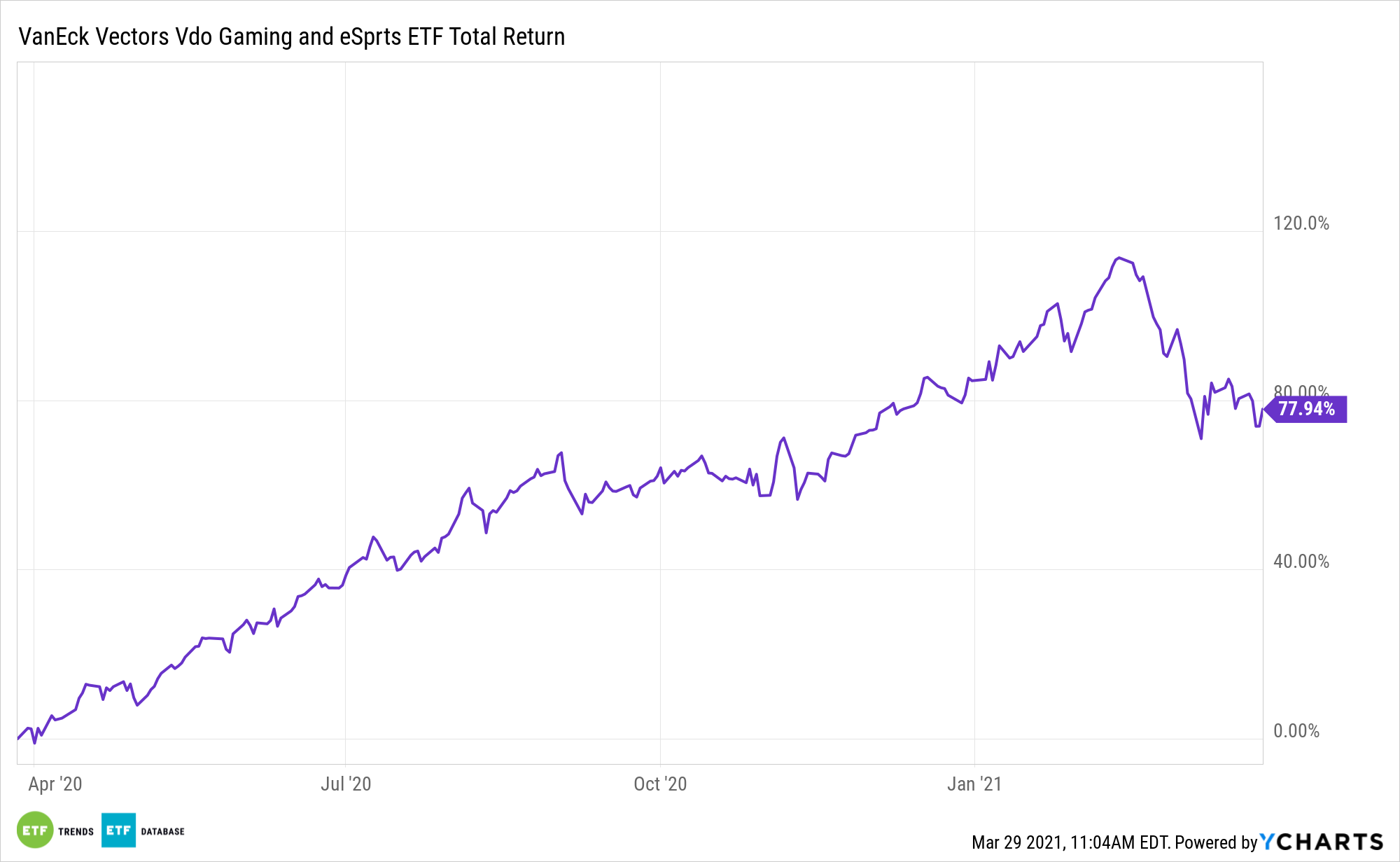

The VanEck Vectors Video Gaming and eSports ETF (NASDAQ: ESPO) and rival video game ETFs enjoyed plenty of catalysts last year. Even more are ahead.

ESPO seeks to track the performance of the MVIS Global Video Gaming and eSports Index (MVESPO). The index is a rules-based, modified capitalization-weighted, and float-adjusted index intended to give investors a means of tracking the overall performance of companies involved in video gaming and eSports.

Industry consolidation is seen lifting ESPO and member firms this year.

“The video game market has seen an increase in merger and acquisition (M&A) activity over the last year, and we expect to see more M&A deals in the public markets going forward,” writes John Patrick Lee, VanEck ETF product manager. “Through these deals, gaming companies are able to enter segments of the market without organically growing a new business line. We believe this M&A activity is helping to drive growth both for the acquiring companies and the broader video gaming industry, creating compelling investment opportunities.”

The M&A Outlook

Vital to the ESPO thesis is the fund’s exposure to the hardware (console) side of the gaming business, which is often overshadowed by game publishers (software). A prime reason why ESPO could prove durable beyond the coronavirus situation is increased availability of recently launched hardware.

As for M&A, data confirm it’s just getting going in the video game space.

“In just the last six months, there have been a number of blockbuster deals from tech conglomerates and top-tier publishers,” adds Lee. “The specific capabilities and limitations of the company within the context of the broader gaming marketplace appear to be guiding M&A decisions.”

Larger tech companies with some video game exposure could go shopping to bolster that footprint – a trend that could impact some smaller ESPO components.

“Tech conglomerates like Microsoft, Sony, Apple, Alphabet and Amazon are trying to position themselves favorably within the future gaming ecosystem,” notes Lee. “Cloud gaming, much talked about and yet to be proven on a mass scale, is an example of one idea of what the future of gaming could become. If game exclusivity is the deciding factor for consumers when choosing between cloud gaming platforms, then the potential cloud providers (Microsoft, Amazon and Sony) might shift their acquisition target focus from mid-caps to large-caps.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.