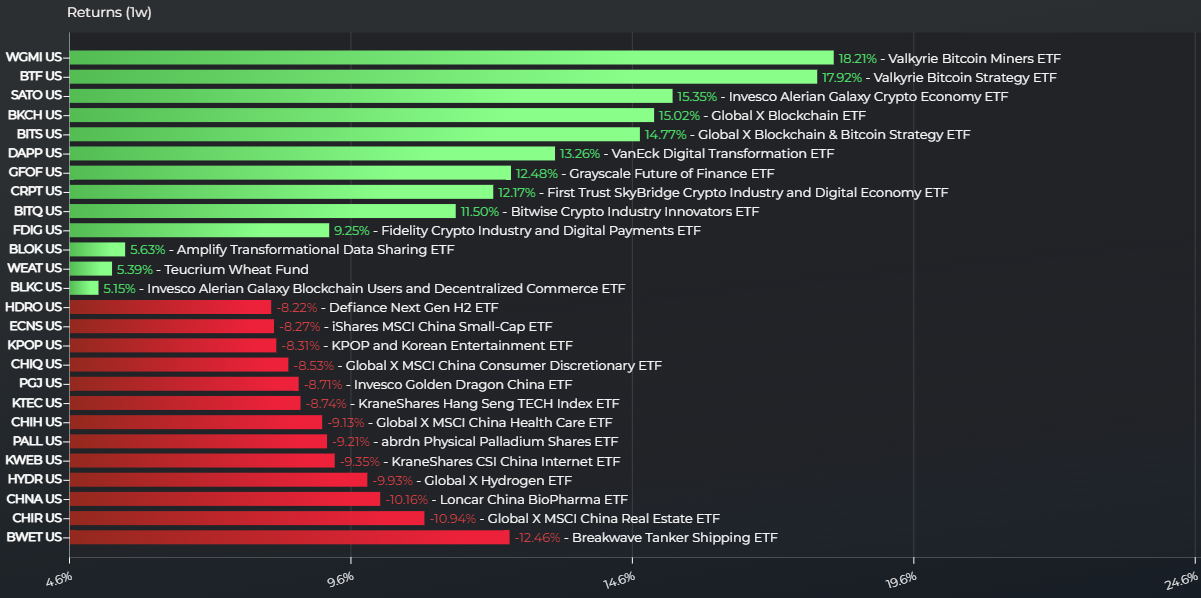

Once again, crypto ETFs led the way among the top weekly ETFs according to data from Logicly. The latest edition of crypto performance suggests that the summer may continue to that out the crypto world. Crypto ETFs took a big hit last year but have offered some of the best performances in ETF land so far in 2023. That comes amid rumors surrounding BlackRock’s filing for a Bitcoin ETF and what that suggests about future SEC rules on crypto.

All but one ETF in the top twelve performers focus on crypto, Bitcoin, and the broader blockchain / digital asset landscape. Only the Teucrium Wheat Fund (WEAT) offered high level performance in an area other than crypto. WEAT charges a big 114 basis point fee to track its index of wheat futures. WEAT has returned nearly 18% over the last month despite -9.4% returns YTD. That turnaround has also shown up in flows, with $10.6 million arriving to the fund over the last three months.

In crypto land, the Valkyrie ETF duo of WGMI and BTF have led the way. The Valkyrie Bitcoin Miners ETF (WGMI) returned 18.2% over the last week, while the Valkyrie Bitcoin Strategy ETF (BTF) returned 17.9% in that time. WGMI charges a 75 basis point fee and only launched last February, returning a staggering 190.4% YTD. BITF meanwhile charges a 95 basis point fee, returning 81.9% YTD. Both invest actively in their respective sides of the Bitcoin asset.

Rounding Out the Top Weekly ETFs List

Other firms making up the list include VanEck, GlobalX, Invesco, Grayscale, and Fidelity. The Fidelity Crypto Industry and Digital Payments ETF (FDIG) launched just this past April, charging a comparatively lower fee of 39 basis points. The ETF has returned 74.6% YTD, having reached $33.9 million in AUM since its launch. The strategy tracks a global index of crypto, blockchain, and digital payments firms including miners and other crypto infrastructure names.

Once again, crypto ETFs took the top positions based on one-week performance.

For more news, information, and analysis, visit the Crypto Channel.