Healthcare is often viewed as a defensive sector, but it’s evolving, offering investors more credible avenues for growth. One of the prime avenues for tapping into that trend is the ARK Genomic Revolution Multi-Sector Fund (CBOE: ARKG).

Genomics companies try to better understand how biological information is collected, processed, and applied by reducing guesswork and enhancing precision, restructuring health care, agriculture, pharmaceuticals and our quality of life in the process. Genomics is a booming market with epic potential for investors.

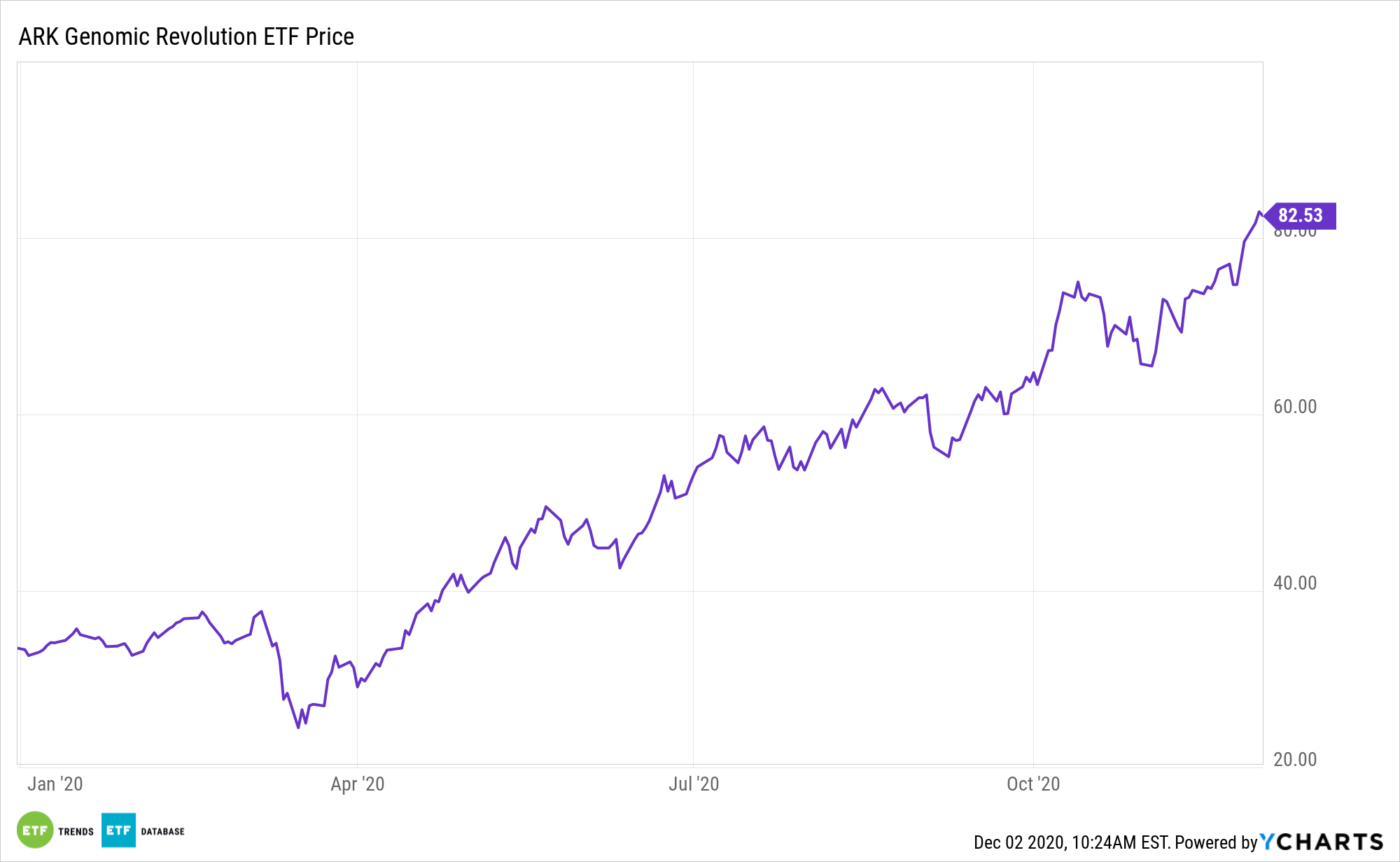

ARKG includes companies that merge healthcare with technology and capitalize on the revolution in genomic sequencing. The fund is up nearly 144% year-to-date.

“Under any circumstances, ARKG’s 2020 showing is impressive, but that’s even more so when considering the fund isn’t excessively allocated to companies working on Covid-19 vaccines. Rather, ARKG is driven by companies engaged in bioinfomatics, CRISPR, stem cell research and targeted therapeutics, among other growthier corners of the healthcare universe,” according to InvestorPlace.

Results in the Short-Term, Reliability for the Long-Term

Bolstering the case for ARKG over the long-term is the importance of genomics in an array of clinical trials. Drug development companies are making clinical trials more efficient by using NGS to find and enroll patients likely to respond. Half of the clinical trials and 80% of oncology trials now collect genetic information. ARK believes that clinical trials using genetic diagnostics will result in fewer failed drugs and will increase capital efficiency.

The fund delivers to investors today a futuristic approach to healthcare. In fact, some market observers believe the genomics space is where the next batch of FAANG stocks reside.

“Only time will tell if ARKG’s recent success will be replicated, but what isn’t up for debate are sound fundamentals,” notes InvestorPlace. “For example, genomics costs are declining, making the treatments and therapies available in this space more accessible to a broader range of patients. Second, genomics companies are at the epicenters of some compelling advancements, including dark read DNA sequencing and precision medicine.”

ARKG’s primary focus is to seek long-term growth of capita via active management. The fund invests primarily in domestic and foreign equity securities of companies across multiple sectors, including healthcare, information technology, materials, energy, and consumer discretionary, which are relevant to the fund’s investment theme of the genomics revolution.

Robotics and artificial intelligence (AI) are typically associated with disruptive technology and before long, this technology could represent standard fare in all industries. As noted, genomics is also taking its own revolutionary steps as a disruptor, particularly in the health care industry.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.