ARK Invest, which manages $14 billion in ETF assets primarily through active, disruptive technology ETFs, moved headquarters last week to Tampa/St. Petersburg, Florida, from New York. The firm runs some of the more popular active ETFs, including the ARK Innovation ETF (ARKK), the ARK Genomics Revolution (ARKG), and the ARK Next Generation ETF Internet (ARKW).

ARK has helped drive advisor interest in active ETFs and thematic strategies for the broader ETF industry since its formation in 2014. Indeed, ARKK gathered $16 billion of net inflows in the last three years, including $1.8 billion in 2022 alone, despite the ETF declining in value. ARKG and ARKW added $6.1 billion and $2.4 billion of net inflows, respectively, over the last three years.

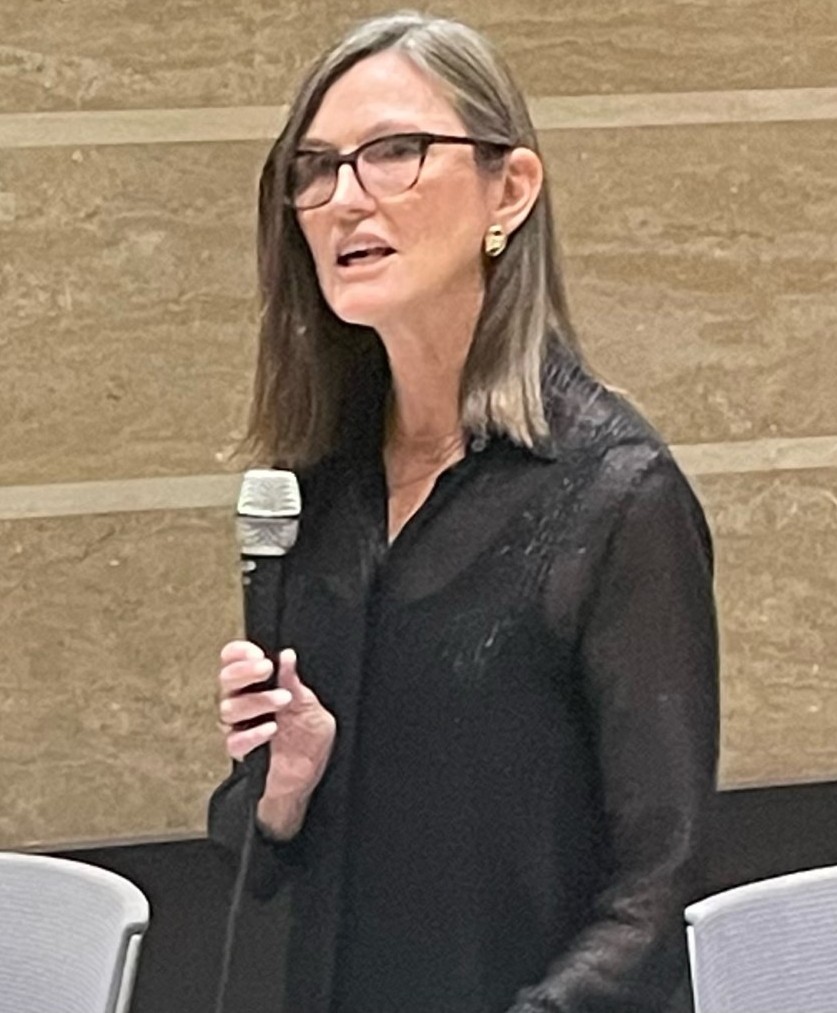

Cathie Wood remains the firm’s CEO and CIO but works with a broad investment research team to select stocks for consideration and inclusion into the ETFs. The ARK Invest team includes Simon Barnett, director of research, life sciences; Frank Downing, director of research, next generation Internet; Nicholas Grous, associate portfolio manager; Tasha Keeney director of investment analysis & institutional strategies; Sam Korus, director of research, autonomous technology & robotics; Dan White, associate portfolio manager; and Brett Winton, chief futurist.

“We believe the Tampa Bay region’s talent, innovative spirit, and quality of life will accelerate our growth initiatives,” Wood previously said in a statement in October 2021. “ARK is not a traditional Wall Street asset management firm, and we are looking forward to breaking the mold further by relocating to St. Petersburg, a city investing in technology, science, and innovation. Our relocation and the ARK Innovation Center will allow us to be more innovative and to impact the broader community while shining a spotlight on the technological advances and creativity permeating the Tampa Bay region.

ARK continues to innovate in 2022 and launched Canadian listed ETFs tied to ARKK, ARKG, and ARKW strategies last week, allowing advisors that work with clients based in Montreal, Toronto, and Vancouver to gain access to the long-term disruptive technology strategies.

For more news, information, and analysis, visit the Disruptive Technology Channel.