With some help from low interest rates and investors again leaning toward quality stocks, dividend-paying equities are back in style.

That’s good news for income investors because, as noted above, the world is awash in low government bond yields and here in the U.S., the government bond market has been surprisingly volatile this year.

Fortunately, an assortment of data points confirm the dividend waters are getting warmer. In fact, some market observers are forecasting that S&P 500 payouts will hit all-time highs in the current quarter. There are some other impressive data points to consider too, and dividends are all the more pertinent today as inflation rises.

“S&P 500 dividends grew 1% in the first seven months of the year compared to the same period in 2020 and 6% compared to 2019,” says WisdomTree analyst Matt Wagoner. “The Federal Reserve’s (Fed) preferred inflation gauge—the Personal Consumption Expenditures Index—is up less than 5% since mid-2019, meaning dividends have proved a nice inflation hedge in a negative real interest rate environment.”

In another positive sign, many of the largest U.S. dividend payers in dollar terms boosted payouts in the first seven months of the year and none have cut or suspended dividends.

“Among the 20 largest U.S. dividend payers, 11 have increased payouts, none have decreased and nine have kept their payouts unchanged,” adds Wagoner. “The average change in dividends was an increase of 3.2%, with double-digit increases coming from Bank of America (16.67%), followed by Proctor & Gamble and Home Depot at 10% each.”

As the WisdomTree analyst points out, two well-known dividend aristocrats didn’t increase payouts. Investors are still waiting on Exxon Mobil (NYSE: XOM) to make a call on its dividend while AT&T (NYSE: T) previously said it’s dividend is being pared in significant fashion.

Of the 20 largest U.S. dividend-payers in dollar terms, four hail from the technology sector, five are consumer staples stocks, and another four are healthcare names. Of the six biggest dividend increases this year, five were delivered by financial services firms.

“Consumer Discretionary companies have rebounded from a challenging 2020 environment in which consumers slashed discretionary spending,” adds Wagoner.

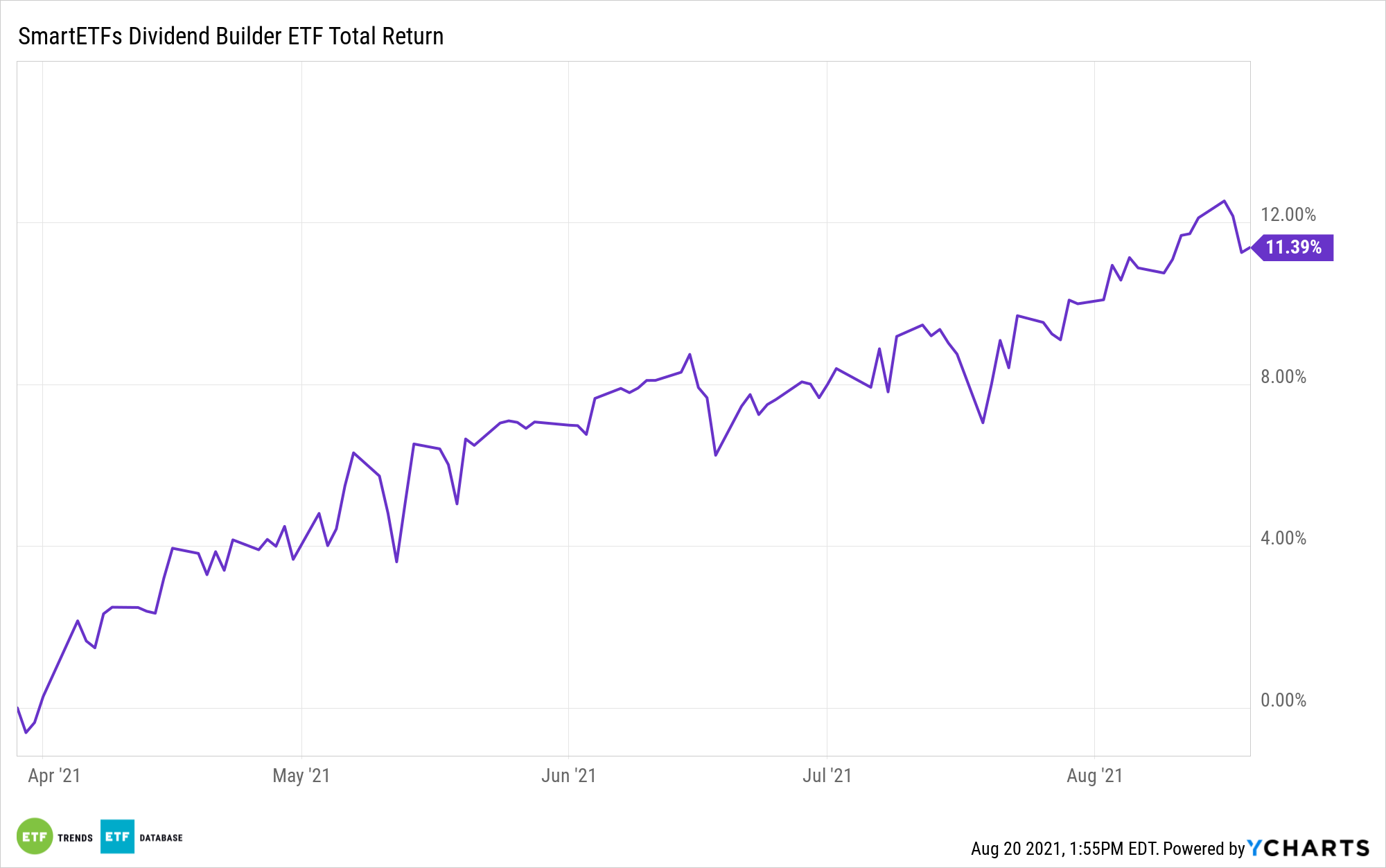

Investors looking for a quality approach to dividends with a global purview may want to consider the actively managed SmartETFs Dividend Builder ETF (DIVS).

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.