Somewhat quietly, the ARK 3D Printing ETF (CBOE: PRNT) was one of 2020’s best-performing thematic exchange traded funds.

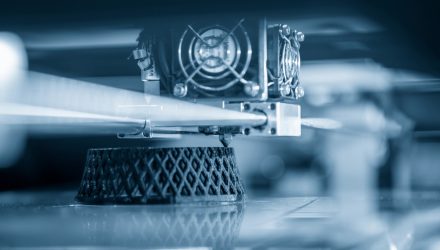

PRNT is the first U.S.-listed ETF dedicated to the 3D printing theme. The fund is one of two passively managed products from New York-based Ark Investment Management. ARK believes 3D printing will revolutionize manufacturing by collapsing the time between design and production, reducing costs, and enabling greater design complexity, accuracy, and customization than traditional manufacturing.

There’s good news for long-term investors: 3D printing is just scratching the surface.

“However, the three-dimensional revolution is still in its infancy, and still has not reached its full potential,” reports the Times of Israel. “According to ARK Investments, 3D printing for end-use parts is the next frontier, but it currently utilizes only 1% of its market potential of an estimated $490 billion. Models & tools utilize only 4% percent of their market potential of an estimated $30 billion, and prototypes utilize only 40-50 % of their market potential of an estimated $12.5 billion.”

3D Printing in Healthcare

3D printing has myriad applications for a variety of sectors, including industrials and technology, but healthcare is one of the prime examples. That’s particularly true if advancements in 3D printing organs and tissue advance beyond the concept to practical application phase.

“3D printing is accelerating innovation thanks to low-costs and rapid prototyping. It lowers the weight of low volume, highly complex parts, saving significant costs. One of the biggest beneficiaries of the 3D revolution is the aerospace industry,” adds the Times of Israel.

Integral to the PRNT thesis is that 3D printing intersects with other disruptive segments, enhancing revenue streams and diversification among end users. Within healthcare, there are myriad opportunities for 3D printing companies to improve patient outcomes.

PRNT’s underlying index index “is composed of equity securities and depositary receipts of exchange-listed companies from the U.S., non-U.S. developed markets, and Taiwan that are engaged in 3D printing-related businesses within the following business lines: (i) 3D printing hardware, (ii) computer-aided design (‘CAD’) and 3D printing simulation software, (iii) 3D printing centers, (iv) scanning and measurement, and (v) 3D printing materials,” according to Ark.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.