The ProShares Bitcoin Strategy ETF (BITO) launched today after issuers spent years of effort to get a bitcoin-linked fund approved by the SEC. The fund, which tracks front-month bitcoin futures, is the first of its kind to get the green light by regulators, but likely not the last.

The ProShares Bitcoin Strategy ETF (BITO) launched today after issuers spent years of effort to get a bitcoin-linked fund approved by the SEC. The fund, which tracks front-month bitcoin futures, is the first of its kind to get the green light by regulators, but likely not the last.

To discuss the new launch, as well as dig into the real-world mechanics of how bitcoin futures exposure works, ETF Trends’ managing editor Lara Crigger sat down with Simeon Hyman, head of investment strategy at ProShares.

Lara Crigger: First off, congratulations on the launch! Pretty exciting stuff.

Simeon Hyman: Thank you. We are excited! We worked hard for this one, and we think it’s a game changer. Because it’s not actually that easy to invest in the spot market. There are a whole bunch of exchanges, there isn’t just one price, and so on. Meanwhile, futures are regulated, there’s a clearing house… If you put the ETF on top of that, then you’ve got your belt and suspenders. So we think it’s an opportunity that hasn’t been there before for investors.

Crigger: You just brought up a good point: how prices are calculated in the bitcoin markets. Because not many folks understand that futures contracts are averaging many prices over many exchanges over many time frames.

Hyman: It’s true. The CME futures use the bitcoin reference rate (BRR) for settlement. The BRR is an effort to amalgamate the price from several different exchanges. You might ask, “Well, why don’t I just invest in the BRR?” But you can’t invest in the BRR. It’s a piece of the information ecosystem for the futures contracts only. It’s the participants that show up there. I mean, there’s actually 40% more volume in CME futures than there is on Coinbase.

See also: Three Big Benefits Of A Bitcoin Futures ETF

A fair amount of experts have indicated that the bitcoin futures market is a better place for price discovery that leads the market. That shouldn’t be shocking to folks who’ve followed futures markets in other spaces and other derivative markets. As an example, the credit default swaps market is often viewed as a place that moves more quickly and responds more quickly to information than, say, the cash bond market. There’s a lot of evidence that may be true here in bitcoin as well. That’s important.

Crigger: How well do bitcoin futures really correlate to spot prices, though?

Hyman: You got to turn [that question] on its head a bit. We launched the ProShares Bitcoin Strategy ProFund (BTCFX) on July 28, and through Friday the BRR is up 51%, while the mutual fund is up 52%.

Crigger: When we talk about futures-based ETFs, it’s important to understand how the strategy rolls its contracts from month to month. Contango and backwardation can make a big difference in returns. Can you explain what sort of experience investors could expect from a front-month bitcoin futures fund?

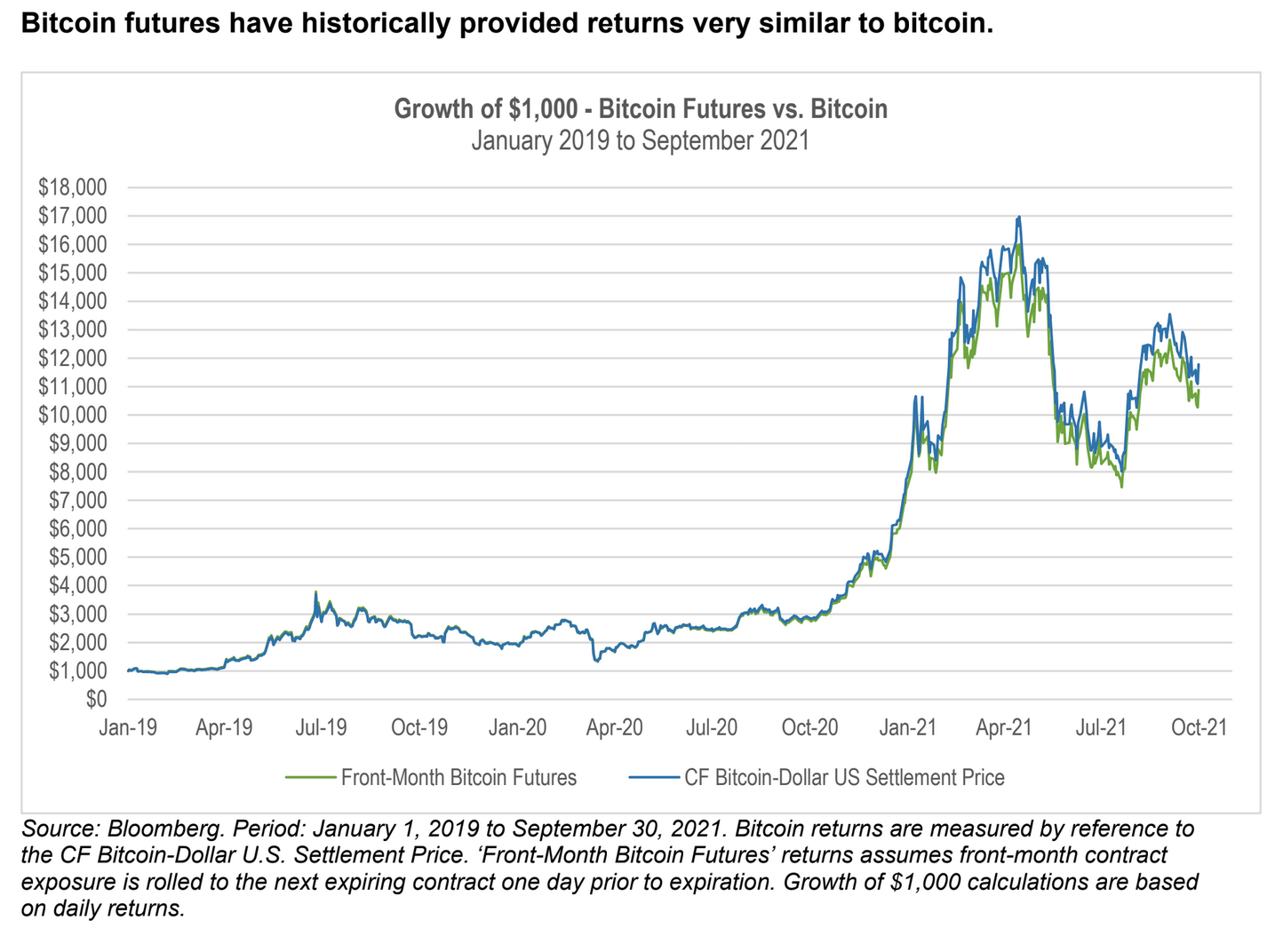

Hyman: History shows that the front month [futures contract] has quite high beta correlation to spot. If you look at what a simple rolling strategy would have done since the inception of the futures, it really tracks quite well. So there really shouldn’t be any surprises here.

Source: ProShares

If you want to reference things like roll cost and premia, then, first of all, there has been both contango and backwardation in the history [of bitcoin futures]. Both have happened.

But let’s look at an example. If you look at September, and the difference between the near month contract and the next nearest month, the difference on a daily basis at any given point in time would have been about 20 basis points. That annualizes to about 2.5%. We think that’s actually not a bad case, compared to other ways you might want to get exposure. But also remember that people quote it annualized. You might go, “Wow, 2.5% is a big number.” But that’s not the price difference between spot and the contract today; that’s the total annualized cost.

See also: What Does It Mean To “Roll” Bitcoin Futures?

Crigger: Another issue that comes up in the futures market is position limits. There’s a rule that one trader can only hold so many of the contracts in any given month, and any given asset. So if the ETF gets a whole bunch of money coming in very quickly and you grow to a very large size, would position limits become an issue?

Hyman: The position limits for bitcoin futures have actually doubled this week. So there’s going to be a lot more room than there was. And it’s a reasonable guess that those limits will alleviate more and more as we go forward.

But you can see the filing, and we’ve got some strategies in place if this high class problem happens. We would also certainly well communicate all that to the investment community.

Crigger: How do you see this ETF fitting within an investment portfolio?

Hyman: This fund is not designed to be three quarters of your portfolio! I don’t want to put numbers on it, but in an appropriate, single-digit percentage, it could be an important diversifier. Now you can put [bitcoin] right in your brokerage account along with everything else as a nice, prudent allocation. Maybe it’s your inflation hedge, or your virtual gold, or your alternative currency. It’s a real diversifier, and they are few and far between these days.

We’re not talking about the underlying use cases of bitcoin, though. They aren’t necessarily exactly the same thing as the portfolio use cases. But all of bitcoin’s use cases — its anonymity, the defi aspects, and so on —they’re important in terms of the growth of its value over time. I’d also note that the launch of our ETF itself is certainly part of growing the robustness of that ecosystem.

There are going to be a lot more participants in the market, which will add to the robustness, but they are two separate things. I guess I’d just say this: Futures are not second best — they are really good!

For more news, information, and strategy, please visit the Crypto Channel.