The ROBO Global Healthcare Technology and Innovation Index (HTEC) has underperformed compared to the equity market this year. At the time of writing on June 20th, 2023, the HTEC index is up +4.5% YTD vs MSCI World Index +8.4% and S&P 500 +14.8%.

Investor interest in healthcare appears jaded after years of Covid disruptions, and healthcare equities have been underperforming, with the iShares Global Healthcare ETF (IXJ) flat YTD, some of the largest healthcare companies seeing a sharp reversal after a strong two years led by health insurers such as UnitedHealth (-9.5% YTD), Elevance (-12.5% YTD), and Cigna (15.5% YTD) which have recently warned of an uptick in medical costs attributed to pandemic-postponed procedures.

In fact, this may bode well for many of the HTEC index members going into the 2H of 2023, with companies predominantly exposed to cutting-edge technologies in medical devices, lab process automation, and multiple healthcare areas of innovation including cancer, chronic and genetic diseases, diagnostics, and medical instruments. We believe the acceleration in elective procedures will benefit companies across orthopedic (Smith & Nephew and), cardiovascular (Abiomed, Edwards, Boston Scientific), ophthalmologic (Staar Surgical), spinal cord (Globus Medical), broader general surgery innovations (Integra – soft tissue reconstruction), and Robotic Surgery players such as Intuitive Surgical and Stryker.

Subsector performance YTD has been mixed, with the largest subsector Medical Instruments, which accounts for 27% of the index, posting a decent 12.4% return led by companies such as Tactile Systems (+112% YTD, yet market cap is ~60% off pre-covid levels).

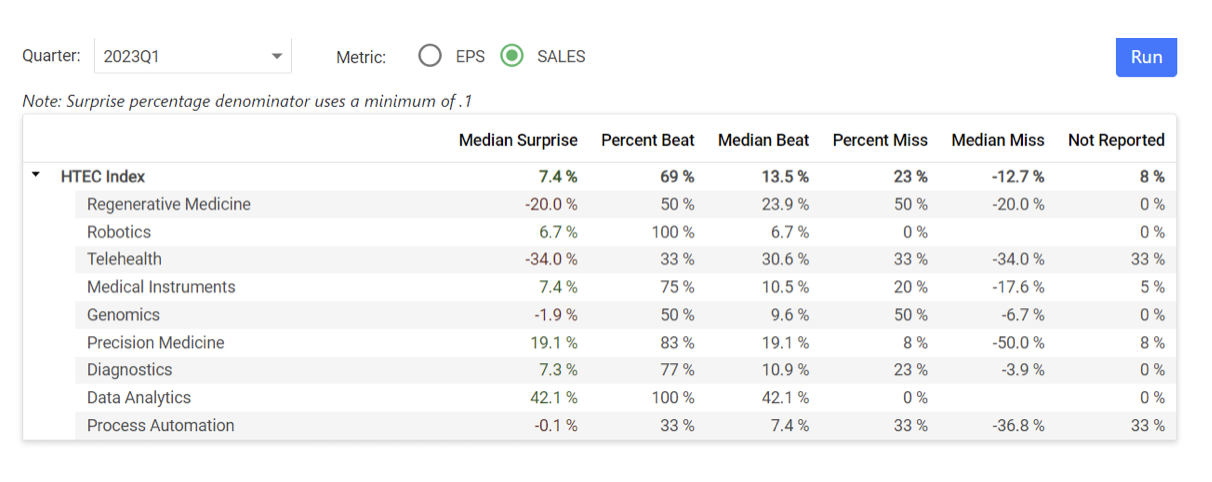

This earning season, with 93% of HTEC reporting, we have seen 75% of companies beat sales expectations with an average surprise of 3.4%, and 71% beat EPS expectations with an average surprise of 7.4%.

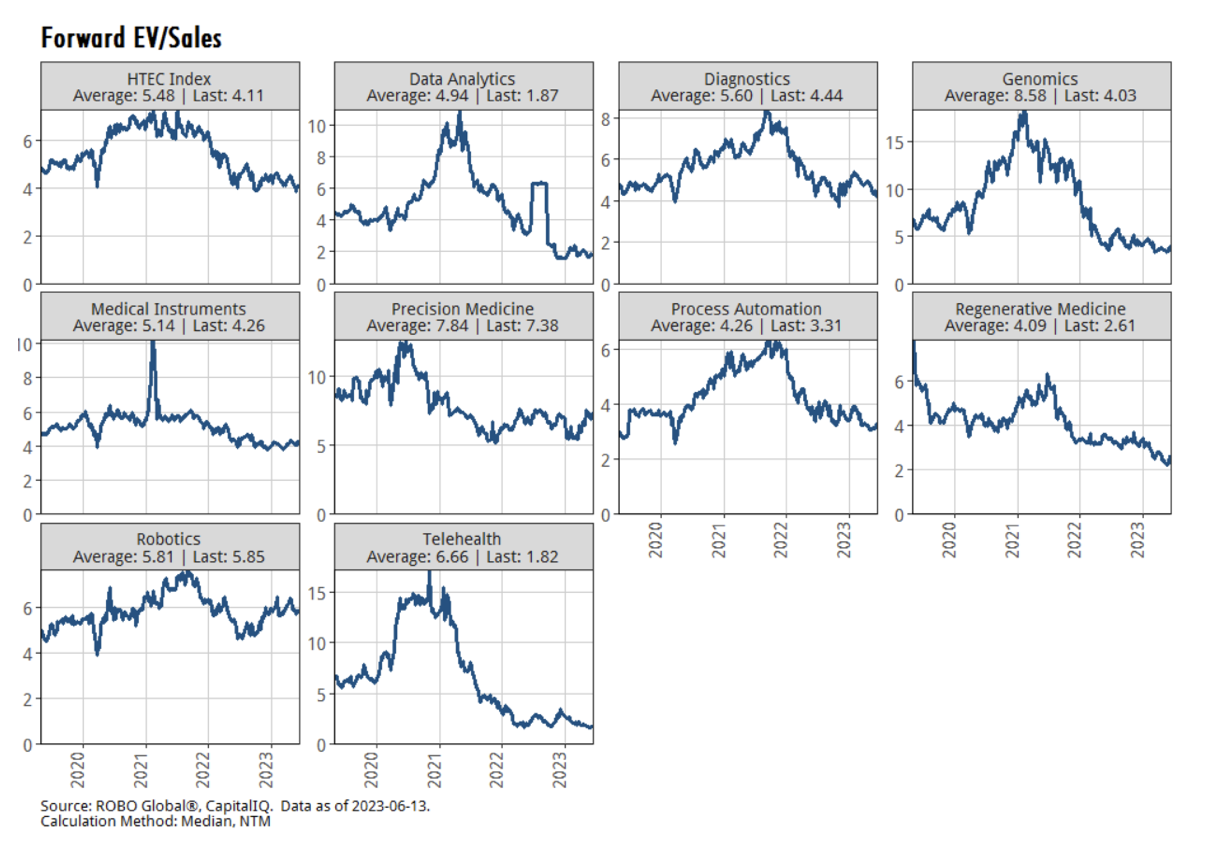

Current valuations reflect significantly reduced expectations, with a forward EV/Sales of 4x compared with the 4-year historical average of 5.5x and the 7.2x high of 2021.

Diagnostics (18.8% weighting, +4.55% YTD) has seen a slowdown at lab diagnostics companies such as DiaSorin and Agilent, partly due to continued COVID-19 normalization. While these areas are contracting, non-covid-related growth rates are more important in the longer-term picture.

Leading diagnostics performance is Exact Science, which raised its full-year 2023 revenue and adjusted EBITDA guidance by $110M and $100M respectively as their novel liquid biopsy cancer screening technology gains further adoption, especially after the recommended colon cancer screening age was adjusted earlier to 45 years old greatly expanding their addressable market. Additionally, on June 20th, it was shown that their latest generation of Cologuard reduces false positives by 30% and improves detection rates further.

Genomics (11% weighting, +3.26% YTD), has projections of sales growth rates declining slightly this year to 13.9% vs 2022’s 14.4%, yet currently projected to jump to 17.2% the following year based on continued adoption and less tough comps against Covid-19. Covid-19 winner Fulgent Genetics, which at one point was up 1,100% from its pre-covid levels, has seen its multiples contact dramatically, down to below book value, at 2.6x EV/Sales 23’E. They are seeing growth in Oncology and Fertility, with growing product lines called Beacon and Lumera, respectively, and now service 6 of the top 10 pharma companies and 3 of the largest contract research organizations. Meanwhile, liquid biopsy pioneers, Natera and Guardant, continue to grow at +20% topline

Precision Medicine is down 8.5%, with Q1 earnings seeing the subsector with a median revenue surprise of 19% with Arrowhead and CRISPR Therapeutics with the largest upside surprise. In contrast, companies such as Moderna saw Covid-19 vaccine revenue contraction. For Moderna, their pipeline of mRNA vaccines targeting a wide range of conditions including flu and RSV to Lymes, Zika, Norovirus, and HIV continues to gain steam. Moderna is also working on cancer vaccines and announced positive results for its Melanoma trial which saw the risk of death or reoccurrence drop by an astounding 44%.

Meanwhile, many other HTEC members also have growing evidence to become some of the most important not only in healthcare but overall, in the world of our time. For example, if BioMarin gets approval for their gene editing drug for Hemophilia A (a $45B market in the USA with 30k patients costing an avg $300k per year in drug transfusions) which would be a one-time cost of $1.5M-$2M vs 20-year cost of $6M. And that isn’t the only drug in their pipeline, to be clear.

Similarly, Vertex and CRISPR Therapeutics joint venture gene editing candidates’ success in Sickle-Cell and Beta-Thalassemia would pioneer in-vivo CRISPR gene editing (the gene editing acting inside the body). Also coming down their JV pipeline is a second collaborative candidate targeting Type 1 Diabetes (T1D), where their gene editing technology could help the pancreas produce insulin again by using insulin-producing beta cells. Furthermore, they are working on an additional trial using the same core technology that encapsulates the beta cells and could allow for administration without immunosuppressants, another potential life-changing milestone.

Data Analytics had the strongest performance with all members beating expectations with a median 42% topline beat, including Veeva Systems which provides software services to the life sciences industry.

In the Robotics subsector, we saw Omnicell, a leader in pharmacy care delivery and automation, which has been expanding its model to include more SaaS and tech-enabled services over recent years, largely beating expectations. The company has seen recent challenges in a harsher hospital capex environment, but labor shortages keep increasing demand for solutions to streamline operations.  As a reminder, certain subsectors are coming off incredibly strong comps, such as the diagnostics and genomics subsector, which saw upwards of 40% growth during the pandemic for several years as both instruments, consumable deployment, and utilization, boomed.

As a reminder, certain subsectors are coming off incredibly strong comps, such as the diagnostics and genomics subsector, which saw upwards of 40% growth during the pandemic for several years as both instruments, consumable deployment, and utilization, boomed.

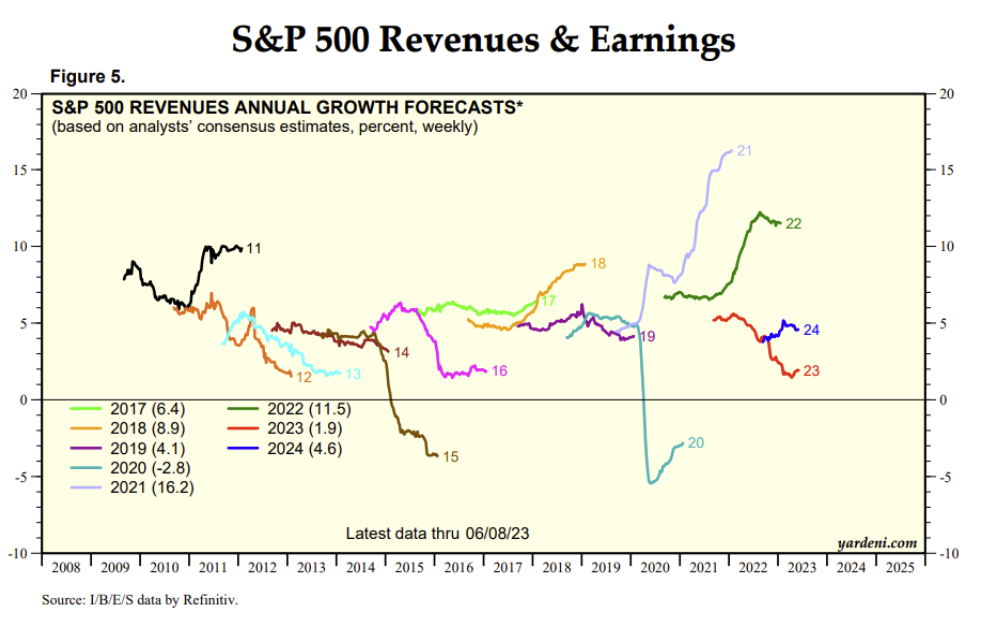

Similarly, earnings are expected to normalize back upwards, as tighter fiscal policies across headcount and focus shift capital back towards top priority and bottom line, similar to what we’ve seen happening in the broader technology landscape.

By: Zeno Mercer, Sr. Research Analyst at ROBO Global

For more news, information, and analysis, visit the Disruptive Technology Channel.