![]() The markets may continue to expand but with some hiccups along the way. Consequently, ETF investors can consider a dividend growth strategy to focus on quality companies that will participate in the ongoing growth and provide some protection against short-term risks.

The markets may continue to expand but with some hiccups along the way. Consequently, ETF investors can consider a dividend growth strategy to focus on quality companies that will participate in the ongoing growth and provide some protection against short-term risks.

On the recent webcast, How Quality Dividend Growers Can Help Fight the Crosswinds on Wall Street, Sam Stovall, Chief Investment Officer for CFRA, warned of some headwinds that could shake the markets but still pointed out some tailwinds that could maintain the overall course.

For instance, an aging bull market, elevated valuations, rising rates, risk of recession and political risks continue to weigh on the market. However, the ongoing corporate strength, low inflation, seasonal trends ahead, potential tax cuts and speed of recovery may still maintain the current course.

Stovall argued that the progression of earnings-per-share estimates may continue to prop up the markets as full-year 2017 EPS estimates have not collapsed like they did in 2015 and 2016. Actual quarterly EPS exceeded estimates in 22 of 22 past quarters by an average of 3.6%.

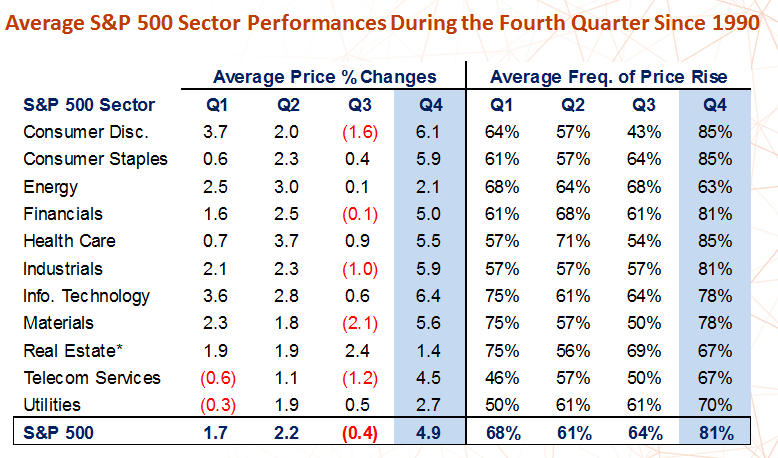

Furthermore, the U.S. is heading toward a seasonally strong period of the year. While the third quarter may be seasonally worst period since 1990, the fourth quarter has historically been the strongest period of the year, with the S&P 500 rising on average 4.9% and showing a positive average frequency of price rises 81% of the time.

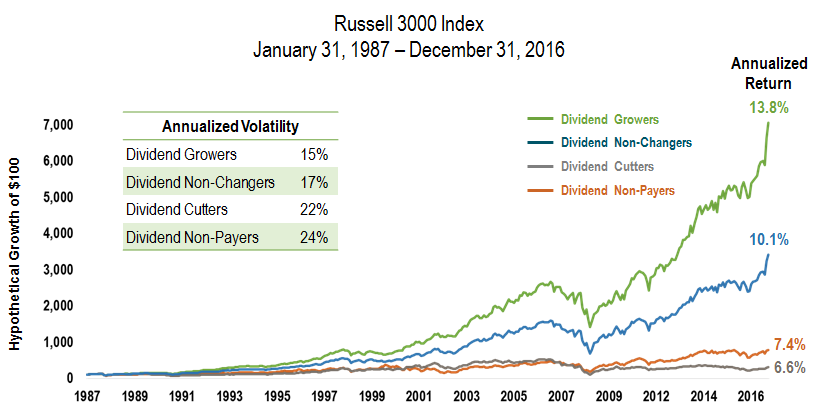

One way for investors to identify companies that can outperform markets over time may be to look at companies that grow dividends, Kieran Kirwan, Director of Investment Strategy for ProShares, said. Companies that have consistently increased dividends outperformed those that did not and have done so with lower volatility.

“Quality and growth are the key. Companies that grew their dividends outperformed companies that didn’t. Companies that consistently grow their dividends tend to be high-quality with strong growth potential. These companies have been able to withstand repeated periods of market turmoil and still deliver strong returns with lower volatility,” Kirwan said.