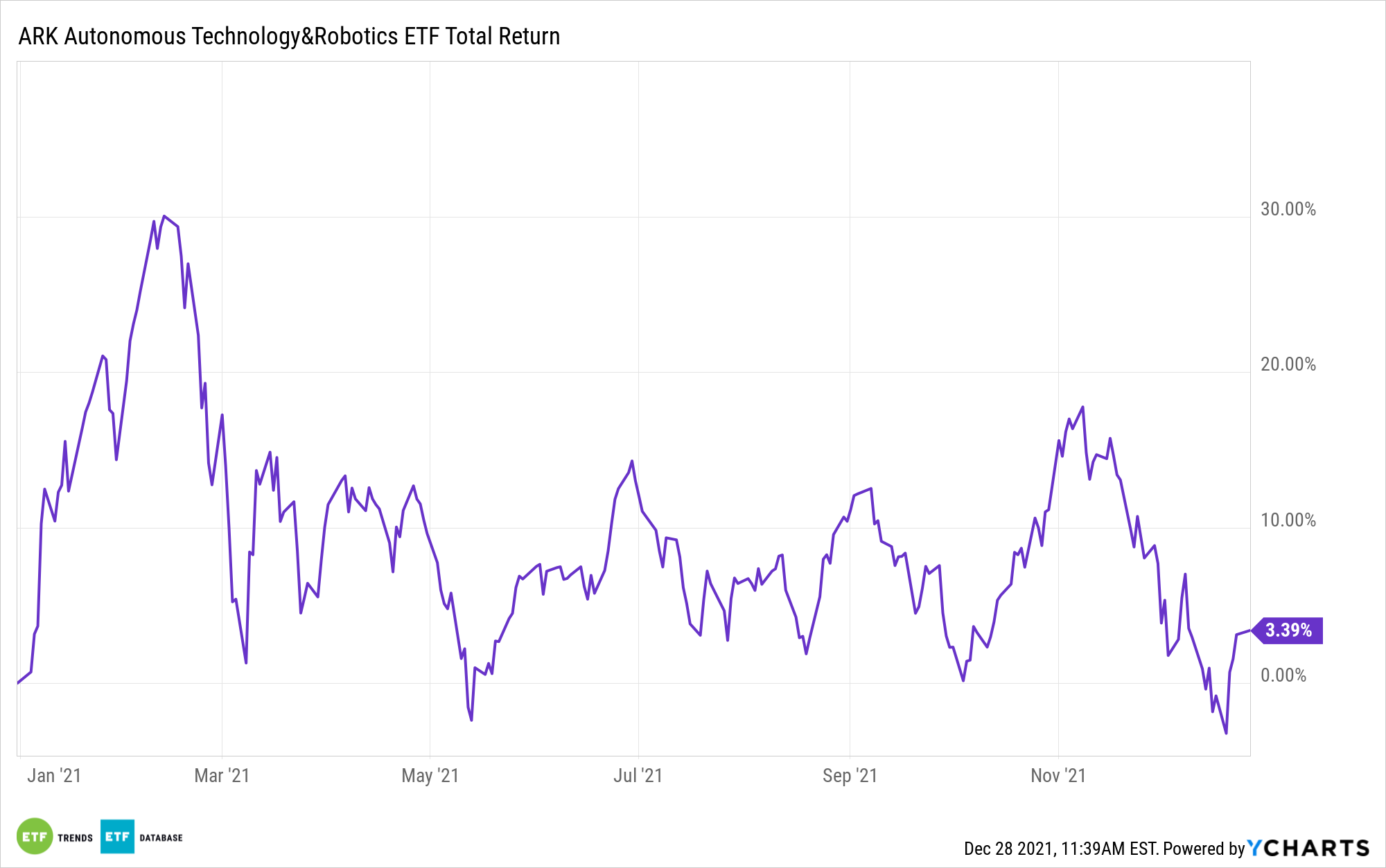

For all the commotion and criticism of disruptive growth strategies this year, quiet as it’s being kept, the ARK Autonomous Technology & Robotics ETF (CBOE: ARKQ) is sitting on a year-to-date gain and is accelerating to end 2021.

Time will tell, but the ARK Invest exchange traded fund’s recent momentum could be the start of something more significant in 2022. The fund’s emphasis on electric vehicles and autonomous vehicles could be a source of allure as experts are forecasting another strong year for EV adoption.

As things stand today, 2021 has been excellent in terms of increasing EV offerings. Ford’s F-150 Lightning already has north of 200,000 orders reserved following its May launch, and Lucid and Rivian are shipping high-end EVs to customers.

“This is all to say that 2021 was a huge year for the shift toward electric transportation. Expect 2022 to be even bigger as appetite for zero-emission cars grows, production accelerates, and more options hit the market,” reports Business Insider.

For ARKQ, much of its EV exposure is tied to Tesla (NASDAQ:TSLA), the fund’s largest holding. Shares of Tesla are up 55%, helping to steady ARKQ.

“Tesla has struggled to keep up with booming demand for its cars, and we should see it continue to drastically grow production capacity in 2022. Two new plants in Berlin and Texas will come online soon, vastly expanding the country’s most popular EV maker’s ability to satisfy orders,” according to Business Insider.

Another benefit with the $2.46 billion ARKQ is that the fund is actively managed, meaning that ARK can increase the fund’s exposure to Tesla or add other EV plays as the managers see fit. That flexibility is important as more EV manufacturers enter the market and as more derivative plays become publicly traded companies.

There’s big growth ahead for the EV market, and that’s relevant to ARKQ because of its Tesla exposure. Elon Musk’s company is now synonymous with luxury in the EV market. It’s an aspirational brand, which is an important trait because as more drivers embrace affordable EVs and enjoy the technology, they’ll look to trade up down the road.

“The zero-emission share of the US car market will grow to a new high of 5% in 2022, IHS Markit estimates. That’s a big jump from the almost 3% market share EVs conquered in 2021, but it still represents a tiny sliver of the 15.5 million new vehicles the firm projects will change hands next year,” according to Insider.

For more news, information, and strategy, visit the Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.