Much has been written about the strong dollar, which has been bolstered by rising interest rates and a flight to safety amid recession concerns and weakness in Europe. A strong dollar has far-reaching implications for earnings, trade, and commodities priced in dollars, including oil.

Typically, dollar strength or weakness takes a backseat to other fundamental factors driving oil prices. After all, oil is much more volatile than the dollar. Aside from currency movements, oil prices are impacted by supply-demand fundamentals, geopolitical news, paper trading, and other headlines that can significantly impact the day-to-day change in oil prices. However, with dollar indexes reaching 20-year highs, the dollar’s strength adds important context to the recent weakness in oil prices. Recall that a stronger dollar puts downward pressure on oil prices, while a weaker dollar is supportive of oil prices. The ten-year inverse correlation between oil and the Bloomberg Dollar Spot Index (BBDXY) is -0.19.

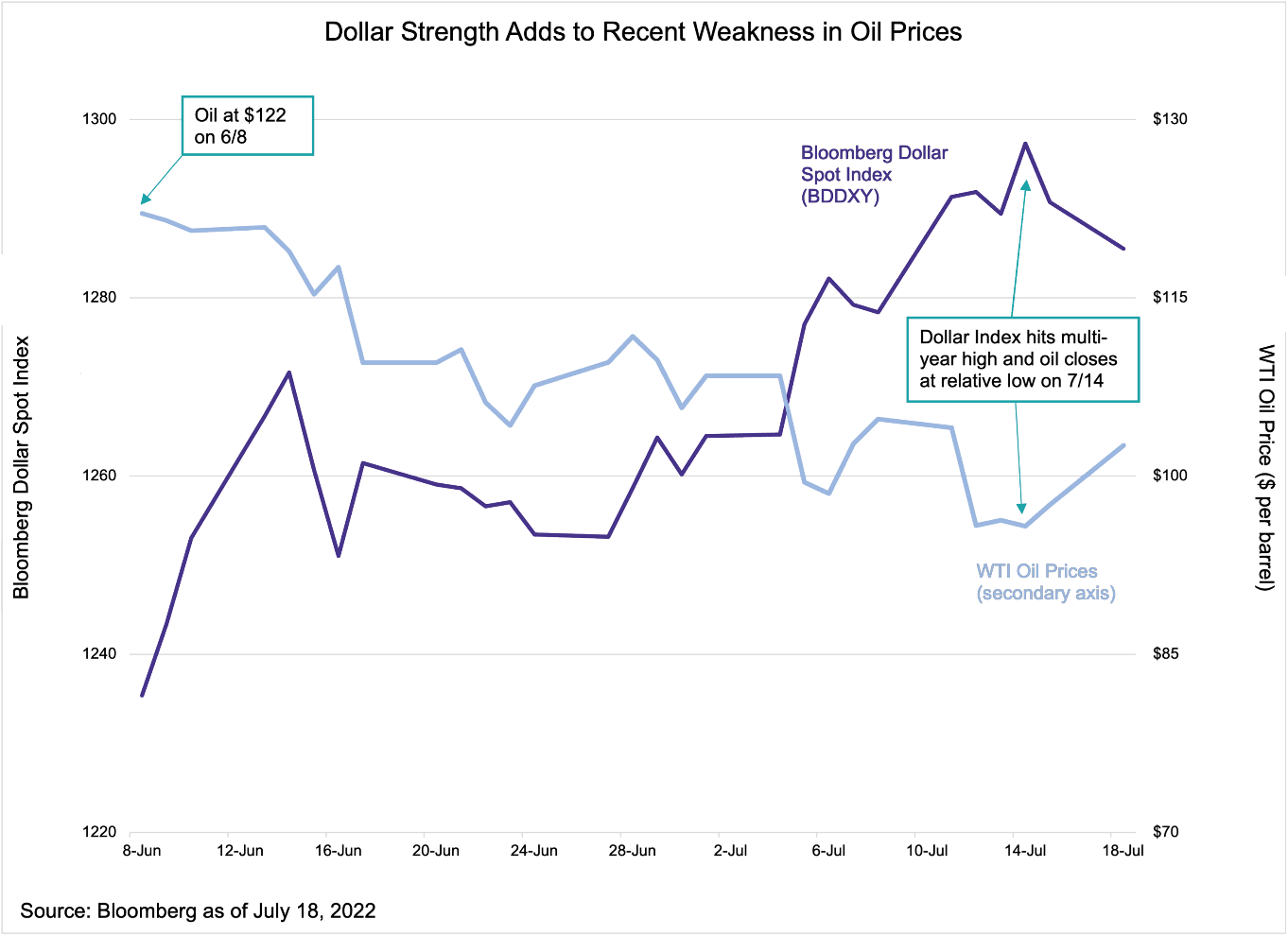

The chart below shows West Texas Intermediate (WTI) oil prices and BBDXY since oil’s relative high at $122 per barrel on June 8. The two lines practically mirror each other, though it bears highlighting that oil prices have fallen 16.0%, and the dollar index has gained 4.0% over the period shown in the chart. Dollar strength has clearly not been the only factor weighing on oil prices since early June – significant selling and profit-taking by traders, recession concerns, and false starts around easing lockdowns in China have also pressured oil. That said, the strong dollar has contributed to oil’s pullback.

For more news, information, and strategy, visit the Energy Infrastructure Channel.