Venture capital firms invested more money into crypto startups in 2021 than all the previous years collectively, in a vote of confidence in the potentials of the crypto economy and blockchain technology, reports Alex Thorn, head of firmwide research for Galaxy Digital, in a recent paper.

More than $33 billion was poured into blockchain and crypto startups in 2021 by venture capitalists, with over two-thirds of that going to fundraising rounds. Startups within the crypto economy took in 5% of all venture capital last year, while valuations within crypto and blockchain in the fourth quarter were 141% higher than the rest of the venture capital areas of allocation.

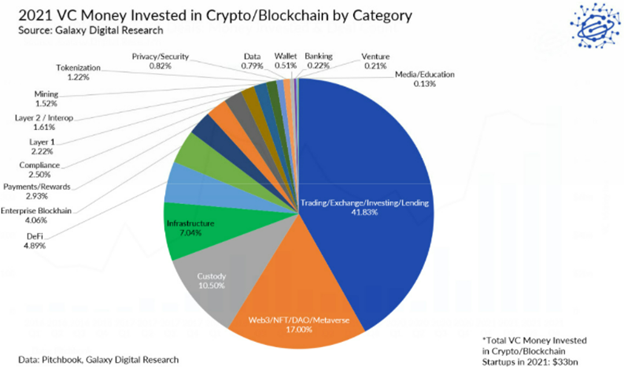

Image source: Galaxy Digital Research

Of the money contributed to crypto, 41% went to companies that had either investing, trading, or lending services for digital assets; second place went to NFT, DAO, and Web4 companies at 17% of allocations. The space continues to grow from the bottom up, with 62% of managers that raised money in 2020 also raising money again in 2021, reflecting rapid growth and the heightened demand from investors.

Preliminary data indicates that there are now over 500 venture firms within crypto and blockchain, and this seems to reflect a maturation happening within crypto, with many of the early companies that were founded between 2018-2020 when crypto was bearish having grown and progressed. Of the fundraisers that happened last year, 69 were above $100 million, and 43 companies raised valuations above $1 billion, hitting the unicorn status.

Thorn wrote, “the share of deals at the Pre-Seed stage continues to decline on a relative basis; and there is more diversity in the types companies being built and products being offered, a consequence of an expanding set of use-cases and market opportunities.”

The Invesco, Galaxy, and Alerian Partnership in Crypto

The Invesco Alerian Galaxy Crypto Economy ETF (SATO) invests across the crypto industry in a variety of crypto-related categories and invests across all market caps within developed and emerging markets. By investing across a range of crypto assets, investors can capture potential within the space while also mitigating the risk compared to a singular spot exposure.

The fund seeks to track the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index, an index that is divided into two different security types: digital asset companies that are engaged in cryptocurrency or the mining, buying, and enabling technologies of cryptocurrency; and exchange traded products (ETPs) and private investment trusts traded over-the-counter that are associated with cryptocurrency.

SATO does not invest directly in bitcoin, cryptocurrencies, crypto assets, or in initial coin offerings or futures contracts for cryptocurrencies, and it is non-diversified. SATO carries an expense ratio of 0.60%.

For investors looking for an opportunity to gain exposure to crypto’s growth, the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC) offers investment in the blockchain innovation making it all possible. The fund is based on the Alerian Galaxy Global Blockchain Equity, Trusts, and ETPs Index.

BLKC invests in companies that are developing blockchain, mining cryptocurrency, buying cryptocurrencies, or else enabling technologies, exchange traded products (ETPs), or private investment OTC trusts tied to cryptocurrency.

The fund does not invest directly in cryptocurrencies or crypto assets and does not invest in initial coin offerings or futures contracts on any cryptocurrencies. It carries an expense ratio of 0.60%.

Both ETFs carry Galaxy Digital in their holdings.

For more news, information, and strategy, visit the Crypto Channel.