Recent data point to a record shopping season for Shopify (SHOP), which saw Black Friday sales grow 22% y/y. Additional reports from Adobe Analytics show a strong $9.8 billion Black Friday season. But a successful Black Friday doesn’t necessarily point to a strong 4Q for retail. This note discusses a couple of ways to play the retail sector during periods of possible consumer weakness including online retail ETFs and discount retailers/staples ETFs.

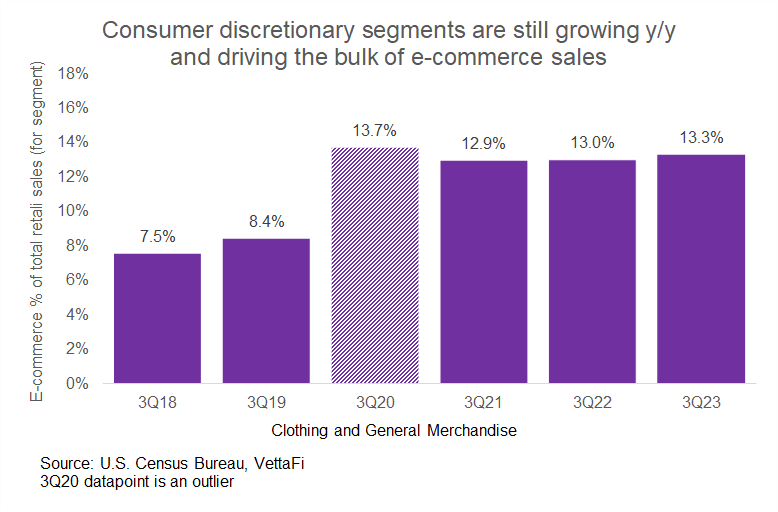

E-commerce continues to take a share of total retail sales.

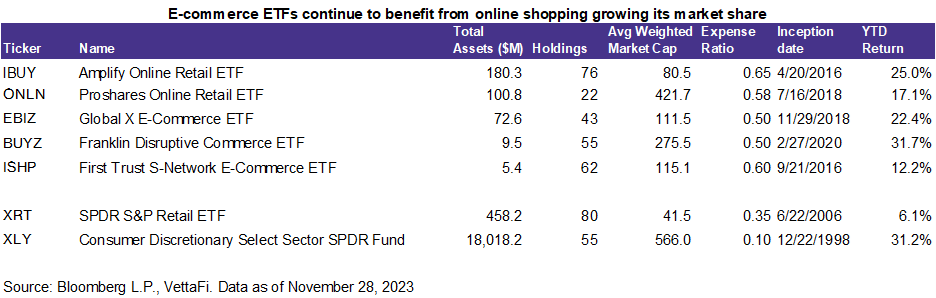

In my most recent note, I forecasted U.S. e-commerce sales for 3Q at 15.8% of total retail sales. Actual e-commerce sales were 15.6% of total retail sales. That is slightly lower than expected but within a reasonable range based on the adjustment factors I used. Regardless, e-commerce continues to take market share for total retail. Looking forward to 4Q, I expect a continued increase in e-commerce market share. Consumers are shopping during extended Black Friday sales ahead of the holidays even as total retail sales growth deteriorates. This was a big theme last year. But consumers are even tighter on cash this year. They are more likely to pull holiday spending forward for Black Friday. Still, online shopping is driven largely by discretionary areas like clothing, accessories, and other general merchandise (in contrast to areas like food and healthcare). These areas will likely see some overall pressure along with the broader consumer discretionary sector. To sum up — consumer discretionary goods may not be out of favor yet. But I would focus on the online shopping/omnichannel portion of the sector for the remainder of the year.

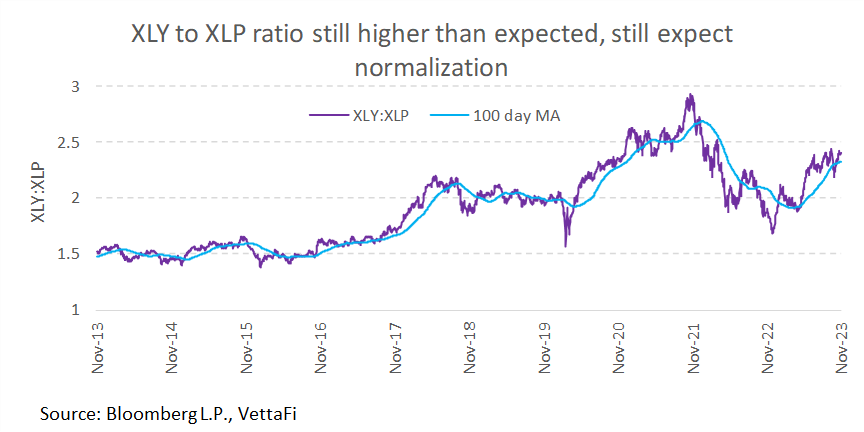

Consumer staples sector likely benefits and currently trading at a relatively lower value.

In another previous note, I wrote about the rotation from consumer discretionary to consumer staples. Staples are typically more stable when the economy is weak. Why? Because spending on necessary goods typically does not change throughout the economic cycle. This year, however, consumers are still valuing entertainment like restaurants and concerts. This will likely remain a sizable share of their wallet spending this quarter. To save money in other spending areas, consumers will use several strategies:

- Buy now, pay later

- Increased credit card spending

- Swapping to bulk, discount groceries

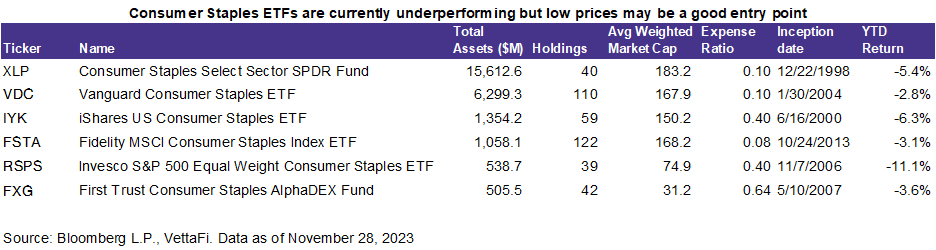

Broadly, staples should benefit but I see the biggest benefit in discount grocers including Walmart (WMT), its discount branch (Sam’s Club), and Costco (COST).

Discount retail model most likely to benefit out of staples.

Walmart, for example, reported its earnings on November 16 and it looked relatively good (despite a drop in its stock price) — most financial metrics were up year-over-year, and the company even raised its net sales and EPS full-year forecasts. E-commerce sales were up 15% globally, led by pickup and delivery. E-commerce sales are now 15% of total sales — about in line with the national average. Additionally, over half of Walmart’s sales come from staples, which has given it a defensive edge over competitors like Target (TGT) which sells more discretionary items and caters to middle and higher-income consumers.

Previously Costco had also reported a good earnings quarter, with higher net sales despite membership fees increasing 13.7% in the quarter. Discount retailers like Costco and Sam’s Club benefit in the current environment as shoppers look for a “no frills” grocery experience for food and healthcare necessities instead of a higher-end grocer like Whole Foods or other organic grocers. Discount retailers also benefit from the profit line as they trade in time/resources on displays and aesthetics in exchange for setting up their store like a warehouse with merchandise still on pallets.

But while these signs point to a potential rotation toward staples vs. discretionary, staples prices are still underperforming relative to discretionary prices. I believe staples — led by discount retailers — will show resilience vs. discretionary — particularly during and post-holiday season — and lower prices might provide a good entry point.

Bottom Line:

Besides individual stocks like Amazon, Walmart, and other big retail names, it may be simpler for investors to take advantage of shifts in consumer behavior through broader sector and industry ETFs. While online retail ETFs shown above like Amplify Online Retail ETF (IBUY), Proshares Online Retail ETF (ONLN), Global X E-Commerce ETF (EBIZ), Franklin Disruptive Commerce ETF (BUYZ), and First Trust S-Network E-Commerce ETF (ISHP) may show some weakness along with the broader retail sector, they may be better able to withstand downturns as online shopping typically remains resilient in times when consumers are spending less money. Alternatively, the broader consumer staples sector is likely to benefit during similar economic periods—particularly led by discount retailers. This means that sector ETFs like Consumer Staples Select Sector SPDR Fund (XLP), Vanguard Consumer Staples ETF (VDC), and iShares US Consumer Staples ETF (IYK) (along with other ETFs listed above) may show strength as the discretionary sector falls.

For more news, information, and analysis, visit the Disruptive Technology Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for ISHP and IBUY, for which it receives an index licensing fee. However, ISHP and IBUY are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of ISHP and IBUY.