High quality companies that continually grow dividends typically exhibit attractive investment characteristics like history of profit and growth, strong fundamentals, stable earnings streams, firm commitment to shareholders and management team conviction in the business.

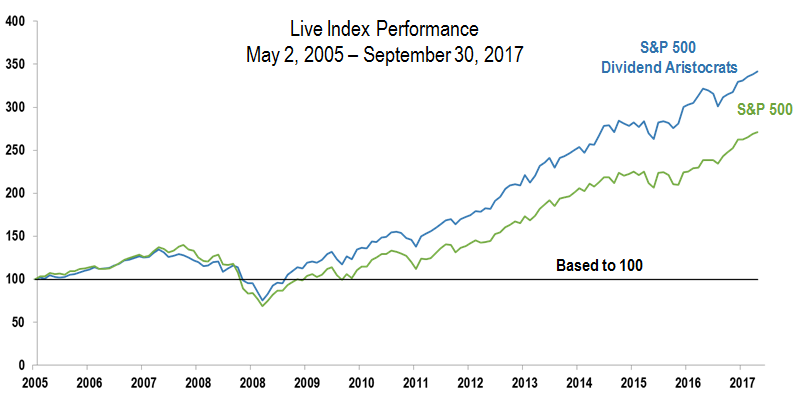

One way to target this elite group of quality companies is through the S&P 500 Dividend Aristocrats Index, which specifically targets those that have grown dividends for at least 25 years. The portfolio has outperformed the S&P 500 under most market conditions and exhibited lower relative volatility compared to the broader benchmark.

Furthermore, Kirwan argued that the so-called dividend aristocrats may even outperform if rates continue to rise as they provide an all-weather dividend solution, compared to high-dividend stocks that may have greater tilts toward rate sensitive sectors.

The S&P 500 Dividend Aristocrats Index acts as the underlying index for the popular ProShares S&P 500 Aristocrats ETF (BATS: NOBL) and is comprised of companies that have consecutively raised dividends for at least 25 years.

Stovall also projected that the S&P 500 Dividend Aristocrats’ relative P/E ratio is projected to dip below long-term averages, which may open an attractive entry point to something like NOBL.

ProShares also offers the ProShares Russell 2000 Dividend Growers ETF (BATS: SMDV) and the ProShares S&P MidCap 400 Dividend Aristocrats ETF (BATS: REGL) for those seeking quality dividend growers in the small- and mid-cap categories, respectively. REGL tracks a Dividend Aristocrats Index. The mid-cap Dividend Aristocrats Index, though, only requires 15 consecutive years of increased dividends for inclusion. SMDV, a dividend spin on the Russell 2000, the benchmark U.S. small-cap index, tracks the Russell 2000 Dividend Growth Index, which includes small-cap firms with dividend increase streaks of at least a decade.

Investors can also diversify into international markets while tracking similar dividend growth strategies. For instance, the ProShares MSCI EAFE Dividend Growers ETF (BATS: EFAD) tracks developed market Europe, Australasia and Far East companies that exhibit a minimum dividend increase streak of 10 years. The ProShares MSCI Europe Dividend Growers ETF (BATS: EUDV) tracks the performance of the MSCI Europe Dividend Masters Index, which consists of at least 25 European companies that have consistently increased their dividends for at least 10 consecutive years. The ProShares MSCI Emerging Markets Dividend Growers ETF (BATS: EMDV) follows the MSCI Emerging Markets Dividend Masters Index, which targets MSCI Emerging Market components that have increased dividend payments each year for at least seven consecutive years.

Financial advisors who are interested in learning more about dividend growth strategies can watch the webcast here on demand.