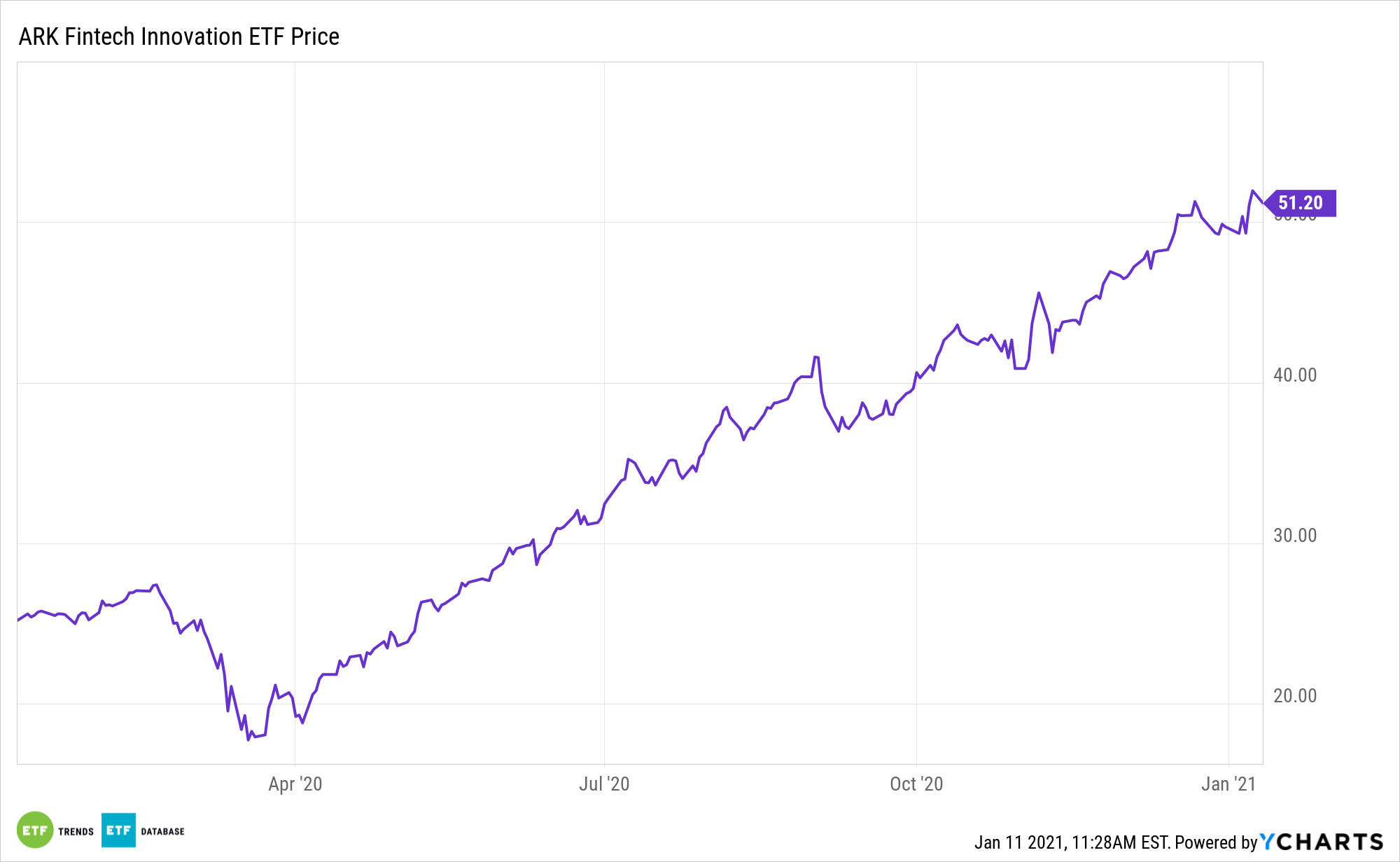

The effects of the coronavirus pandemic have been felt throughout the payments landscape. The ARK Fintech Innovation ETF (NYSEARCA: ARKF) delivered for investors in a big way.

The actively managed ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility while driving down costs.

Vital to the long-term thesis for fintech assets such as ARKF is that many of the changes forced by the pandemic will be sticky, sticking around long after the virus is defeated.

“The Covid-19 pandemic has provided a major boost for the fintech sector, with more financial decision makers now using start-up tech companies as part of their every day lives, according to research by McKinsey,” reports Banking Exchange. “The global consultancy group polled US consumers on a monthly basis between March and November last year to assess their use of fintechs such as challenger banks, payment firms, investment companies, and lenders.”

ARKF Holds the Future of Fintech

With COVID-19 flaring up again in some regions, contactless payments and the ARKF components with exposure to that theme stand to benefit once more. At the industry level, contactless is viewed as a futuristic concept, but integral to the ARKF thesis, that future is now. Contactless payments could see their share of all payments rise 10% to 15% because of the coronavirus. Adding to the case for ARKF is that the idea of digital payments isn’t confined to younger, more tech-savvy generations.

“The research also challenged the notion that mobile or online banking platforms were exclusively for younger people. While Generation Z (18-23 years old) and millennial (24-39) customers had the most fintech accounts, more than a quarter of baby boomers (aged 56-74) said they relied on a fintech account,” according to Banking Exchange. “However, McKinsey’s report also highlighted that, while the pandemic had increased fintech platform usage, very few of these new users had never used such a platform before.”

ARKF member firms are already encroaching upon territory previously dominated by traditional banks, including smaller business loans, payment processing, and business payroll. Plus, there are advantages for fintech companies in pursuing bank charters even if it doesn’t mean those companies will open brick-and-mortar branches.

Social distancing may have kept customers away from brick-and-mortar banks, giving financial technology time to shine. As consumers forge on following the pandemic, the ease of use provided by fintech will be a major disruptor for banks.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.