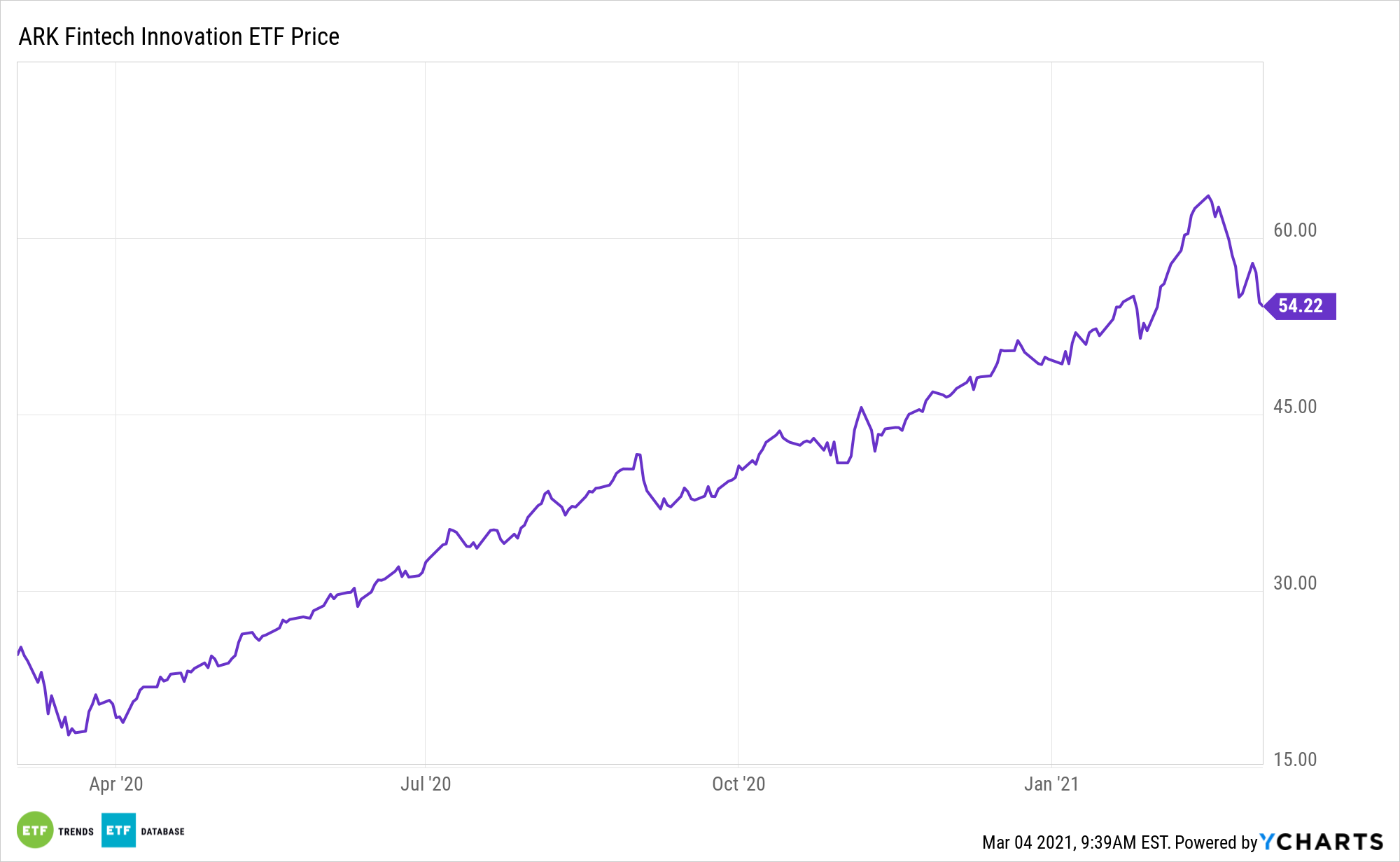

Fintech is at the corners of mass financial services disruption, and digital wallets are leading the charge. That’s great news for the ARK Fintech Innovation ETF (NYSEARCA: ARKF).

ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility while driving down costs.

The fintech industry is upending traditional financial services on multiple fronts. One of the cornerstones of that disruption is digital wallets. That disruption is being seen at the point of sale (POS) level.

“According to a recent study by Worldpay, last year digital wallets surpassed cash for the first time as the number one payment method at all points of sale (POS) globally. In e-commerce alone, digital wallets have dominated checkouts since at least 2018, the year that Worldpay published its first Global Payments Report,” notes ARK research.

For ARKF, Ample Digital Wallet Momentum

Fintech firms are companies that are powered by innovations, working to disintermediate or bypass the current financial markets and challenge traditional institutions by offering new solutions that are better, cheaper, faster, and more secure.

Stocks in this category, including Square and PayPal, have a myriad of tailwinds. Square and PayPal are currently challenging major credit card networks, a threat that is emerging more rapidly than many industry observers expected.

Boding well for the long-term ARKF thesis is that digital wallet users should be valued at the same rate as traditional bank customers, but that’s currently not the case. Plus, it’s cheaper for Venmo and Cash App to acquire new customers.

Those are relevant points, but digital wallets also play pivotal roles in increasing payment efficiency, while simultaneously providing convenience on various consumer-driven platforms.

“By offering inexpensive and rapid access to financial and other commercial services like e-commerce, digital wallets on mobile phones could become the dominant app for both personal finances and shopping around the world,” adds ARK. “Leading this trend is Asia where digital wallets have dominated ecommerce payments since 2018, if not earlier, and POS transactions since 2019. Motivated to change behavior patterns during the COVID-19 pandemic, consumers elsewhere seem to be following Asia’s lead, as digital wallets now are the second most popular e-commerce payment method in North America.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.