Amid low interest rates and potentially diminished upside for fixed income assets, income-starved investors are again evaluating dividend exchange traded funds.

These days, they’ve got a sizable universe to consider as hundreds of ETFs reside in the dividend category. The older guard typically focus on one of two methodologies: companies’ track records of boosting payouts or dividend yield. Then, there’s the newer crop of dividend ETFs, some multiple years old and with lengthy track records, that approach dividend growth in different fashions.

“What these funds give up is the opportunity to participate in the dividend growth among an emerging class of dividend-growers,” says Morningstar’s Ben Johnson. “Those stocks that had never paid dividends previously had begun more recently–and might have up to nine years’ worth of consecutive dividend growth.”

One sector that many old dividend ETFs skimp on is technology, and that’s a drag for investors, because not only is the sector proving to be a reliable source of payout growth, it also has the capital and balance sheets to support long-term payout growth. Older dividend ETFs usually aren’t heavy on tech is because the sector isn’t a high-yield destination, and many of its components don’t yet meet dividend increase streak requirements because the marriage of dividends and tech is still relatively new.

“What we’ve seen most recently is that this has characterized a significant chunk of some of the largest names in the technology sector, for example, and most prominently Apple (AAPL), which is just within a hair’s breadth now of being eligible for inclusion in both of these portfolios,” adds Johnson. “So what investors are missing out on, given that there are these very stringent dividend-payment selection criteria in place, is the class of emerging dividend-payers, emerging dividend-growers.”

High dividend strategies are often heavy on consumer staples and utilities stocks, while older dividend growth ETFs usually feature noticeable weights to healthcare, industrial, and staples names.

Acknowledging that dividend investing is a long-term strategy, investors would do fell to prioritize durability and sustainability, meaning focusing on ETFs chock full of companies that can not only meet current dividend obligations but also grow those payouts consistently going forward.

“I think income-seekers should be focused on durability and dividend growth, especially in the context of the current low yield and increasing inflation environment,” notes Johnson.

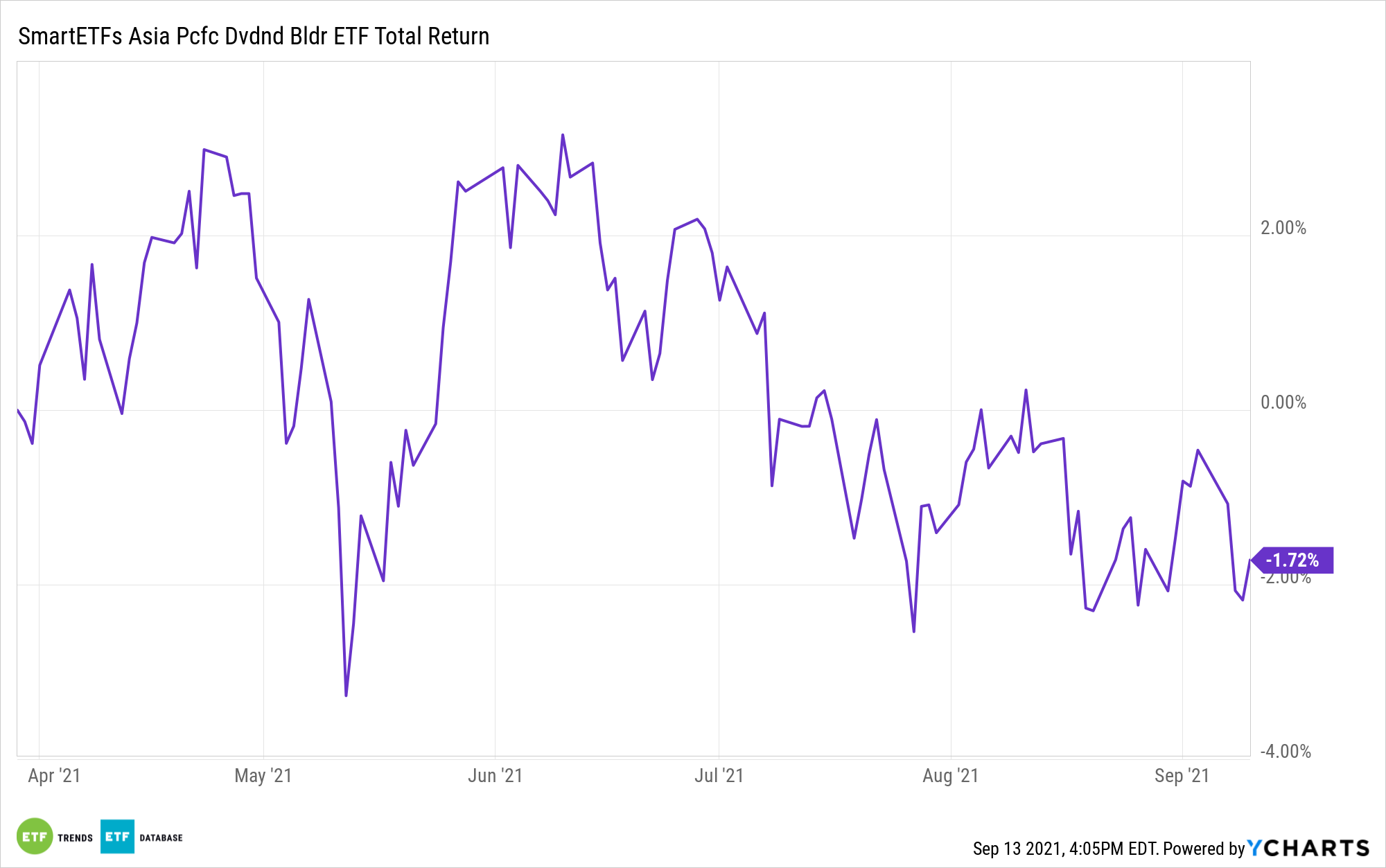

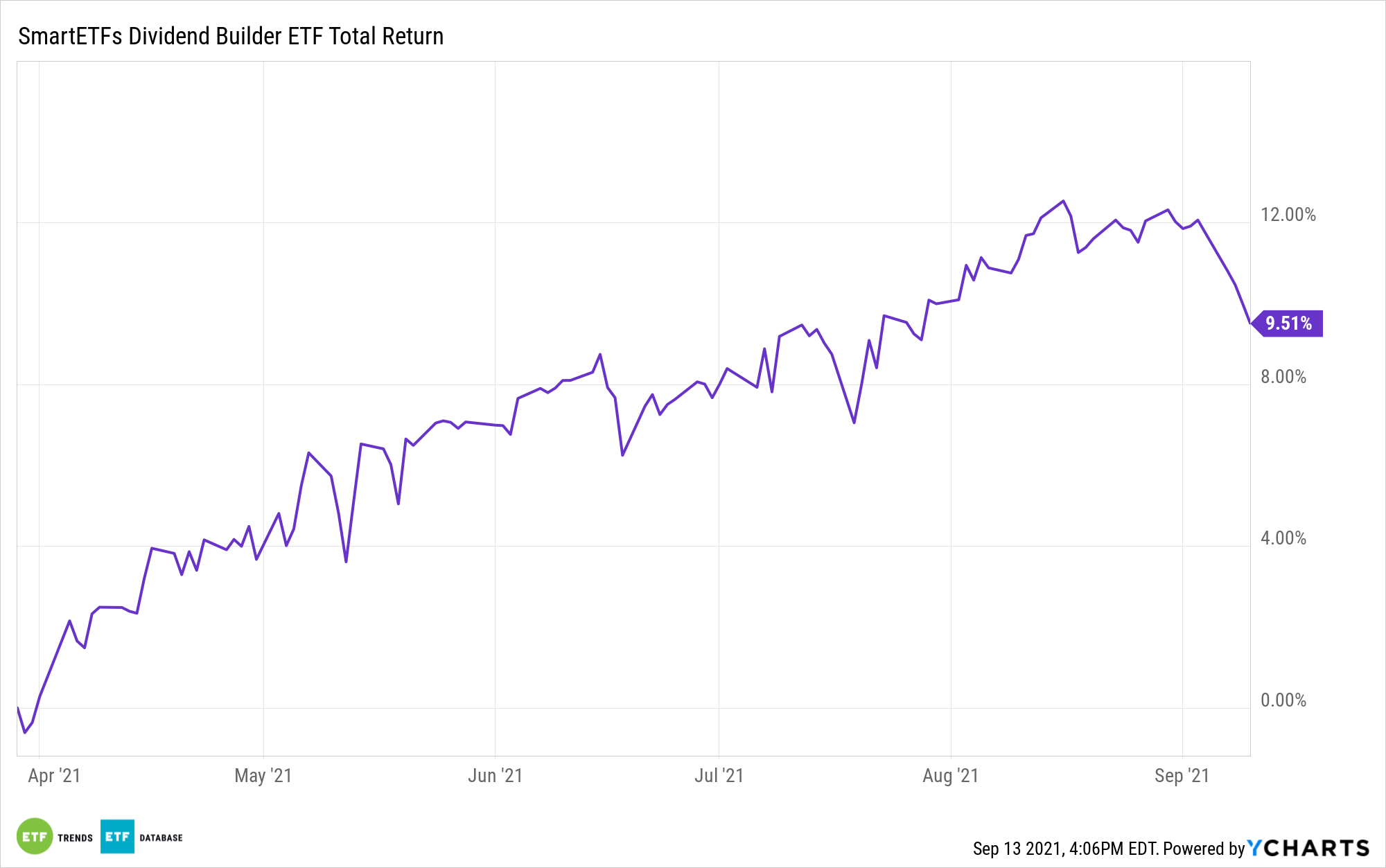

Investors looking for quality equity income ideas may want to consider the SmartETFs Asia Pacific Dividend Builder ETF (ADIV) and the SmartETFs Dividend Builder ETF (DIVS). These are actively managed exchange traded funds that emphasize quality and dividend durability over high dividends.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.