August is typically a tame month when it comes to market activity, but as summer winds down, vacationing subsides, and school gets back in session, potential fall volatility is ahead. This creates an opportunity for direct indexing.

The strategy involves mimicking an index — like the S&P 500, for example — and purchasing the holdings in the underlying index. As currently constructed, using the S&P 500 would mean handpicking big tech names like Apple and Amazon, which comprise the majority of the index.

By holding individual stocks, an investor subjects themselves to the whims of price fluctuations in that particular stock. While the CBOE Volatility Index (VIX) is down over 30% for the year, it could be the proverbial calm before the storm if history repeats itself.

A Seeking Alpha post by Luckbox Magazine noted the summer malaise in market fluctuations amid a year-to-date market rally that’s seeing the S&P 500 gain almost 17%. However, as the leaves go from green to orange, the VIX can go from staid to dynamic.

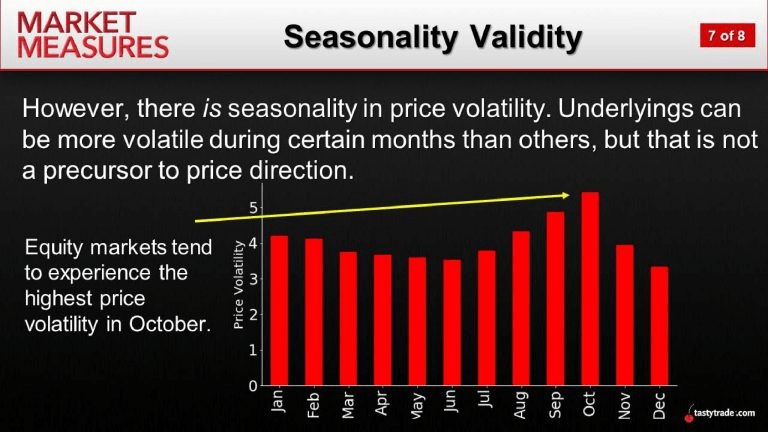

“Interestingly, an uptick in volatility isn’t necessarily uncommon at this time of the year — historical data shows that September and October are traditionally the most volatile months on the calendar (on average),” the post said, revealing a chart that showed that seasonality can be a factor when predicting forthcoming volatility, but not necessarily price direction.

A Tax-Loss Harvesting Opportunity

When market activity turns frenzied, it can create opportunities when it comes to tax-loss harvesting — the deliberate selling of assets at a loss in order to offset capital gains. If the fall season this year correlates with historical data, then potential losses could be forthcoming as major market indexes head lower while the VIX goes in the opposite direction.

“As most active market participants are well aware, the VIX shares a relatively strong inverse correlation with the major market indices,” the Seeking Alpha post said. “So, when the Dow Jones Industrial Average (or S&P 500) is moving higher, the VIX is usually trending lower-and vice versa.”

However, as mentioned, this creates a perfect storm for tax-loss harvesting. This can be made easier with an automated platform that will target tax-loss harvesting opportunities in the market without the investors or advisor doing the heavy lifting.

“With bundled products like mutual funds and ETFs, you’re not able to isolate losing stocks for tax-loss harvesting,” a Vanguard Perspective blog noted. “With direct indexing, you’re able to sell individual stocks at a loss in a client’s portfolio to offset capital gains, even when the benchmark index is up.”

“Recent software innovations in direct indexing technology have automated processes such as scanning for tax-loss harvesting and rebalancing opportunities, allowing you to scale up what used to be a time-consuming process—and preventing your clients from missing out on opportunities you might not have time to implement on your own,” the perspective added, highlighting the features of Vanguard’s own direct indexing solution and how it can assist advisors’ clients.

For more news, information, and analysis, visit the Direct Indexing Channel.