Tech has been one of the hottest investment areas for the past few years, which we can credit to the impact it has had on our daily lives. This includes the spread of online shopping, for example, or the grand entrance of OpenAI’s ChatGPT. Biotech may be less obvious, but this sector has also ridden a rising tide of tech advancement, as seen in HTEC, the ROBO Global Healthcare Technology and Innovation ETF.

Why biotech? Especially as the Fed raised rates once again Wednesday, it may not be immediately clear why investors would flock to stocks from cutting-edge firms that have yet to necessarily deliver future profits from new drugs or advanced surgeries. That hasn’t stopped investor interest in funds like HTEC, however. The fund actually rose above both its 50-day and 200-day simple moving average (SMA) Wednesday, according to YCharts.

HTEC’s new price of around $30.57 as of the late afternoon is well above both averages which sit at $29.65 and $29.76, respectively.

So why the burst of investor attention? It may well be that investors believe that the bad news and looming recessionary turbulence are already priced in.

Opportunity In This Biotech ETF

If so, the thinking goes, the cutting-edge approach in an ETF like HTEC, which tracks the ROBO Global Healthcare Technology and Innovation Index, could have plenty of upside at such a low price relative to where biotech was last year and in years prior.

HTEC invests in global healthcare tech names flagged for ties to diagnostics, lab process automation, regenerative medicine, and more. Robo Global picks 50 to 100 names with high revenue scores from those and other biotech areas and invests accordingly.

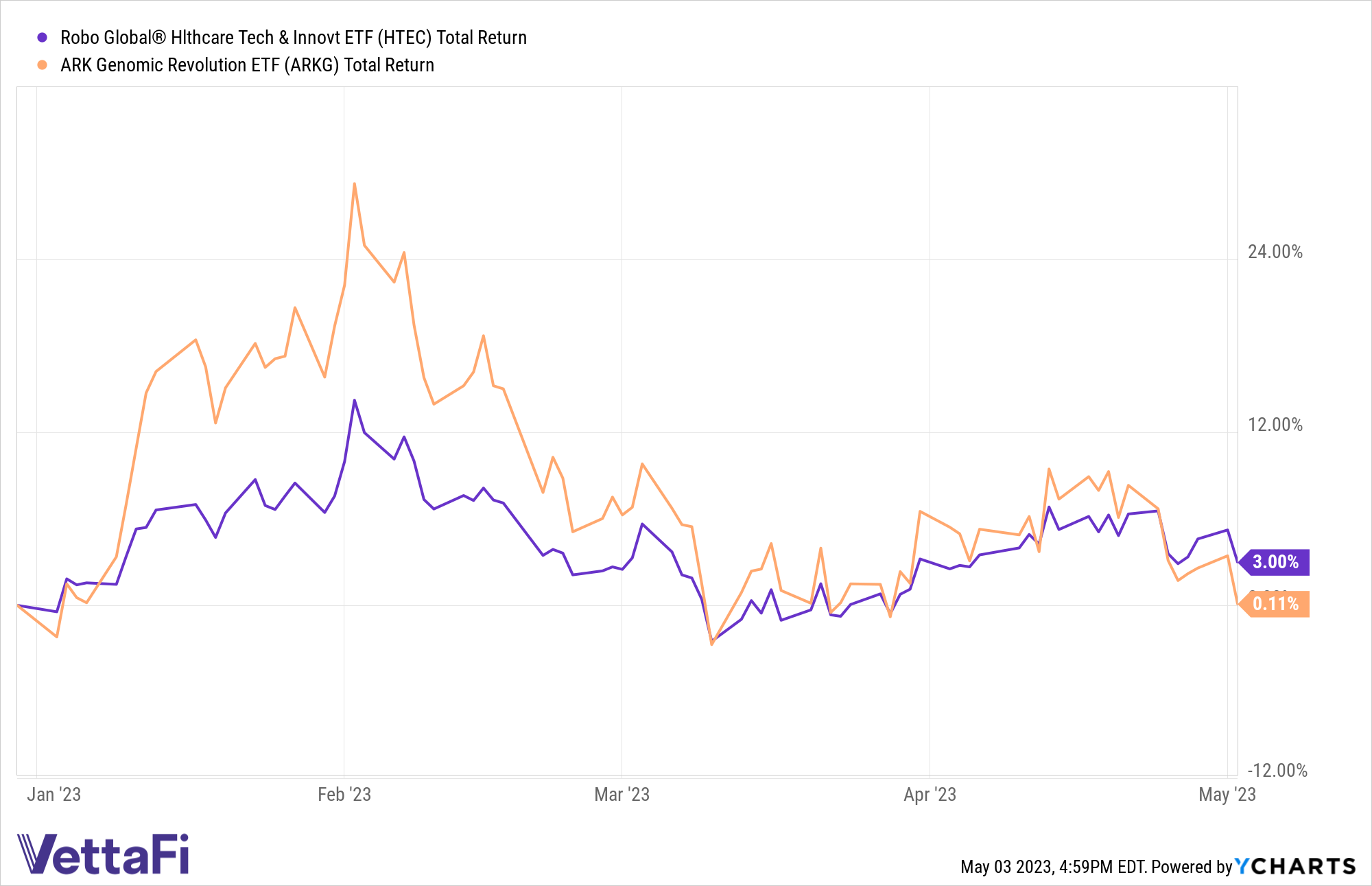

HTEC has returned well on a YTD basis. It may be worth watching if it can ride its tech indicator through a tumultuous back half of 2023.

For more news, information, and analysis, visit the Disruptive Technology Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for HTEC, for which it receives an index licensing fee. However, HTEC is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of HTEC.