For equity income investors, the headlines are positive this year as S&P 500 dividend growth is putting U.S. payouts on pace to reach (and perhaps soon eclipse) the highs seen prior to the ongoing coronavirus pandemic.

Adding to that, international dividends are on the mend, particularly in developed markets where payouts were hit hard by the global health crisis. However, investors should dig deeper than the headlines and investigate how some dividends are growing. Due in large part to low interest rates, plenty of companies are issuing junk-rated corporate debt to fund dividends.

“Nonfinancial companies including insurance provider Asurion LLC and fast-food chain Whataburger Inc. have issued more than $72 billion worth of speculative-grade loans to pay dividends in 2021, according to S&P Global Market Intelligence’s LCD. That is already a full-year record in data going back to 2000, topping 2013’s previous high of $54.4 billion,” reports Sebastian Pellejero for the Wall Street Journal.

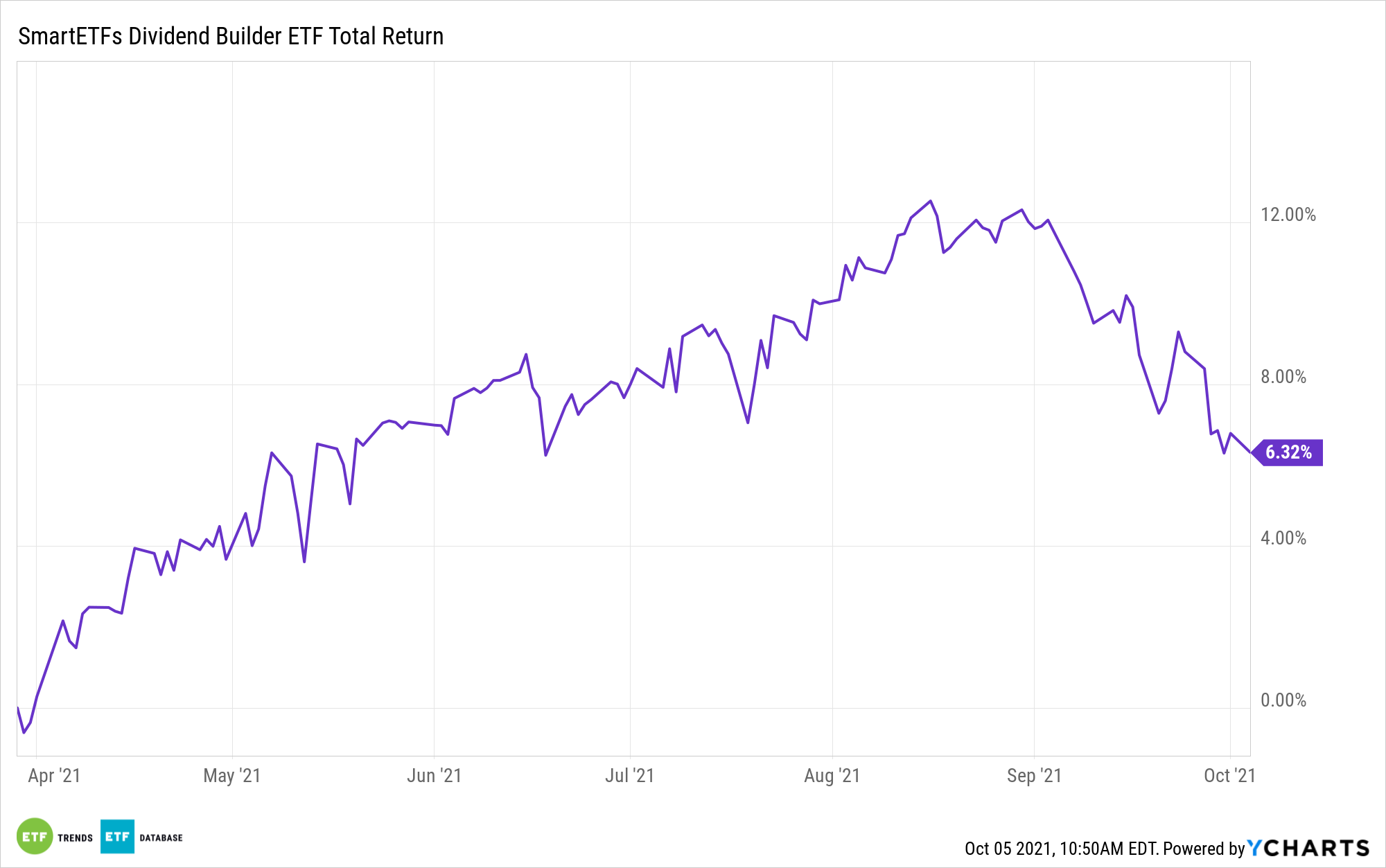

Companies rushing to debt markets when rates are low to finance dividends is a movie that investors have seen, and as 2020 confirms, it’s a movie that often has a bad ending. Investors can avoid that with the SmartETFs Dividend Builder ETF (DIVS).

Many DIVS holdings avoid the pitfall of issuing debt to fund dividends because they’re strong generators of free cash flow and finance payouts the “right way.” And if some DIVS member firms do head to debt markets, they’re generally selling lower interest rate investment-grade bonds.

“U.S. companies have also issued a record amount of junk bonds this year, while leveraged loan sales are on pace to surpass 2017’s record of $503 billion. After the Federal Reserve cut interest rates to near zero and started buying billions of dollars worth of bonds, many companies were able to lower their interest costs and raise record amounts of cash by selling junk debt, thanks to strong demand from investors in search of higher yields,” according to the Wall Street Journal.

Profligate debt issuance to fund dividends isn’t something that DIVS investors need to worry about. The actively managed fund explicitly seeks companies with high rates of return on invested capital and those with low debt burdens. Those traits are hallmarks of companies that can support current dividend obligations — often without needing to sell debt to do so — and are signs of firms with the ability to prudently grow dividends over the long haul.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.