MLPs have a history of providing generous income and compelling returns to investors.

As investors look to add exposure to MLPs, it’s important to understand the differences between the two largest MLP ETFs available to investors: the $7.1 billion Alerian MLP ETF (AMLP) and the $1.4 billion Global X MLP ETF (MLPA).

On the surface, AMLP and MLPA appear to be very similar. In fact, the two funds’ have a 95% portfolio overlap by weight, per ETF Research Center. However, looking under the hood uncovers a staggering difference in the funds’ performance and distributions.

AMLP charges 87 basis points, while MLPA charges just 45 basis points. A lower expense ratio can be compelling, particularly in the low-cost ETF realm. However, by prioritizing a lower fee, investors may be giving up performance. Despite its higher cost, AMLP has a track record of outperforming MLPA.

Performance and Liquidity

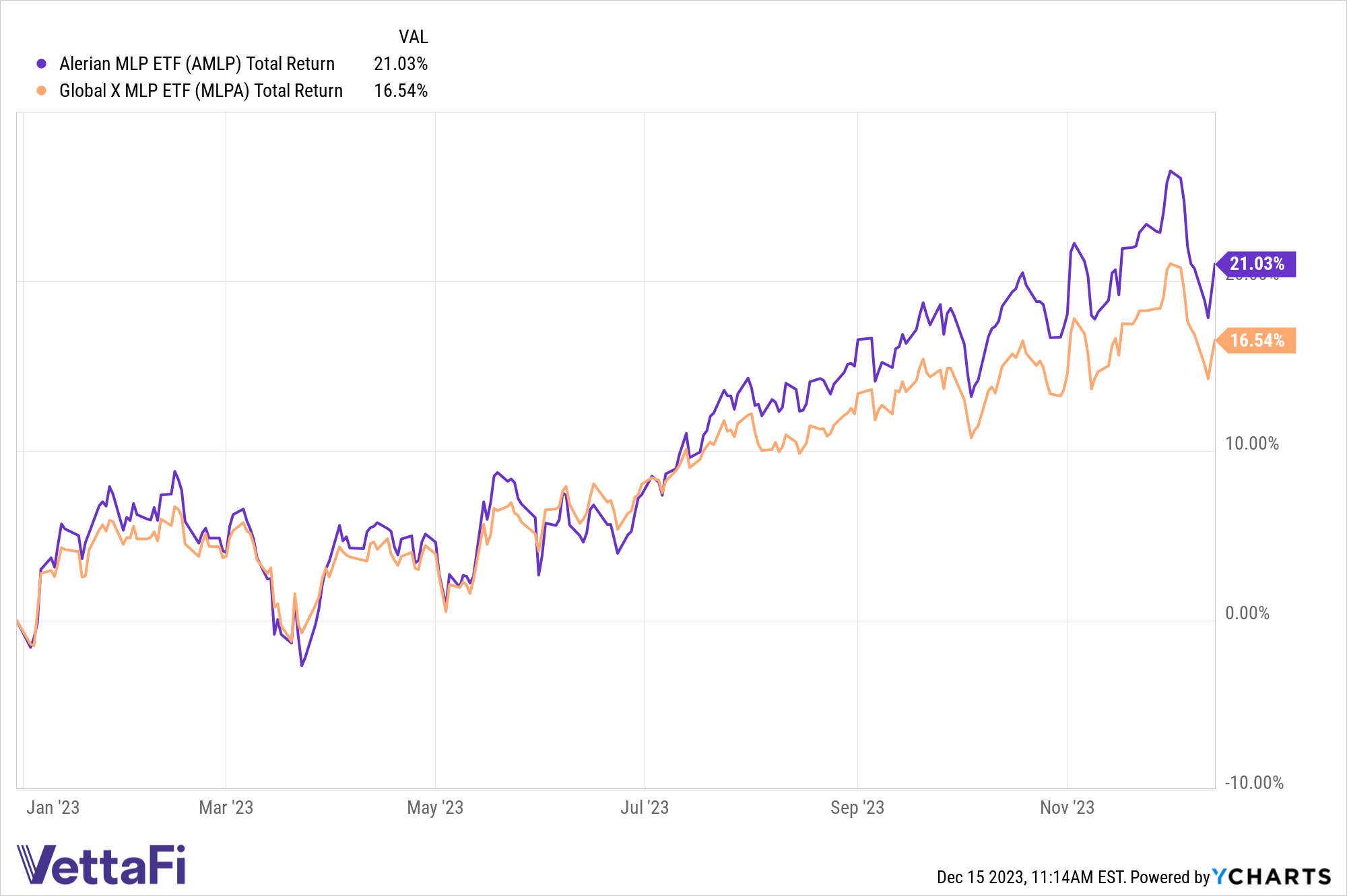

AMLP is up 21.0% year to date through December 14, and MLPA is up 16.5%, each on a total return basis. Over three years, AMLP is up 99.1% and MLPA is up 95.1% nonannualized.

See more: “VettaFi’s Head of Energy Research on 2023 Highlights and Outlook for Midstream”

Investors may prefer the greater liquidity of AMLP. AMLP’s three-month average daily trading volume is almost 1.7 million shares compared to MLPA’s three-month average volume of 106,163 shares.

Using MLP ETFs to Maximize Income

Income is a primary reason why many advisors use MLPs in portfolios. The segment is known for offering generous income and for being more defensive than other subsectors of energy. MLPs offer compelling yields relative to other income-producing asset classes such as REITs or utilities.

Notably, midstream yields are not sensitive to the Fed’s actions or interest rate movement, meaning MLPs have the potential to provide attractive income throughout various interest rate environments.

AMLP has an edge over MLPA in generating steady, growing distributions for investors. AMLP’s 2023 distribution increased 14.0% compared to the year prior. Meanwhile, MLPA’s 2023 distribution was only up 9.9%.

In 2022, AMLP’s distribution grew by 4.6% compared to 2021, while MLPA’s distribution declined.

Currently, AMLP’s indicated yield is 8.37% and MLPA’s is 7.86%, according to Bloomberg.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.