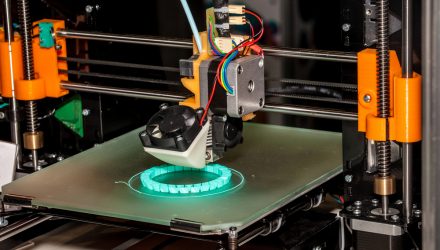

3D printing is one of the original disruptive technologies, and while it’s being overshadowed by newer entrants to the disruptive fray, 3D printing is evolving and remains highly relevant today.

That sets the stage for a compelling long-term outlook for the technology, and that could be beneficial to the ARK 3D Printing ETF (CBOE: PRNT). Today, PRNT components are already intersecting with other innovative companies, including those in industries such as healthcare innovation and space communication. That confirms the utility of 3D printing and the wide opportunity set for the industry.

Another recent scenario highlighted the advantages of 3D printing. Owing to global supply chain shocks caused by the coronavirus pandemic, more companies are turning to 3D printing to realize cost efficiencies and ease supply chain burdens.

“Supply chain shocks and labor shortages should accelerate the use of 3D printing and robotics. ARK estimates that 3D printing and robotics could scale at a 56% annual rate, from nearly $70 billion in public enterprise value in 2020 to over $6 trillion in 2030,” according to ARK Investment Management.

Undoubtedly, those are bold forecasts, but it’s also hard to ignore the growth potential of the 3D printing industry, particularly as these companies scale and offer manufacturers more flexibility while enhancing ability to respond to demand changes and labor challenges, among other positive factors.

“Manufacturers can place 3D printers near the destinations of final products, reducing supply chain footprints and shipping costs,” adds ARK. “3D Printing allows manufacturers to vertically integrate, reducing reliance on outside suppliers while saving time and cost.”

Another bonus for manufacturers is that 3D printing allows for order flexibility. The technology can be used on the fly for large or small orders, meaning that retained inventory could become a thing of the past.

Adding to the case for PRNT are at least two other factors. As noted above, 3D printing is considered “old” among disruptive technologies, but the industry is still in its early innings. Second, the ability of 3D printing to intersect with other disruptive industries is a vital feature in the long-term investment story.

“According to our research, as electric vehicle sales scale from nearly 5 million to roughly 40 million over the next five years, auto manufacturers will have to adapt by retooling and reinventing manufacturing lines. 3D printing allows for rapid prototyping, the elimination of tooling, a reduction in the number of parts, and faster time-to-market,” concludes ARK.

For more news, information, and strategy, visit the Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.