With the exchange traded funds industry on pace for another year of record-breaking asset-gathering, plenty of smaller issuers are joining the party, a trend that’s buoyed by investors’ affinity for thematic ETFs.

The ROBO Global Healthcare Technology and Innovation ETF (HTEC) is capitalizing on those trends as it recently topped $100 million in assets under management, an impressive run for an ETF that only came to market in June 2019.

“After closely monitoring the healthcare space for five years as part of our flagship index, it was clear that technological advancements would be reshaping this sector for decades to come,” said Travis Briggs, CEO of ROBO Global. “It was a natural extension for us to launch a healthcare technology index designed to capture this long-term growth opportunity.”

Home in on HTEC’s (Well-Performing) Methodology

HTEC seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the ROBO Global Healthcare Technology and Innovation Index.

The fund will normally invest at least 80 percent of its total assets in securities of the index or in depositary receipts representing securities of the index. The index is designed to measure the performance of companies that have a portion of their business and revenue derived from the field of healthcare technology, and the potential to grow within this space through innovation and market adoption of such companies, products, and services.

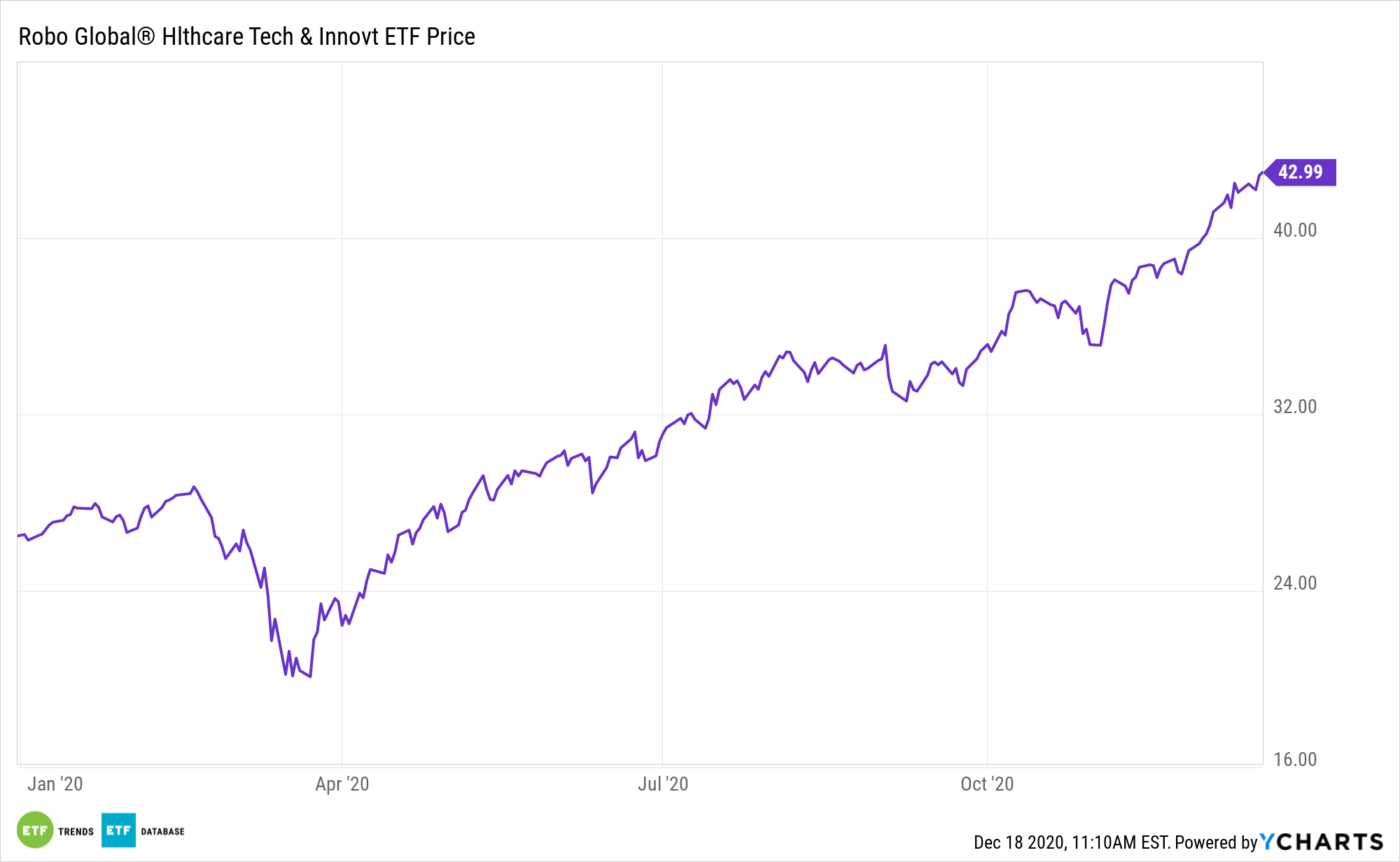

Importantly, HTEC is delivering the goods for investors, returning 74% since inception and more than 59% this year.

“HTEC’s performance and asset accumulation are indicators of the growing investor appetite for healthcare innovation,” said Nina Deka, Senior Research Analyst at ROBO Global. “COVID-19 illuminated the need for advanced healthcare technology, like new therapeutics and virtual care. Yet we are still in very early days of adoption, and there is much more innovation to be realized as companies seek to address rising healthcare costs, improve access to care, and ultimately save lives. This presents a tremendous potential opportunity from an investment perspective.”

The future of healthcare looks more technologically driven as the industry shifts into the digital age from old analog equipment, developing early detection and prevention, with robotics or artificial assisted technicians. For example, ROBO Global pointed out that we may see key applications of artificial intelligence in healthcare, such as AI-powered diagnostics, surgical robots, genomic analysis, new drug discovery, streamlined clinical trials and smart monitoring devices. A.I. in health care could balloon to a $6.6 billion industry by 2021 from only $600 million back in 2014. A.I. funding has almost doubled to $2.3 billion in 2018, compared to $1.2 billion in 2017.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.