With rising expectations of a Federal Reserve interest rate cut, developing country central banks have more room to cut their own benchmark rates and stimulate their economies, potentially bolstering emerging market-related exchange traded funds.

Year-to-date, the iShares Core MSCI Emerging Markets ETF (NYSEArca: IEMG) rose 6.3% and Vanguard FTSE Emerging Markets ETF (NYSEArca: VWO) gained 8.5%.

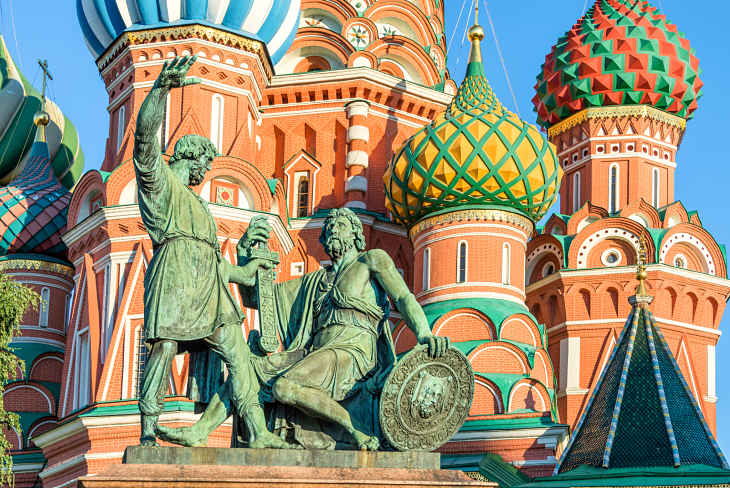

Supporting the emerging market outlook, central banks are beginning to loosen their monetary policies, with Russia the latest example. The Russian central bank cited the change from the Federal Reserve in its recent act to lower key interest rates by a quarter percentage point to 7.5%, and Bank of Russia Governor Elvira Nabiullina stated a further rate cut was possible at one of the bank’s upcoming board meetings, the Wall Street Journal reports.

The sudden dovish stance out of the Russian central bank was a stark contrast to its previous move to raise interest rates just six months ago to get ahead of the Fed’s ninth hike in three years. Last year, tighter monetary policy in the U.S. pushed a number of emerging markets’ central banks to keep monetary policy tight as well to stave off the negative effects of a stronger U.S. dollar.

However, the tone is softening as Fed officials consider cutting rates as soon as their meeting next week or in the coming months.

U.S. monetary policy has caused big ripples on central banks in emerging markets due to the influence over global flows of capital and currency moves. When the U.S. hikes rates, it encourages investors to bring their capital back home, forcing developing countries to follow suit even if it means crippling their own economies to keep their domestic currencies steady against the greenback and avoid a jump in inflation as the prices of imports rise.

On the other hand, if the Fed is easing, emerging countries can follow behind, and it is especially evident in countries that want to avoid appreciations in their currencies, which would hurt exports and push inflation down.

Since April, India, Malaysia and the Philippines have all cut rates while China’s central bank has taken steps to encourage more bank lending. Looking ahead, if the Fed goes ahead with a looser monetary policy, analysts anticipate more emerging economies to follow closely behind.

For more information on global markets, visit our global ETFs category.