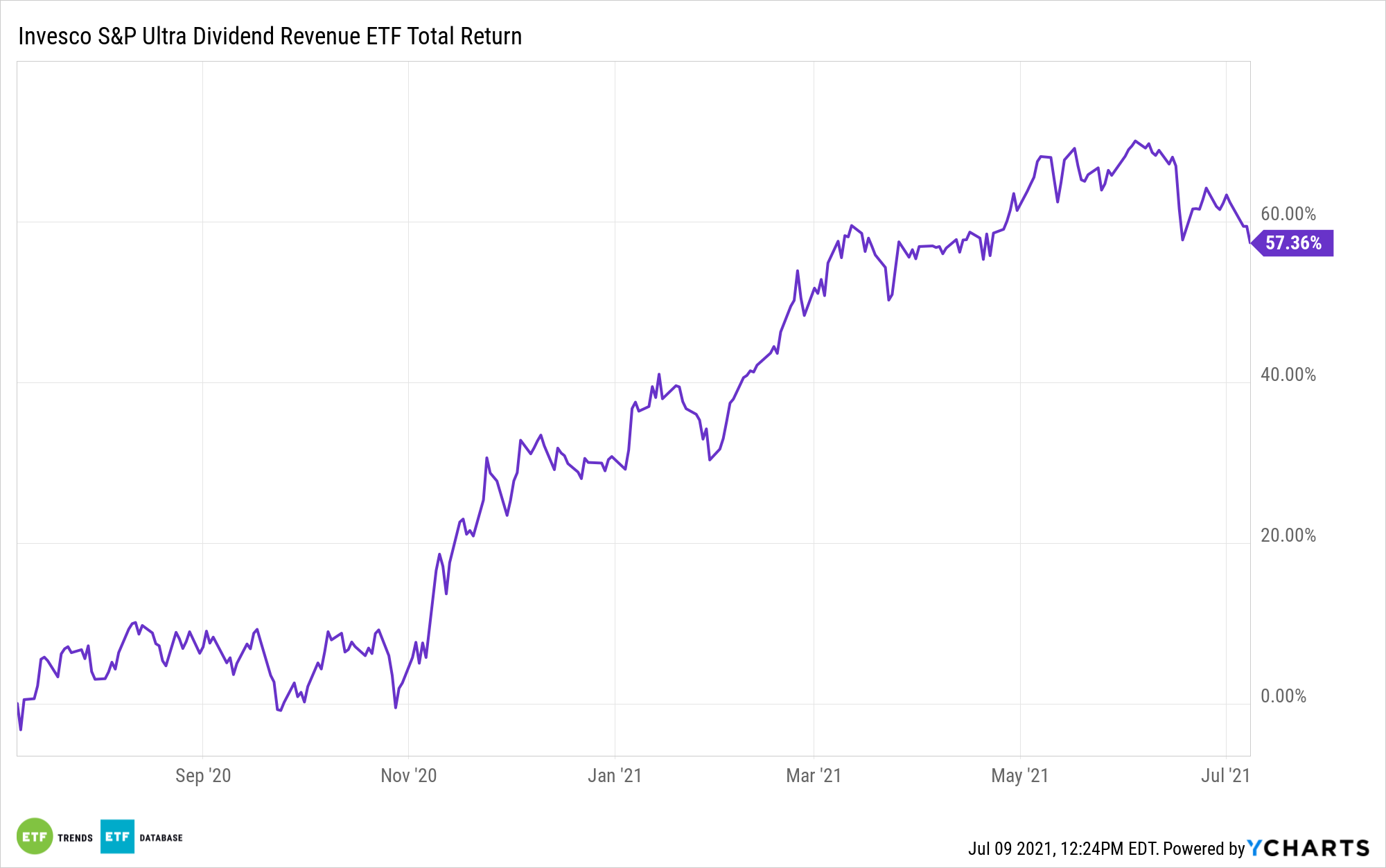

Some dividend exchange traded funds, including the Invesco S&P Ultra Dividend Revenue ETF (NYSEARCA: RDIV), turned in impressive performances in the first half of the year, and as 2021 moves along, payout funds could be ready to deliver even more upside.

As CFRA Research Director of ETF & Mutual Fund Research Todd Rosenbluth notes, investors were enthusiastic about dividend ETFs in the first six months of the year, pouring a whopping $28 billion into such funds. A firmer, more positive dividend growth outlook is among the reasons investors renewed their affinity for the asset class.

“Unlike in 2020, when companies were regularly suspending dividend programs, investors sought out equity income generation in 2021,” said Rosenbluth.

The $755 million RDIV follows the S&P 900® Dividend Revenue-Weighted Index, meaning its 60 components are dividend-paying companies weighted by revenue.

RDIV: More Quality Than Meets the Eye

With a trailing 12-month distribution rate of 4.75%, it’d be easy to assume RDIV is a high-dividend strategy. Indeed, the Invesco fund’s weights to high-dividend sectors, namely energy, materials, real estate, and utilities, are well in excess of those found in the S&P 500.

Those four sectors combine for about 42% of RDIV’s roster as compared with just over 10% of the S&P 500. However, RDIV has avenues for mitigating some of the risks associated with high-yield equity strategies. For example, the top 5% of highest yielders in each sector are excluded from RDIV’s underlying index as are the top 5% as measured by payout ratio. Elevated dividend yields and payout ratios can be signs companies may not be able to sustain current payout obligations.

From there, the top 60 stocks as measured by yield are selected and those companies are then weighted by revenue. That methodology gives RDIV a highly cyclical value feel, likely explaining its impressive 20% year-to-date gain. In addition to the aforementioned substantial exposure to energy, materials, real estate, and utilities stocks, RDIV devotes over 21% of its roster to financial services names, it’s largest sector exposure. Overall, more than 91% of the fund’s holdings are classified as value stocks.

“RDIV, which offers a 4.7% yield and rose 24%in value in the first half of 2021,earns four stars from CFRA for its modest risk profile and high reward potential,” notes Rosenbluth. “Our positive view on RDIV also contrasts with the fund’s one-star rating from Morningstar relative to its large-cap value peer group.”

Investors added $27 million in new capital to RDIV in the first six months of the year.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.