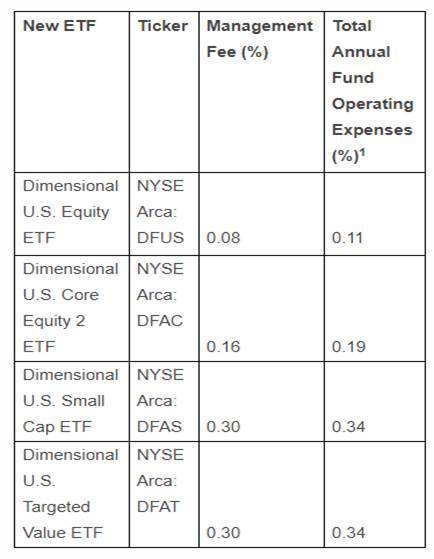

On June 14, 2021, Dimensional Fund Advisors, a global leader in systematic investing, extended its exchange traded fund (ETF) offerings by converting four U.S. tax-managed mutual funds into active transparent ETFs listed on the New York Stock Exchange (NYSE). The new ETFs expand Dimensional’s suite of broadly diversified investment solutions, offering greater choice in how financial advisors and institutional investors access Dimensional’s investment solutions.

The four ETFs listed today are part of the firm’s plan to convert six tax-managed mutual funds into ETFs, which offer investors an additional tool to manage capital gains, supporting the funds’ goal of delivering higher after-tax returns by minimizing tax impact. Dimensional plans to convert two additional non-U.S. market tax-managed mutual funds to ETFs in September 2021.

Dimensional is one of the first asset managers to convert mutual funds into ETFs. With the successful launch of the firm’s first three ETFs and the conversion of these four mutual funds, Dimensional becomes one of the largest active ETF issuers in the industry, with more than $30 billion in combined ETF assets under management, placing the firm in the top 10% of all ETF issuers across both active and passive offerings.

“We expect to have a full lineup of ETFs to offer clients alongside our mutual fund offerings and expanded separately managed accounts platform,” said Dimensional Co-CEO and Chief Investment Officer Gerard O’Reilly.

“Our strategies offer the benefits of indexing—such as low costs, low turnover, and high diversification—paired with the advantages of flexible implementation that provide a continuous focus on higher expected returns and robust risk management.”

See also: Yahoo Finance: Crypto Gudiance And Dimensional’s Conversion

“For four decades, we have focused on empowering investment professionals, so they can deliver their clients the best investment experience,” added Dimensional Co-CEO Dave Butler. “The solutions we are bringing to the ETF marketplace will further that mission, offering more ability to customize and tailor investments to clients’ specific needs and preferences.”

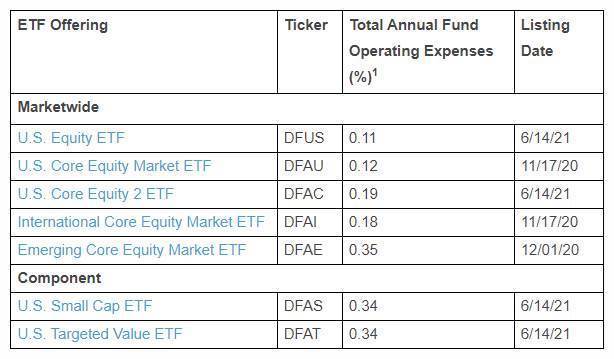

The new listings follow Dimensional’s successful launch of three core equity market ETFs in 2020. Dimensional investment strategies seek to harness a consistent, broadly-diversified, and systematic approach that aims to outperform the market without outguessing the market. Strategies within Dimensional’s suite of ETFs have varying tilts from market weights to securities that offer higher expected returns, such as small cap, value, and high profitability securities.

Dimensional ETFs now provide a range of equity solutions that include marketwide, core equity portfolios with varying degrees of emphasis on drivers of expected returns, and component solutions, such as value and small cap portfolios. This range of strategies provides more customization in asset allocation, which can help financial professionals meet the specific investment goals and needs of their diverse investor bases.

More information about Dimensional ETFs can be found here: us.dimensional.com/

For more market trends, visit ETF Trends.