One of the biggest advantages that direct indexing boasts is the ability to mine portfolios for tax-loss harvesting opportunities. And while advisors often wait until Q4 to scan for TLH opportunities, these opportunities don’t just occur at year-end. So, when it comes to scanning the portfolios for such opportunities, the frequency of the scans matters.

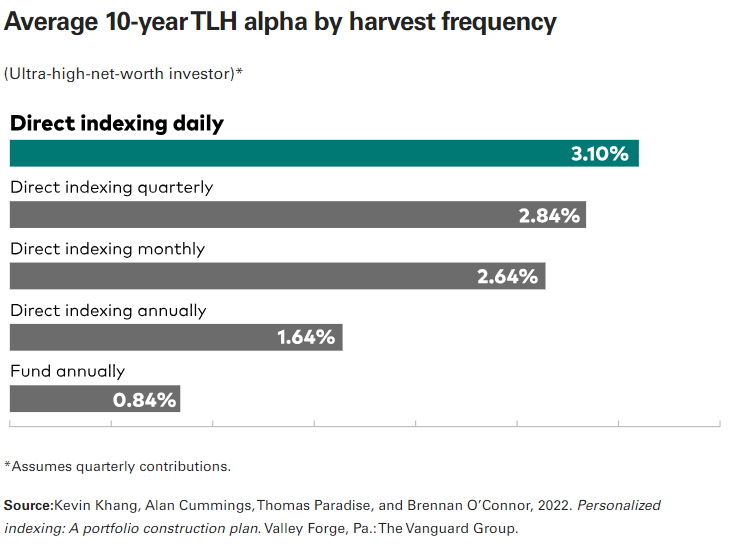

The more frequent the scans, the higher and more consistent the TLH alpha. And the differences in TLH alpha can be very wide. Research from Vanguard found that the difference can range from 20 basis points to well over 100.

According to Vanguard, when considering a direct indexing strategy for its tax-loss harvesting abilities, those with daily harvesting scans “is critical to achieving the maximum harvest in ‘typical’ (non-high) volatility environments.”

See more: “Use Direct Indexing to Mitigate Concentration Risk”

The figure below shows the average 10-year TLH alpha for each mode for ultra-high-net-worth investors. For UHNW investors with unlimited loss-offsetting income, TLH alpha rises from 1.64% for “direct indexing annually” to 3.10% for “direct indexing daily.” That’s a difference of 1.46%.

A service like Vanguard Personalized Indexing can automatically scan portfolios for tax-loss harvesting opportunities at a set frequency. That frequency can be monthly, quarterly, or even daily. VPI can also scan for opportunities across dozens of investments and hundreds of investment lots.

Vanguard CEO Tim Buckley said at Exchange 2023 that the company will “be investing heavily” in direct indexing.

More information about Vanguard Personalized Indexing can be found online.

For more news, information, and analysis, visit the Direct Indexing Channel.