Investors are focusing on the second quarter earnings season, with some marquee names from domestic sectors yet to report. However, market participants may not want to overlook what could be a stellar batch of earnings in Europe.

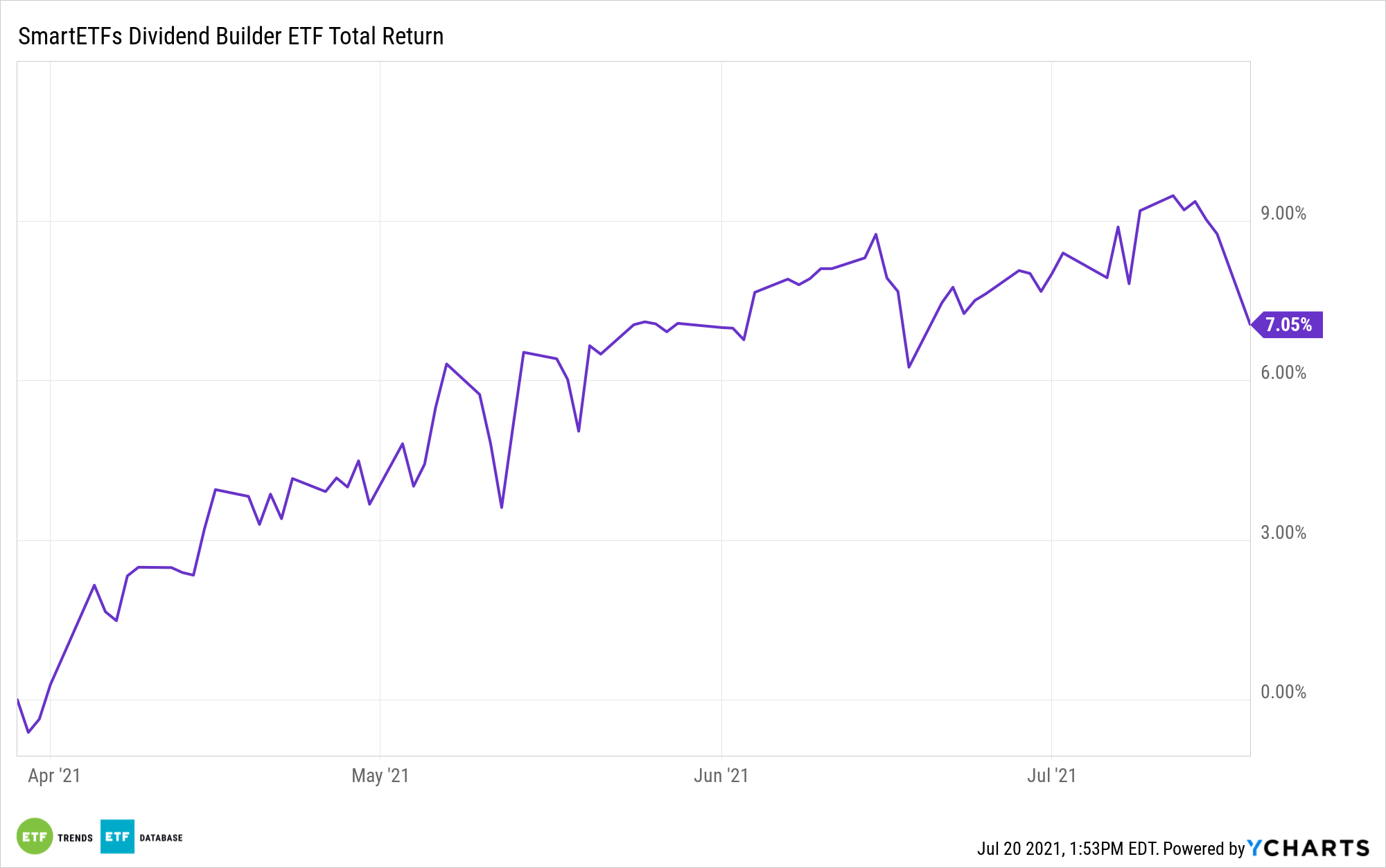

One avenue for getting involved with European equities without full commitment to the region is the SmartETFs Dividend Builder ETF (DIVS). DIVS is a global exchange traded fund, allocating almost half its weight to domestic stocks while also featuring more-than-adequate exposure to Europe’s rebounding dividends and earnings. In a note out last week, UBS analyst Nick Nelson says Europe’s excellent first quarter earnings could set the stage for more of the same this year.

“There were record earnings beats in the first quarter of the year, but, even so, outperformances in terms of stock price moves were modest, Nelson and his team said. But when earnings missed expectations last quarter, the result for stocks was punishing—with some sectors seeing the worst one-day relative performance for 10 quarters, according to UBS,” reports Jack Denton for Barron’s.

The DIVS Difference

As of May 31, DIVS held 35 stocks with seven European countries found amongst its geographic exposures. The fund is actively managed so the managers have discretion to increase allocations to Europe and other regions in an effort to capitalize on dividend growth opportunities and compelling valuations.

The next two weeks could prove pivotal to the near-term fortunes of European equities because half the members of the Euro STOXX 600 Index deliver quarterly results during that time.

“In aggregate, we believe that European corporates can manage the higher input costs and grow margins—corporate sentiment around pricing is at a decade high,” note the UBS analysts. “But clearly there are large differences across sectors and even intra-sector.”

At the sector level in Europe, UBS likes several corners of the consumer staples group, including alcohol, food retailers, and tobacco. Across all geographies, those groups combine for 11% of the DIVS roster. The bank is also bullish on luxury good retailers. DIVS has some exposure to that group via a 4% allocation to apparel and shoe retailers.

“Airlines, non-premium automobile makers, and some chemical groups are in a weaker position,” according to Barron’s.

DIVS isn’t excessively allocated to those industries. Formerly an active mutual fund, the ETF yields 1.75%.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.