On its most recent earnings call, J.M. Smucker (SJM) announced that it plans to raise its quarterly dividends 10%, going from $0.90 a share to $0.99 a share. The stock now has a forward dividend yield of 3.04%

Several ETFs count Smucker among their holdings, most notably the First Trust NASDAQ Food and Beverage ETF (FTXG) which allocates 8.21% of its holdings to the well-known jam brand.

The First Trust Consumer Staples AlphaDEX Fund (FXG) and Vesper U.S. Large Cap Short-Term Reversal Strategy ETF (UTRN) have 4.23% and 4.05% allocated to Smucker’s, respectively.

All three of these ETFs could see a nice bump in their dividends going forward.

About the Three ETFs

The dividend increase was announced at a shareholder meeting last week. Dividends are set to paid on Wednesday, September 21st.

Smucker, which owns several iconic brands, including Jif, Rachel Ray, Milkbone, and Folgers, announced a 4.6% sales growth and a 19.1% adjusted operating margin.

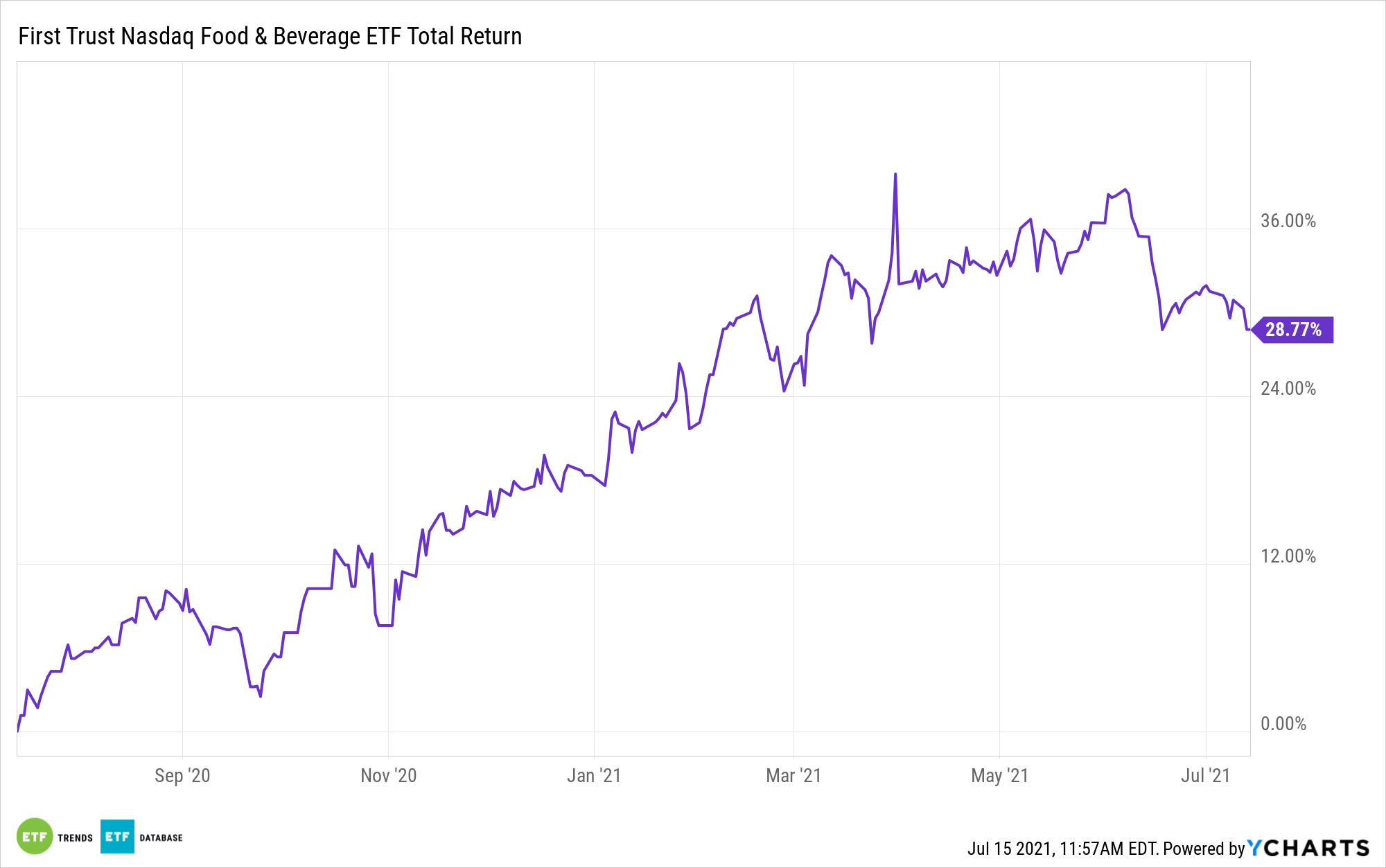

FTXG tracks the Nasdaq US Smart Food and Beverage index. Its year-to-date returns are up 8.82% and look to gain strength in the coming months, since food and beverage stocks also tend to heat up in the summer.

FTXG also boasts a strong ESG score, putting it ahead of 86.75% of other funds in its category.

Meanwhile, FXG offers investors exposure to the consumer staples sector, utilizing a strategy designed around identifying stocks poised to outperform relative to consumer staples stocks.

Due to its active management strategy, FXG’s management fees are a little higher, but it has performed well, up 8.96% on the year.

Smucker is currently FXG’s top holding, as it tends to keep a diverse field in play to mitigate the risk that comes from leaning too heavily on a few top holdings.

Finally, there’s UTRN. This fund utilizes the Chow Ratio, which is premised on the idea that investors tend to overreact to recent bad news and sell off stocks that are likely to rebound.

By identifying which stocks are likely to rebound, UTRN can get in before a rebound and then deliver big returns once its portfolio gets the longer-term bounce-back.

UTRN is currently up 14.11% on the year.

For more news, information, and strategy, visit the Dividend Channel.