The age-old growth vs. value tussle is on full display in 2021, with the latter maintaining the upper hand thus far.

As of May 28, the S&P 500 Value Index is higher by 17.7%, or more than double the 8.3% returned by the S&P 500 Growth Index. Moreover, some market observers believe the growth-to-value rotation is actually lengthening the current bull market and that could ultimately work in favor of disruptive growth equities. Count ARK CEO Cathie Wood as part of that group.

“In our view, this rotation has broadened and strengthened the bull market significantly, preventing another tech and telecom bubble and setting the stage for another leg up in innovation-based strategies,” said Wood in a recent note. “Had the equity market continued to narrow toward innovation, the odds of a bust like that after the tech and telecom bubble would have increased.”

As Wood points out, one of the factors hindering innovative growth names this year is that the “stay at home” investment thesis nurtured by coronavirus pandemic shutdown is wearing off as more folks get vaccinated and seek a return to some form of pre-Covid normalcy.

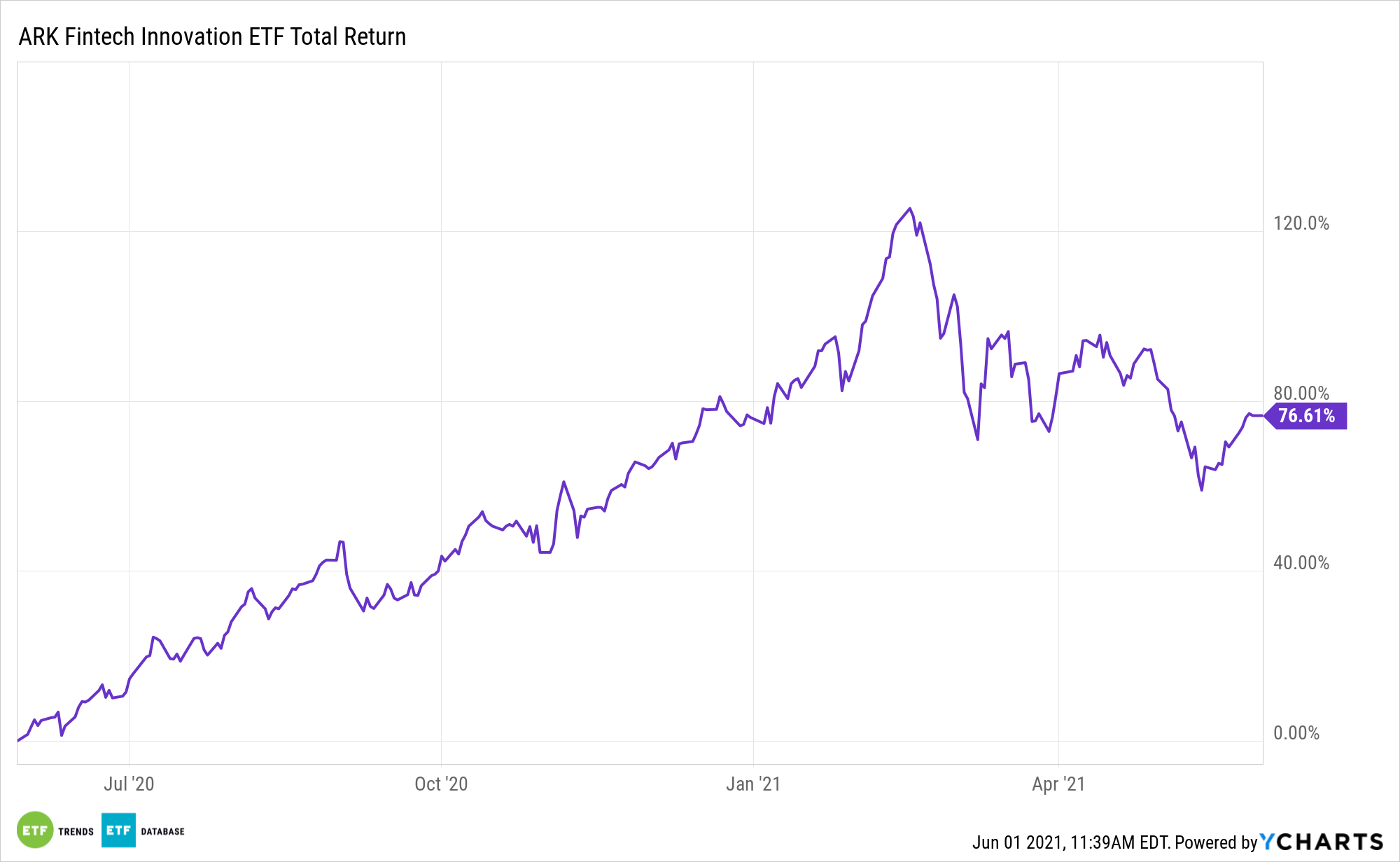

That’s weighing on disruptive growth strategies like the ARK Fintech Innovation ETF (NYSEARCA: ARKF) and the ARK Web x.0 ETF (NYSEArca: ARKW), which enjoyed substantial pandemic-related surges.

Yet there’s more to the story.

“The good news is that fear, uncertainty, and doubt (FUD) have provided investors with an opportunity to average down into some innovation strategies at an approximate 30-40% discount to their recent peaks,” Wood said.

Think about the near-term post-pandemic environment for disruptive growth this way. First, as noted above, growth stocks aren’t dead. They’re simply lagging value. That’s not a point against disruptive growth because factor leadership is transitory.

Second, the case for innovative technologies isn’t going to wilt simply because of rising vaccination levels. As Wood notes, these are sticky concepts that were being embraced prior to Covid-19.

“The coronavirus pandemic accelerated behavior shifts that already were underway and are unlikely to reverse now that the world is recovering from its shock,” she concluded.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.