The first ETF in the United States to focus solely on the 3D printing ecosystem launched today on BATS ETF Marketplace.

ARK Investment Management LLC said its launch of The 3D Printing ETF (Bats: PRNT) adds to its investment product line-up that focuses on disruptive innovation.

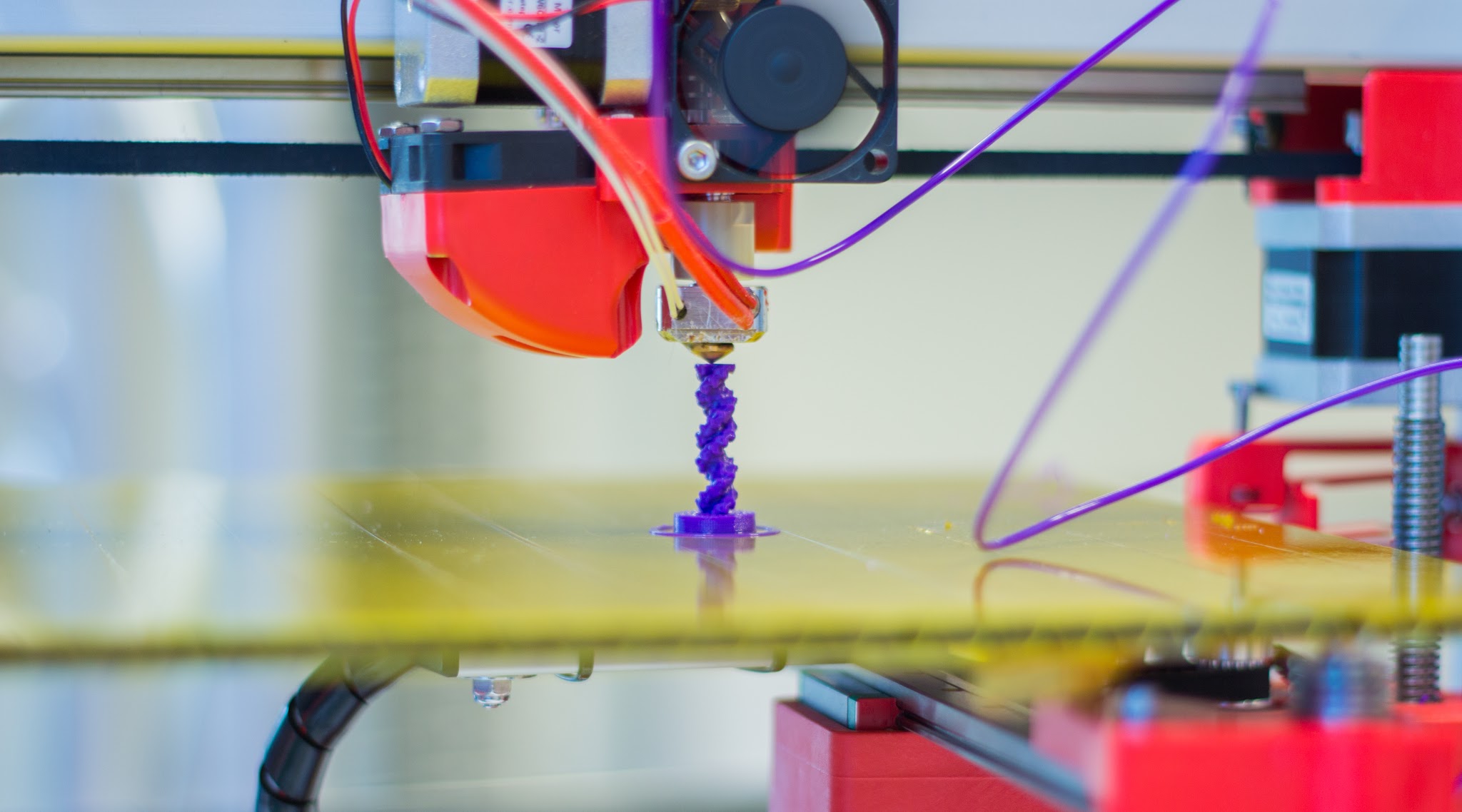

ARK believes 3D printing will revolutionize manufacturing by collapsing the time between design and production, reducing costs, and enabling greater design complexity, accuracy and customization than traditional manufacturing.

While 3D printing is a $5.2 billion market today, ARK estimates that it could grow to more than $40 billion by 2020; McKinsey projects a growth of up to$490 billion by 2025.

Related: A Big Day for ETFs as 5 Sponsors Launch New Products

Catherine D. Wood, ARK Founder, Chief Executive Officer and Chief Investment Officer, said ARK’s research showed that the 3D printing industry has one of the highest growth projections in the economy.