A new era of artificial intelligence began with the release of ChatGPT. While it and similar tools have left many pondering the impact of AI in their everyday lives, investors have been keen on profiting from this craze.

But with the renewed furor over AI receding in the wake of other pressing news, some may be wondering what exactly is going on with AI now, months after ChatGPT shook up the space. To provide some insights, we use data pulled from LOGICLY to gain an in-depth perspective on the three-month performance of the two largest AI-focused ETFs.

See more: “A Diversified Approach to Investing in the AI Sector”

Which AI-Focused Funds Will We Be Focusing On?

The Global X Robotics & Artificial Intelligence ETF (BOTZ) and the Global Robotics & Automation Index ETF (ROBO) have seized the top two positions in terms of assets among AI-focused funds, but there are some key differences between them.

BOTZ leads the pack as the largest AI-focused fund in U.S. markets, boasting $2.5 billion in assets. The fund added inflows of $670.85 million this year. Notably, June and the first half of July alone contributed $294.09 million to this total.

ROBO takes the second spot with $1.5 billion in assets. ROBO’s net flows have not matched the success of BOTZ this year, bringing in only $64 million since the beginning of the year. Nonetheless, there is positive momentum for ROBO, with recent net flows of $32.7 million in June and July, indicating some renewed interest from investors.

Examining Performance of the AI-Focused Funds

When delving into the long-term performance of BOTZ and ROBO, it becomes evident that BOTZ has been on a winning streak causing it to pull ahead of its chief rival. It recorded a YTD return of 36.69%. However, ROBO still has achieved a respectable YTD return of 25.45%.

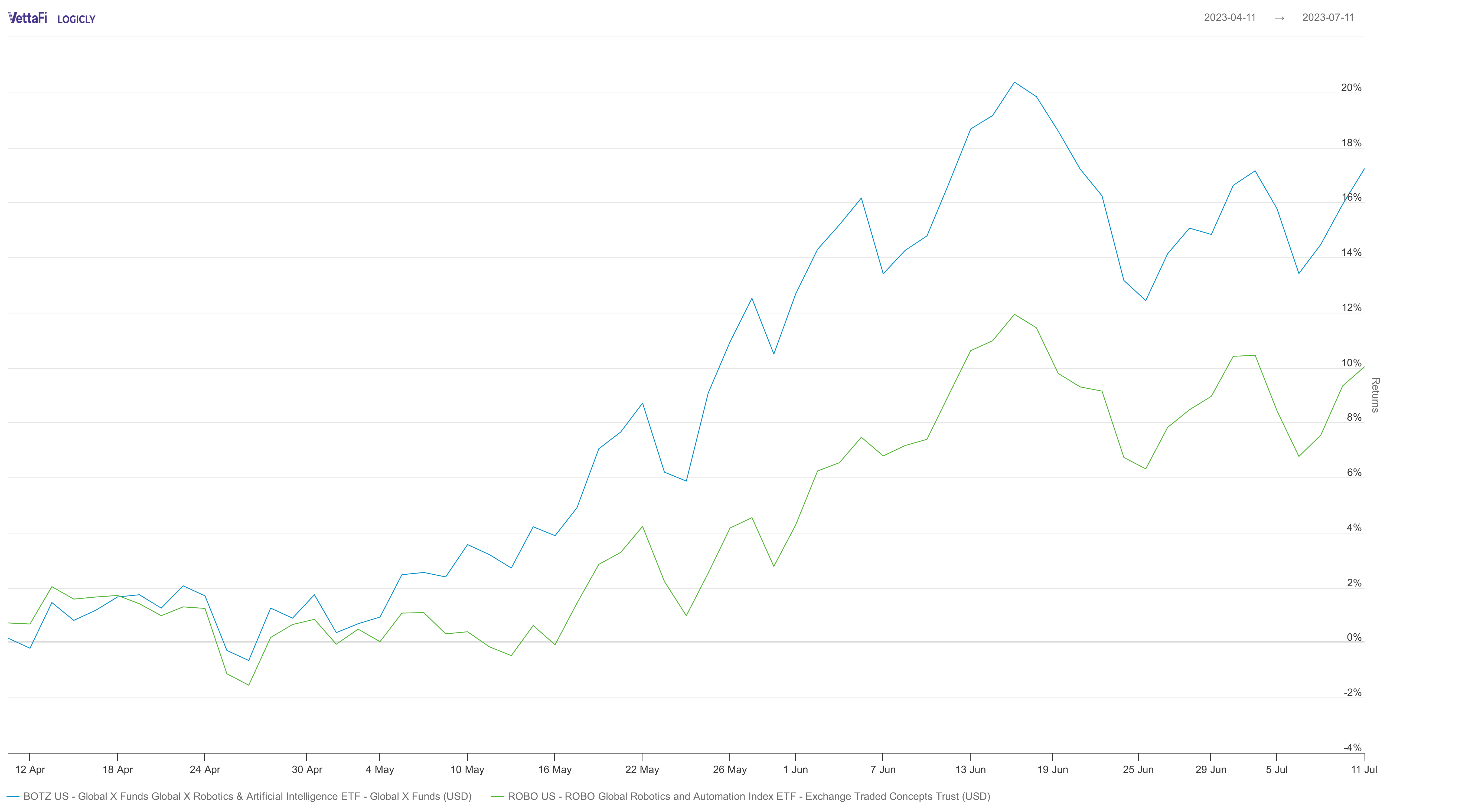

Taking a closer look at the past three months gives a better picture of the reasons for the performance gap between the two artificial intelligence funds. The graph shows that they exhibited fairly similar performance in early May. However, during the past few months, the gap between BOTZ and ROBO has widened significantly.

One explanation for this outperformance is the exceptional performance of BOTZ’s top holding, NVIDIA Corporation (NVDA). The semiconductor company has been one of the hottest stocks in the market all year. BOTZ has 12.43% of its portfolio in NVIDIA, while ROBO only has 1.55%. It doesn’t even fall within ROBO’s top 15 holdings.

NVIDIA Performance

Using LOGICLY’s stock screener tool we are able to get a more accurate picture of the performance of NVIDIA Corporation in that three-month time frame. The graph above shows a huge jump in stock price, as well as volume flowing into the stock on May 25. The sharp increase directly followed NVIDIA’s announcement of its expectations for the upcoming quarter, which excited investors.

Interestingly enough, looking back to the first chart, this is when you begin to see BOTZ pull away significantly from ROBO. The higher weighting in NVIDIA in BOTZ could be an explanation as to why the fund is outperforming ROBO.

See more: “Investing in AI-Focused ETFs: A Smart Move for Modern Investors”

Two of ROBO’s largest holdings, IPG Photonics Corporation and Intuitive Surgical, Inc. have both performed well, notching positive returns this year so far, but not to the extent of NVIDIA. That said, not many stocks have been able to match its performance this year. Still, the rest of BOTZ’s holdings have not stood out or have not been as successful as NVIDIA, which has been the largest contributor to the ETF’s upside performance this year.

Conclusion

In a time overshadowed by other significant concerns, the AI sector continues to captivate investor attention with its potential. The performance of top AI funds, such as BOTZ and ROBO, provides valuable insights into this novel sector. BOTZ has exhibited exceptionally strong performance largely due to its heavy weight in NVIDIA, and this fund may not be for investors who are unsure if NVIDIA’s success will continue. The firm is dominating the semiconductor industry now, but technology can change quickly.

ROBO’s performance and its more equal-weight approach to its holdings may hold more appeal for those investors. Regardless, with both funds posting double-digit returns, they both can present a positive opportunity for investors. As the AI landscape unfolds, investors should consider the nature of AI-focused funds closely.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.

For more news, information, and analysis, visit the Disruptive Technology Channel.