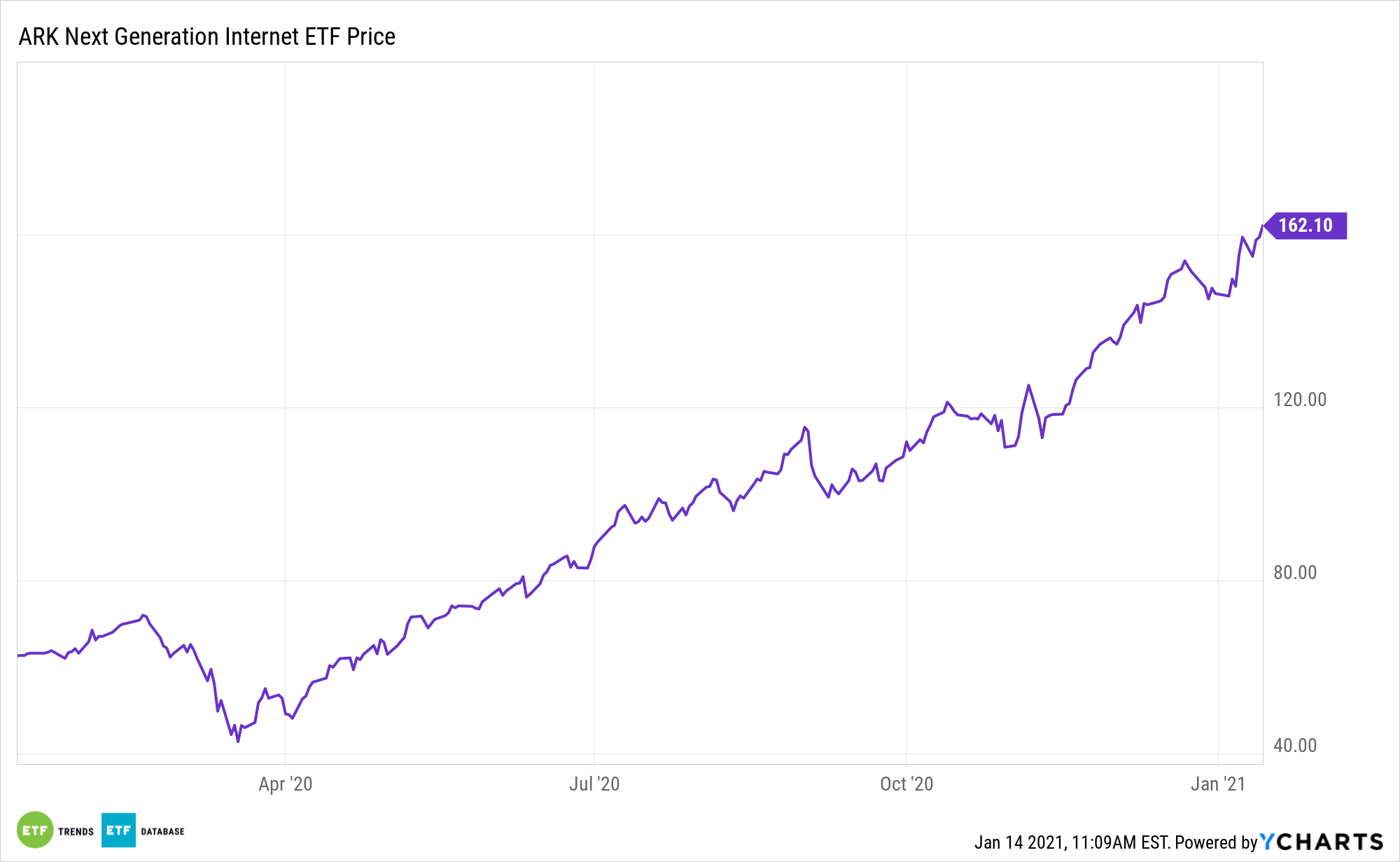

As an industry, digital media is still in its nascent stages, but spending in this frontier is growing. That’s good news for some holdings in the ARK Web x.0 ETF (NYSEArca: ARKW).

ARKW aims to capture long-term growth with a low correlation of relative returns to traditional growth strategies and negative correlation to value strategies. It serves as a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets. This active strategy comes in the low-cost and efficient ETF wrapper.

Data confirm the explosive growth of the digital media industry.

“According to data presented by Finaria, the revenue of the global digital media industry is expected to hit $292.4Bbn value in 2021, a 15% jump year-over-year,” notes the research firm.

ARKW: An Avenue to Digital Media

Some ARKW components are levered to trends in online advertising spending, a point in the actively managed ETF’s favor because online ad spending is expect to jump over the next several years.

Integral the long-term digital media thesis are factors including mobile penetration and large companies embracing social networking as an avenue for attracting new customers. Those factors and more are expected to lift average revenue per user (ARPU).

“In 2017, the entire industry hit $158.3bn in revenue, revealed the Statista survey. By the end of 2019, this figure jumped to $208.3bn. However, the COVID-19 lockdown triggered a surge in the use of digital media content, with revenues growing by 22% year-over-year to $254.8bn in 2020. The increasing trend is set to continue in the following years, with this figure rising to over $414bn by 2025,” adds Finaria.

ARKW is focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.

“Statistics show the video-on-demand segment witnessed the most significant growth amid the COVID-19 pandemic, with revenues rising by 29% YoY to $72.5bn in 2020. This figure is expected to increase to $85.8bn in 2021,” concludes Finaria.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.