COVID-19 tanked the global economy, but the recovery continues to be a boon for investors seeking dividends.

The recovery has been faster than previous recessions. Typically, it takes anywhere from four to seven years for the economy to reach its pre-recession size. This time around, the economy has grown past its early March 2020 levels in just a year and a half.

Companies have benefited from smart, defensive strategies, seeking liquidity to weather what was assumed to be a much longer storm. Then came strong earnings. That, coupled with defensive pivots towards liquidity, means that raised cash can be returned to shareholders. Dividend growth happens when companies are flush with cash, and though there is a lot of uncertainty around climate change, geopolitical upheaval, and inflation, this is an excellent time to seek out stocks that can get you yields.

Traditional high-yield stocks, such as REITs, are generating jaw-dropping amounts of income for their shareholders, and even with uncertainty on the horizon, making a move for that cash could be a smart play. Dividends can help hedge against inflation and income always has some utility and provides investors with a tool that can allow them to be nimble in volatile times.

Buybacks Are In

Amid all of this, buybacks are at their second-highest rate in twenty years. Even in Europe, which is traditionally colder on buyback programs, investors are turning their dividends right back into the companies that have doled them out. Companies have been quick to taut their buyback rates, which is striking because dividend growth is generally what indicates strong fiscal health, with buybacks as a “nice to have” side statistic. The fact that buybacks are hitting these record highs is a strong indicator that robust dividend boosts are in the works.

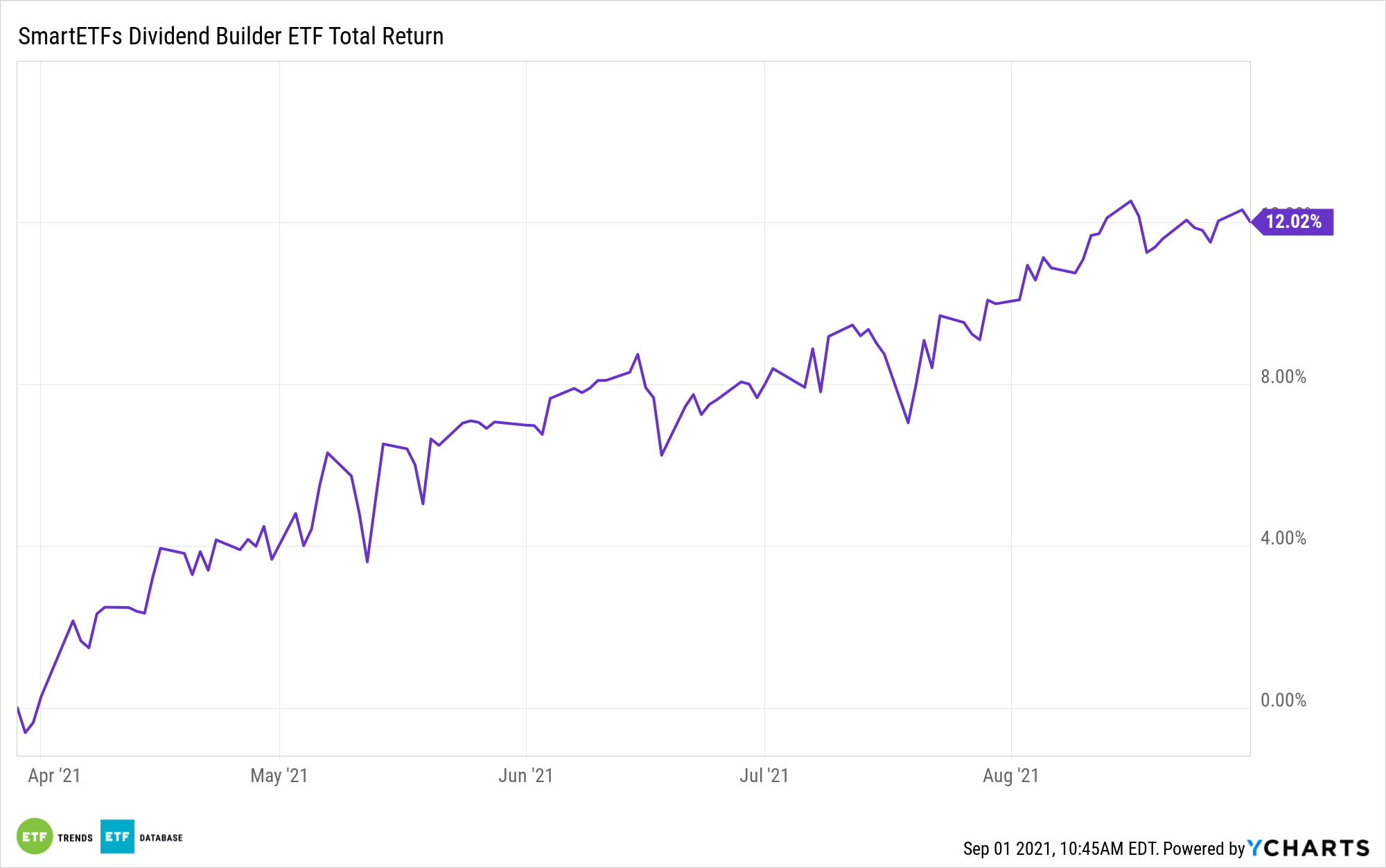

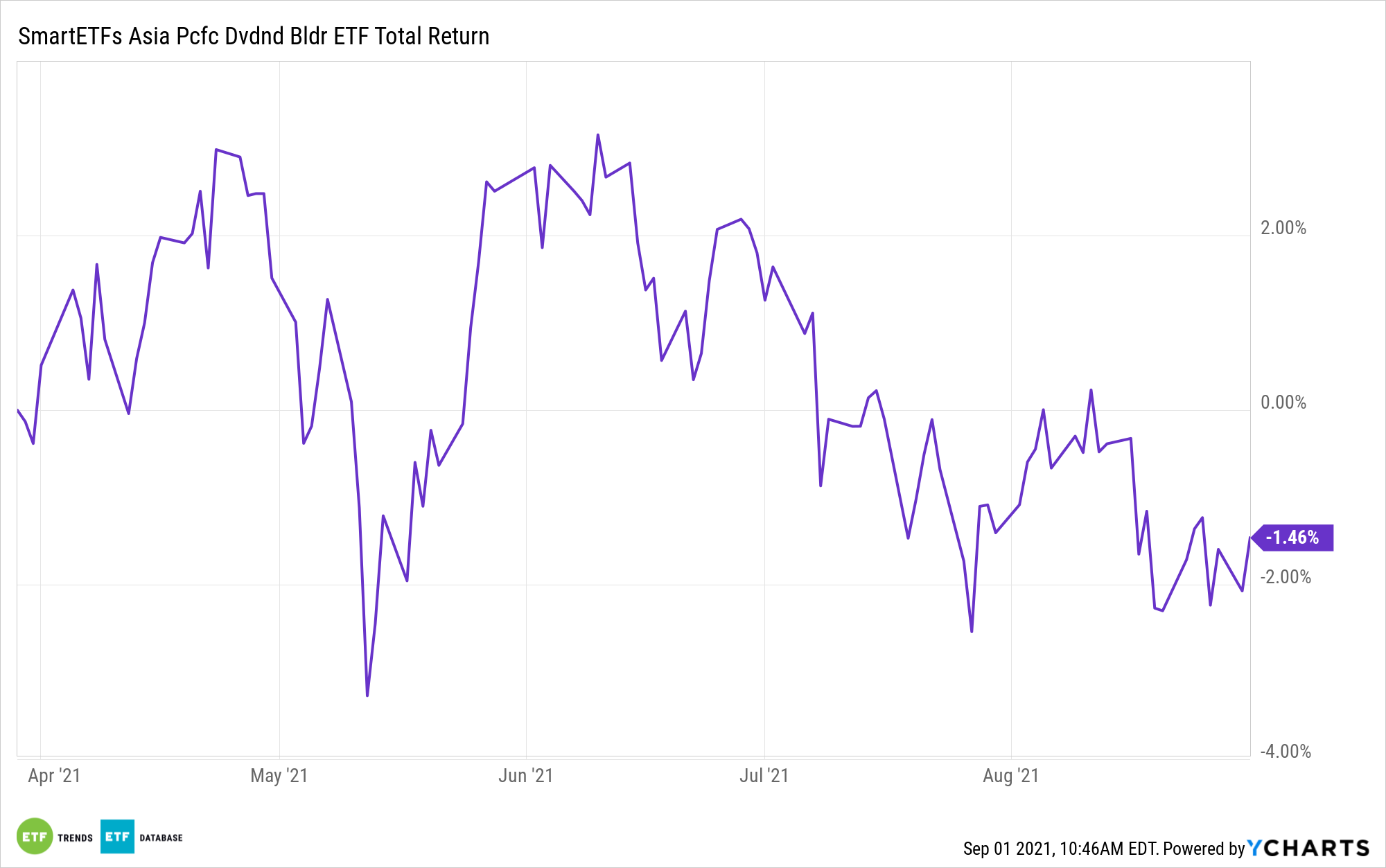

Investors can take advantage of this ideal dividend market with the actively managed SmartETFs Dividend Builder ETF (DIVS) and the SmartETFs Asia Pacific Dividend Builder ETF (ADIV). The VanEck Vectors Mortgage REIT Income ETF (MORT) is also a fantastic dividend option, boasting a yield of 7.02%.

For more news, information, and strategy, visit the Dividend Channel.