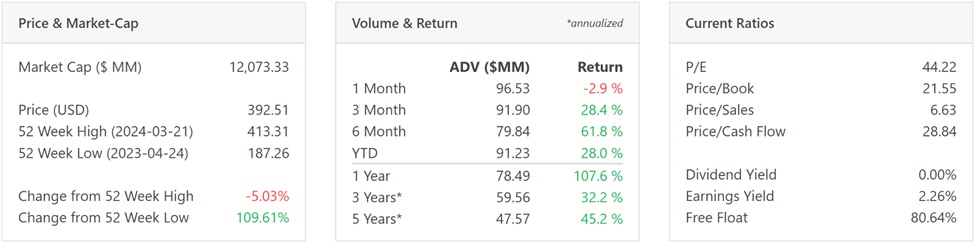

In this quarter’s ROBO Global Healthcare Technology and Innovation Index spotlight, we take a look at Medpace Holdings (MEDP). The index underlies the $62.4 million ROBO Global Healthcare Technology and Innovation ETF (HTEC). Here, we explore what makes Medpace unique within the Process Automation subsector and dive into its recent performance.

Medpace, a leading global clinical contract research organization (CRO), operates across 42 countries. It provides a comprehensive suite of services for emerging players in the biotechnology, pharmaceutical, and medical device industries. Those services include clinical trial design, study management, execution, lab services, imaging services, and regulatory consulting.

The company’s focus on small and mid-sized (SMID) companies, which account for 78% of their clients, has proven to generate substantial margins (19.2% in 2023). MEDP is one of the main CROs supporting the innovative drug makers that drive most drug development and intellectual property.

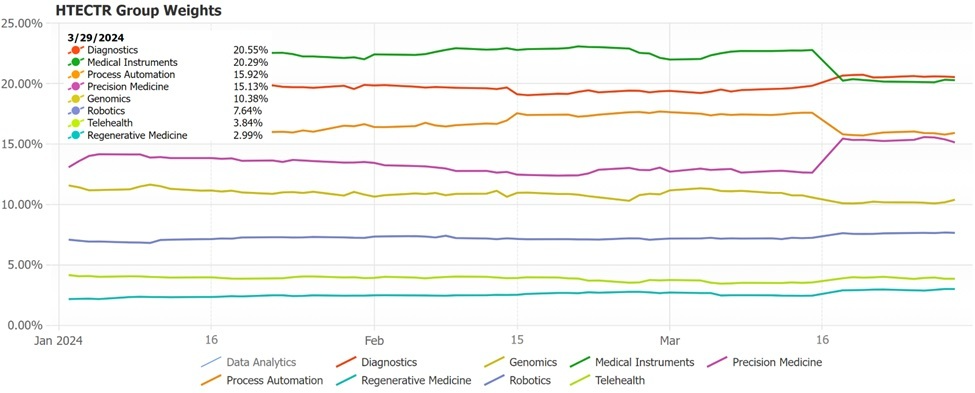

HTEC Subsector Weights

Medpace has a well-diversified client and service portfolio. Its top 5 clients account for 23% of revenue, and the oncology category represents 31% of revenue. That helps mitigate risks and ensure a stable revenue stream.

For the fiscal year ended December 31, 2023, Medpace saw year-over-year (Y/Y) net revenue growth of 29.2%, taking total revenue to $1.9 billion. It also saw net new business awarded increase by 28.8% to $2.4 billion. The company ended the year with a backlog of $2.8 billion, which it expects to convert $1.5 billion in 2024.

The demand for innovative drug development continues to rise, particularly from smaller biotech and pharmaceutical companies. Medpace is well-positioned to capitalize on this trend and maintain its strong growth trajectory in the coming years.

For more news, information, and analysis, visit the Disruptive Technology Channel.

VettaFi LLC (“VettaFi”) is the index provider for HTEC, for which it receives an index licensing fee. However, HTEC is not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of HTEC.