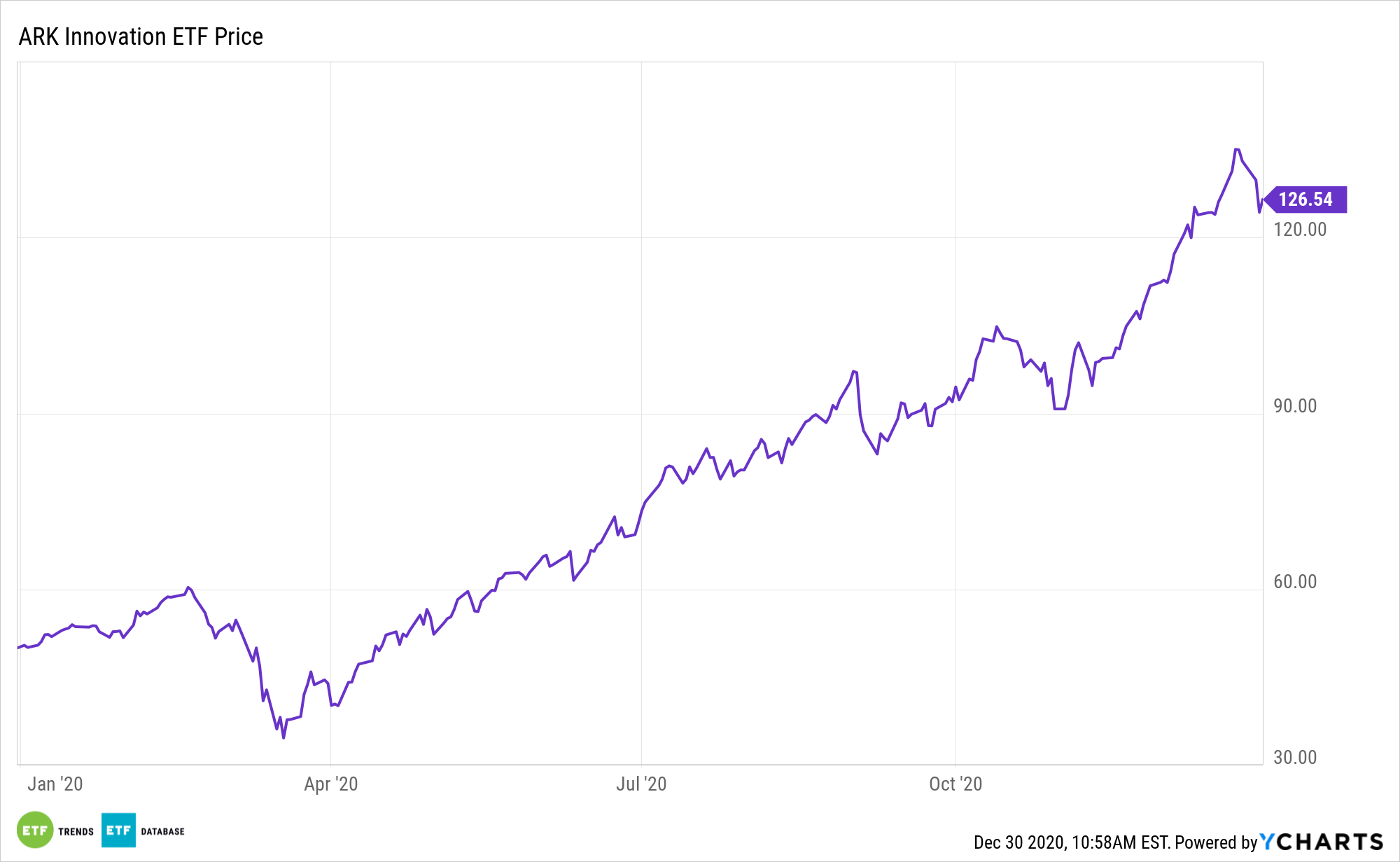

There’s growth investing, and then there’s disruptive growth investing. The latter took center stage in 2020, a theme that’s likely to prove persistent in the years ahead. The increasingly popular ARK Innovation ETF (NYSEArca: ARKK) has a lot to say on the topic.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘’Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘’Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

Asset allocators and their clients are hearing more and more about disruptive growth, but harnessing the advantages of this investment style requires more than just broad approaches. Disruptive themes include cloud computing, cybersecurity, fintech, genomics, social commerce, and much more.

“According to our research, among the siloed sectors at risk of disintermediation are energy, industrials, consumer discretionary, communications services, health care, and financial services,” said ARK Invest founder and CIO Cathie Wood in a recent note.

ARK Invest Poised to Capitalize on Deep-Sated Changes

Disruptive technologies are changing the way new products and services are being brought to market, already seen in the development of artificial intelligence and robotics. As the number of companies that focus on highly advanced computer integration grows, so does the number of targeted ETF strategies that have been designed to capture the best growth opportunities.

Wood outlines the platforms and technologies that are driving disruption.

“The five innovation platforms that we believe will transform the global economy are: DNA sequencing, robotics, energy storage, artificial intelligence, and blockchain technology. These platforms involve 14 technologies including gene therapies, 3D printing, cloud computing, big data analytics, and cryptocurrencies,” she said.

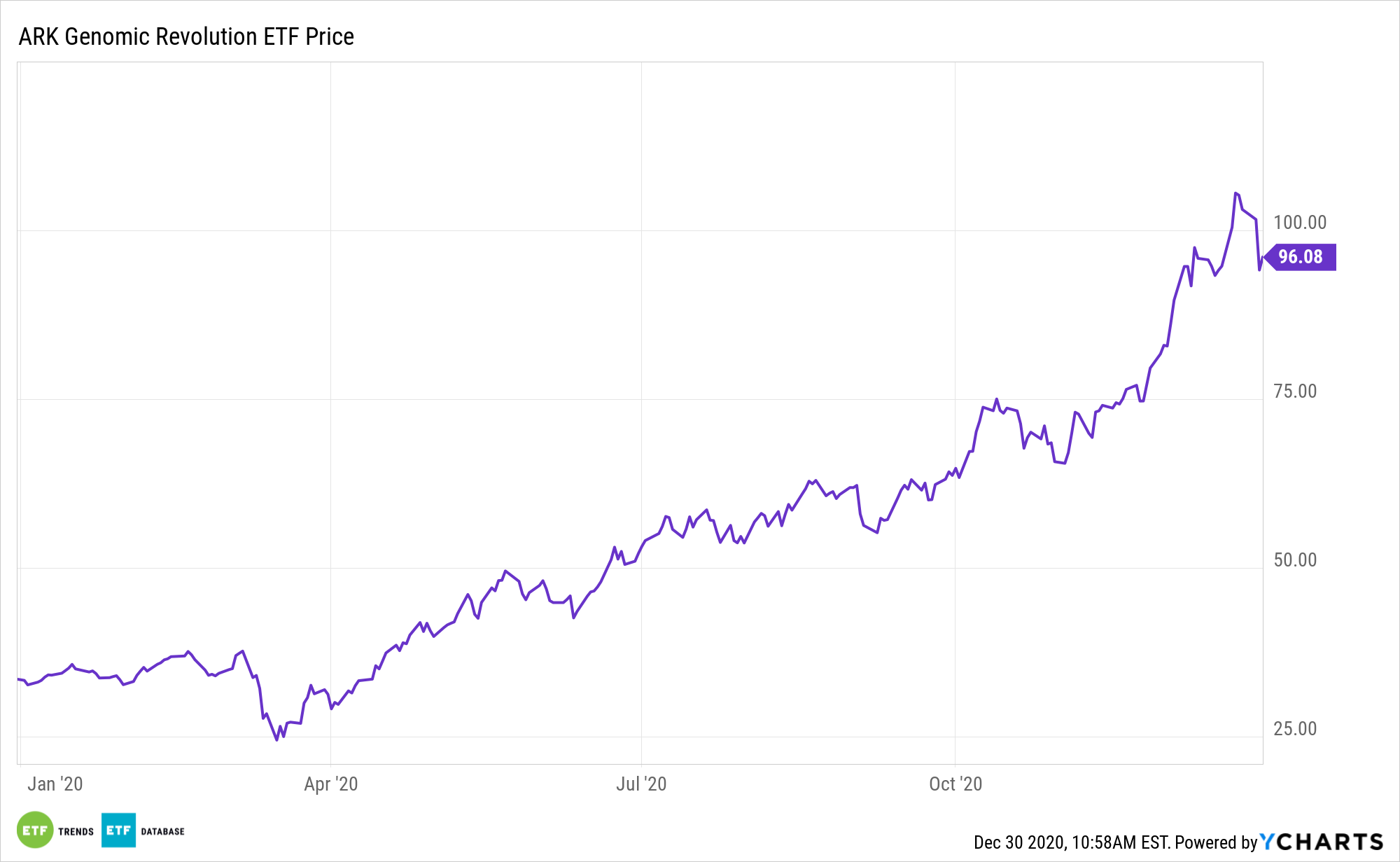

Investors looking for seismic shifts in the healthcare arena should evaluate the ARK Genomic Revolution Multi-Sector Fund (CBOE: ARKG), which is one of the best-performing healthcare ETFs over the past several years.

“Securities within ARKG are substantially focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments, improvements and advancements in genomics into their business. One such way this is accomplished is by offering new products or services that rely on genomic sequencing, analysis, synthesis or instrumentation,” according to the issuer.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.