Batteries are pivotal to the electric vehicle (EV) equation. For instance, Tesla, a prime holding in the ARK Innovation ETF (NYSEArca: ARKK), needs a robust battery pipeline to up production and meet demand for its EVs.

Manufacturers are ramping up efforts to meet growing EV battery demand and reduce carbon emissions.

“Automakers’ compliance with emission standards will drive growth in BEVs and battery capacity in the coming years. But the specific impact on battery makers’ revenue will be a function of potential declines in battery prices due to technology innovation and economies of scale, and rising sales of BEVs,” according to Moody’s Investors Service.

The long-term outlook for EVs shows significant growth for the sector over the next two decades, all driven by supportive government policy and acceleration of investment in the space.

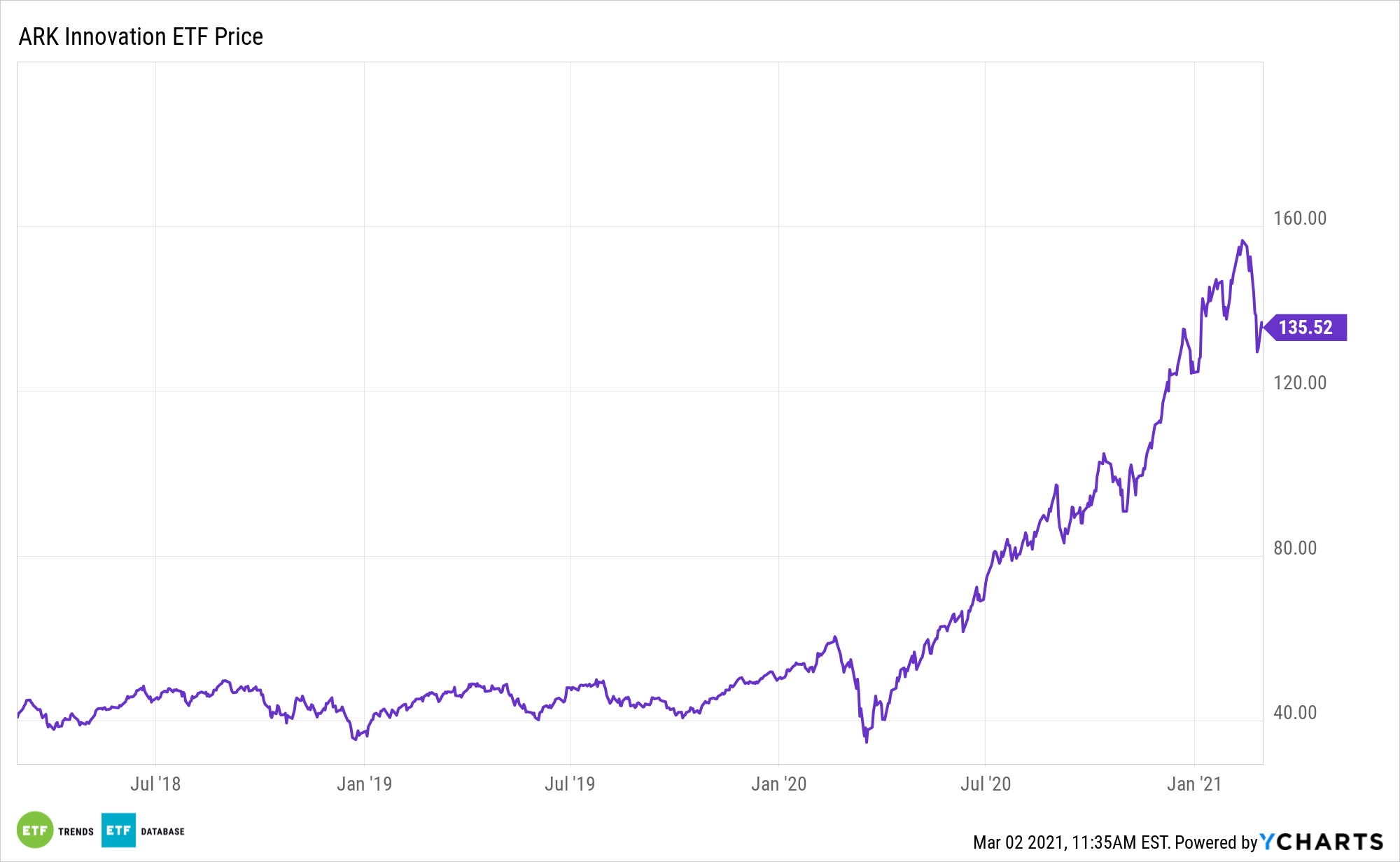

ARKK at the Center of a Revolution

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

Rapid adoption of EVs should be propelled by improving battery technology, favorable economics for buyers, and an acceleration in investment in EVs by automakers. Innovations in battery technology by EV companies also have positive implications for the rest of the alternative energy space.

“Upfront investments to add new facilities and develop emerging technology present risks,” notes Moody’s. “EV battery technology is evolving rapidly as battery makers strive to improve driving distance or reduce reliance on high-cost rare metals. Companies are taking varying paths to expansion as they manage operational and investment risks.”

Solidifying strong battery relationships is integral for electric vehicle manufacturers like Tesla.

“To ensure investment returns to incorporate new technologies, battery makers need to cooperate closely with automakers. Solid relationships with automakers that have a clear strategy to expand BEV sales will ensure stable revenue and profit for the battery makers,” concludes Moody’s. “Automakers, meanwhile, tieup with battery makers to secure battery supplies.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.