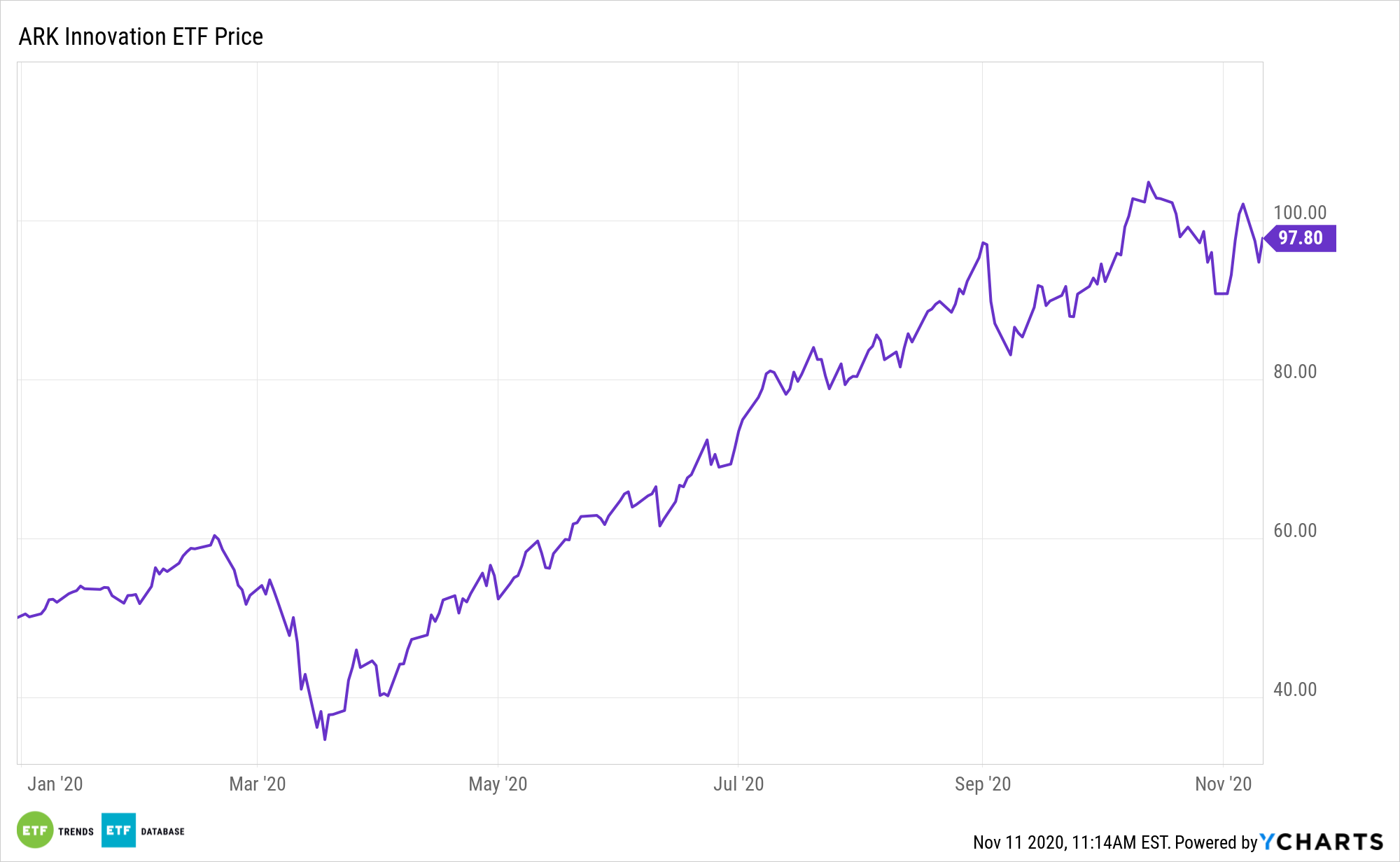

Most folks would like to forget 2020, but the ARK Innovation ETF (NYSEArca: ARKK) would love to run it back. Up almost 95%, it has become the largest actively managed equity ETF on the market.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘’Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘’Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

ARKK is adding to its legendary status where it matters most: total returns. But this is old hat for an ETF with a long history of topping broader benchmarks by wide margins.

“ARKK’s phenomenal CAGR of 30.97% for ARKK since inception six years ago means that $10,000 invested would be worth $50,469 today. For some perspective, investing $10,000 in the highly recommended passive index funds that track the S&P 500 (SPX) such as the most popular fund SPY would be worth $22,298,” reports Seeking Alpha.

The ARKK ETF: Emphasizing Disruptive Names

ARKK’s success is rooted in its ability to consistently identify companies at the corners of seismic shifts. In addition to Tesla, Nvitae (NASDAQ: NVTA), Roku (NYSE: ROKU), and Square (NYSE: SQ) are among the names driving ARKK upside this year, to name just a few.

“Companies that spawn further innovation, stimulating growth over extended time horizons. Amazon (AMZN) is a great example for this in terms of both transformation and new businesses: online marketplace, e-commerce, cloud computing (AWS), AI, retail (through Amazon Go and Whole Foods), space (Blue Origin), streaming service (Twitch),” according to Seeking Alpha.

Investors are always looking for the next big thing and, in recent years, much of that search has revolved around finding the next equivalents of the famed FANG stocks. Doing so is difficult, but there are some ETFs that offer investors exposure to the next generation of hyper-growth names.

ARKK, often known as one of the ETFs with one of the largest weights to Tesla, typically holds between 35 and 55 stocks. Although that’s a concentrated lineup, the fund offers wide exposure to a compelling cross-section of fast-growing themes.

“Markets tends to be myopic and often at best discounts only the next year. Thus, the market can be easily distracted by short-term price movements, losing focus on the long-term effect of disruptive technologies. There is a time arbitrage ARK can take advantage of by seeking opportunities that offer growth over 3-5 years that the market ignores or underestimates,” notes Seeking Alpha.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.