwind for prices.

So What?

For investors worried about downside but wanting some energy exposure, MLPs or midstream may be a good option. For those more bullish on oil, a product focused on oil and gas producers may be of greater interest and provide more exposure to oil moves than a broad energy fund.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB).

For more news, information, and analysis, visit the Energy Infrastructure Channel.

Related Research:

OKE Acquiring MMP: Taxes Add Wrinkle, Valuation Nice

As Banks Sneeze, Oil and Energy Stocks Choked. What Now?

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and MLPB, for which it receives an index licensing fee. However, AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and MLPB.