The ETF industry is buzzing as long-awaited spot bitcoin ETFs are likely to get the green light from the SEC in the coming days. We expect trading of multiple products to begin soon after. VettaFi is so focused on advisor education about the asset class, we are hosting a Crypto Symposium on January 12.

This two-plus hour virtual event, complete with continuing education credits, will provide much needed insights. We believe many advisors understand ETFs but need to learn how to talk to clients about cryptocurrencies. We also know that many investors are knowledgeable about cryptocurrency given that bitcoin rose more than 150% in 2023. Yet, they need to understand what makes investing in ETFs unique.

What Do Advisors Think About Cryptocurrency?

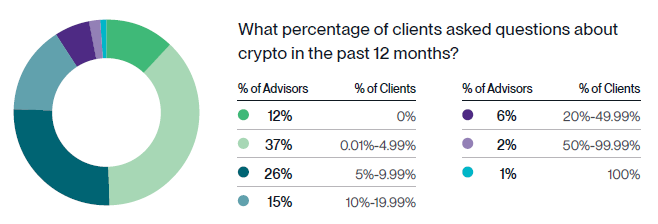

A December survey of advisors Bitwise Asset Management and VettaFi conducted helps set the stage. In the prior 12 months, 88% of advisors were asked questions by a segment of their client base. Approximately 10% are hearing from more than one-fifth of their relationships. However, there is strong likelihood that more people see and hear cryptocurrency advertisements once spot bitcoin ETFs are trading and the competition heats up.

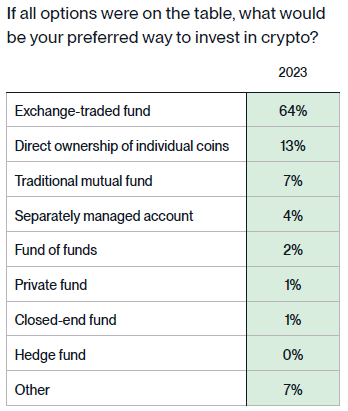

VettaFi expects multiple spot bitcoin ETF products will be trading soon. Which is great, since an ETF is the preferred choice of gaining access to cryptocurrency. Nearly two-thirds of surveyed advisors are looking to ETFs. All other choices provided including direct ownership of coins, a mutual fund, or a separately managed account were significantly less popular.

We Think the Crypto ETF Universe is About to Expand

Currently there are futures-based bitcoin and Ethereum ETFs trading in the U.S. The largest, the ProShares Bitcoin Futures ETF (BITO), has $1.8 billion in assets. However, ARK, Bitwise, and VanEck provide competing futures-based crypto ETF alternatives. These three firms along with BlackRock, Franklin Templeton, Invesco Galaxy, and WisdomTree are among those awaiting approval of a spot bitcoin ETF. TWe expect this is imminent. This would be a milestone event and a decade in the making.

The largest provider of a bitcoin-based product is Grayscale, which offers the Grayscale Bitcoin Trust (GBTC). Grayscale is trying to convert GBTC into an ETF and we expect it to be allowed to do so shortly.

VettaFi Crypto Symposium – January 12, 2024

On January 12, Tom Lydon and I will be covering cryptocurrency investments with many industry experts, including Eric Balchunas of Bloomberg Intelligence. We expect attendees to learn more about the likely benefits of using an ETF, how bitcoin can fit into a broader portfolio, and what the outlook is for 2024. However, because this is a new asset class for many, we will talk about the risks and what clients need to know. I hope you will join us by registering today.

For more news, information, and analysis, visit the Crypto Channel.