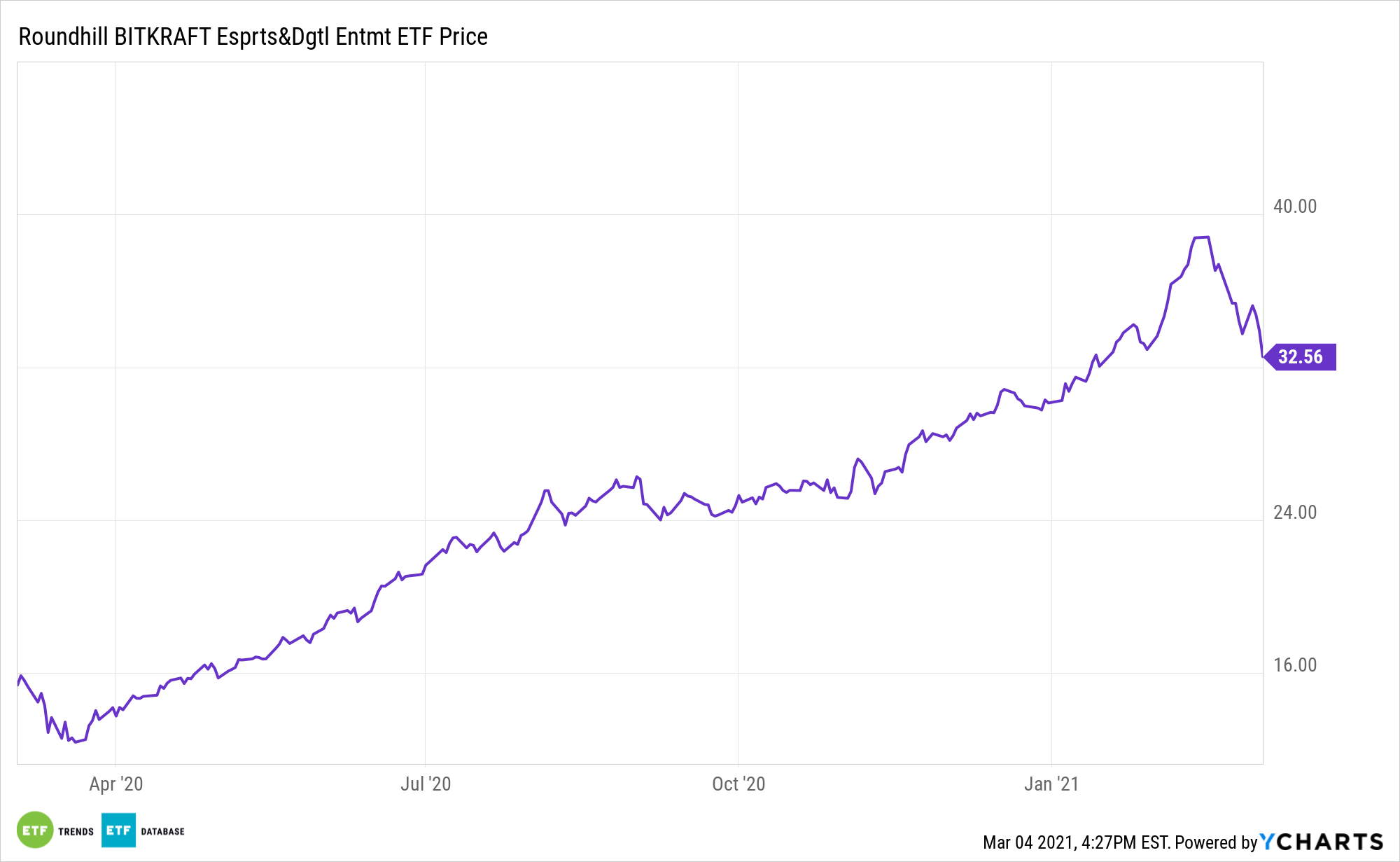

Boosted by shelter-in-place orders due to the coronavirus pandemic, videogame equities and exchange funds like the Roundhill BITKRAFT Esports & Digital Entertainment ETF (NYSEArca: NERD) soared last year. They may just be getting started.

NERD seeks to track the total return performance of the Roundhill BITKRAFT Esports Index, which tracks the performance of the common stock of exchange-listed companies across the globe that earn revenue from electronic sports, or eSports related business activities.

“Video games have been around for over 50 years, and despite its age, the industry continues to not only grow but also evolve,” writes Morningstar analyst Neil Macker. “During 2020, the pandemic and associated stay-at-home regulations provided a tailwind to the secular trends underpinning the growth of video games as well as some potential evolutionary shifts. The secular trends include the switch to digital downloads and microtransaction growth, with more evolutionary changes including subscription plans and cloud gaming.”

NERD’s underlying index consists of a modified equal-weighted portfolio of globally-listed companies who are actively involved in the competitive video gaming industry. This classification includes, but is not limited to video game publishers, streaming network operators, video game tournament and league operators/owners, competitive team owners, and hardware developers.

Beyond the Pandemic

Covid-19 social distancing measures led gamers to keep their consoles fired up to pass the time away. Videogame engagement has broken records across a variety of metrics since the virus shutdown began.

The explosive growth of eSports could even power the space past traditional sports, where revenue generation is now heavily tilted towards enhancing a fan’s multimedia experience. Adding to the NERD case is new data confirming just how much gaming spending is soaring.

“In November 2020, Sony and Microsoft launched their next-generation consoles to very high demand. Despite the closures of retail outlets in many markets, the new versions of the PS5 and Xbox quickly sold out, and subsequent restocks at every retailer have been snapped up by consumers and scalpers,” adds Macker. “The secondary market for both consoles provides some indication that the demand remains strong, at least among early adopters. We expect that the supply shortfall will end by the 2021 holiday season as both companies rev up their supply chains to meet the demand and overcome the pandemic-related challenges, thus eroding most of the premiums in the secondary market.”

NERD is up almost 17% year-to-date.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.