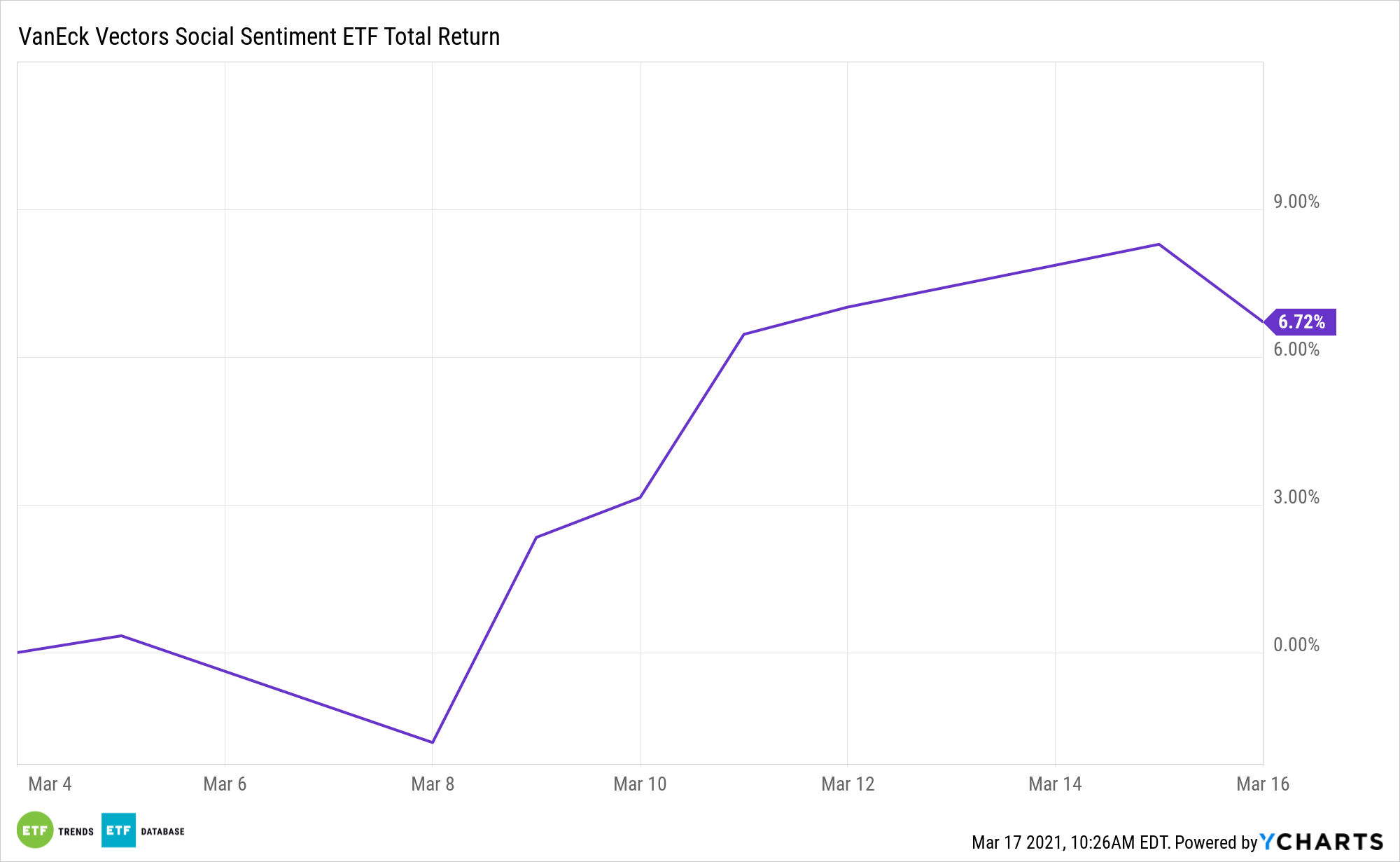

Few ETFs debut to as much fanfare as did the recently launched VanEck Vectors Social Sentiment ETF (BUZZ), but there’s plenty of substance to go with the hype.

The fund tracks the BUZZ NextGen AI US Sentiment Leaders Index. It employs leading-edge analytics to harness the collective conviction of millions of investors. The Index tracks the performance of the 75 large cap U.S. stocks that exhibit the highest degree of positive investor sentiment and bullish perception based on content aggregated from online sources, including social media, news articles, blog posts, and other alternative datasets.

Using social sentiment to glean insight about potential movements by individual stocks has been around almost as long as social media itself. Investors that are new to social sentiment and its applications may be surprised to learn that many of the early adopters of social sentiment in the financial markets were high-level, sophisticated market participants, including hedge funds and institutional investors.

BUZZ Backed by a Credible Approach

Mining consumer data is nothing new, but using data analytics in an ETF index-based strategy is. Consumer companies have utilized predictive analysis from social media to identify marketing insights and gain competitive advantages. Now, BUZZ taps into the same methodology to find stocks gaining momentum among the investment community, using social analytics to identify U.S. stocks with the most positive insights collected from social media.

In other words, investing using social sentiment is not a far-flung idea; it is widely accepted and happening every day.

See also: BUZZ & the Portnoy Problem

“What people are saying about stocks matters more than ever before—and they are saying a lot more than ever before. Today’s individual investors collaborate, discuss, share insights, express opinions and debate the merits of investment opportunities across a range of online platforms. Tapping into the sentiment from these communities can identify trends that potentially impact stock performance,” according to VanEck research.

Millions of investment-related messages and posts on sites like Reddit, StockTwits, Twitter, and others are analyzed to identify stocks with the highest future return potential. The index is dynamic and keeps the portfolio of stocks current by reviewing picks each month, dropping stocks that have declined in investor sentiment, and adding others where sentiment has increased.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.