After a rush among issuers to file for spot bitcoin ETFs, followed shortly by a rush to file for ether futures ETFs, the environment for crypto-related ETFs looks significantly different from early 2023 when several crypto ETFs announced closures. What has changed since then and what does this all mean for crypto ETFs? Today’s note discusses common questions around the recent ether futures ETFs filings and what this could mean for spot bitcoin ETFs.

What’s different now from earlier this year?

2022 was brutal for crypto. Many retail investors who flocked to Bitcoin and crypto investments in 2020 were burned after Bitcoin prices declined by around 64%. It dragged down most other crypto-related investments with it. The decline was due to several high-profile bankruptcies and crashes. This includes Celsius Network, Terra Luna, and the more recent collapse of FTX in November 2022.

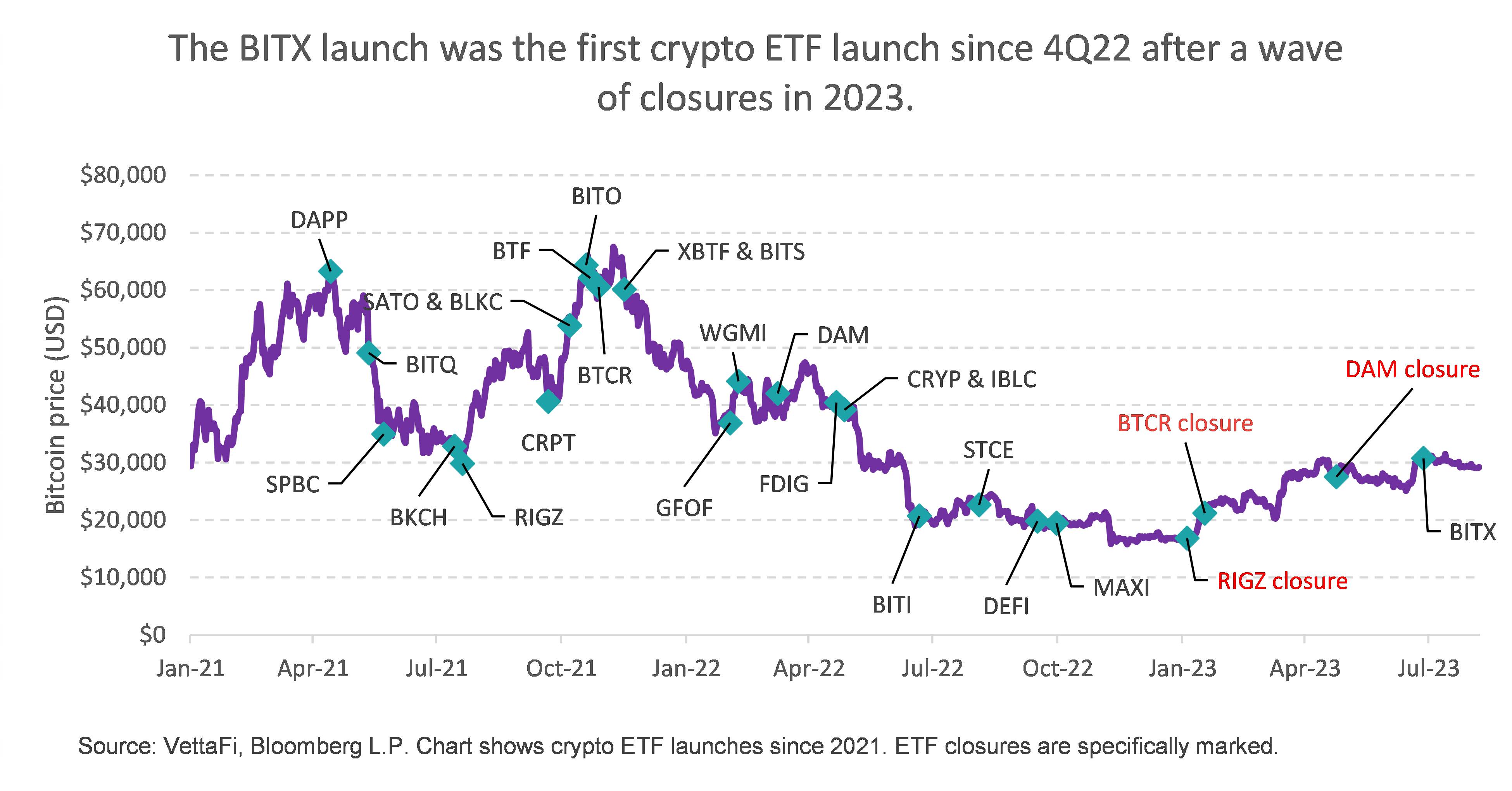

Bitcoin prices started 2023 off at lows so the eventual recovery led to Bitcoin price rising 76% YTD. Bitcoin futures ETFs like BITO were up 75%, and crypto equity ETFs which were down even more in 2022 outperformed the entire equity ETF universe YTD. But despite significant returns (+228% in the case of WGMI), investors shied away from even these funds. And several crypto ETFs closed in early 2023 including RIGZ, BTCR, and DAM. I believe that many retail investors were uninterested in crypto after losing money in 2022. They were not tempted even with the possibility of high YTD returns. And those that remained interested did not see a significant catalyst to add to their current holdings. See more here.

But news of Blackrock filing for a spot bitcoin ETF created more confidence for the approval of spot bitcoin ETFs — reviving the demand for crypto and narrowing the discount of the Grayscale Bitcoin Trust (GBTC). Since then, investors and analysts have been closely watching the SEC. Ether futures filings in early August have added to that momentum.

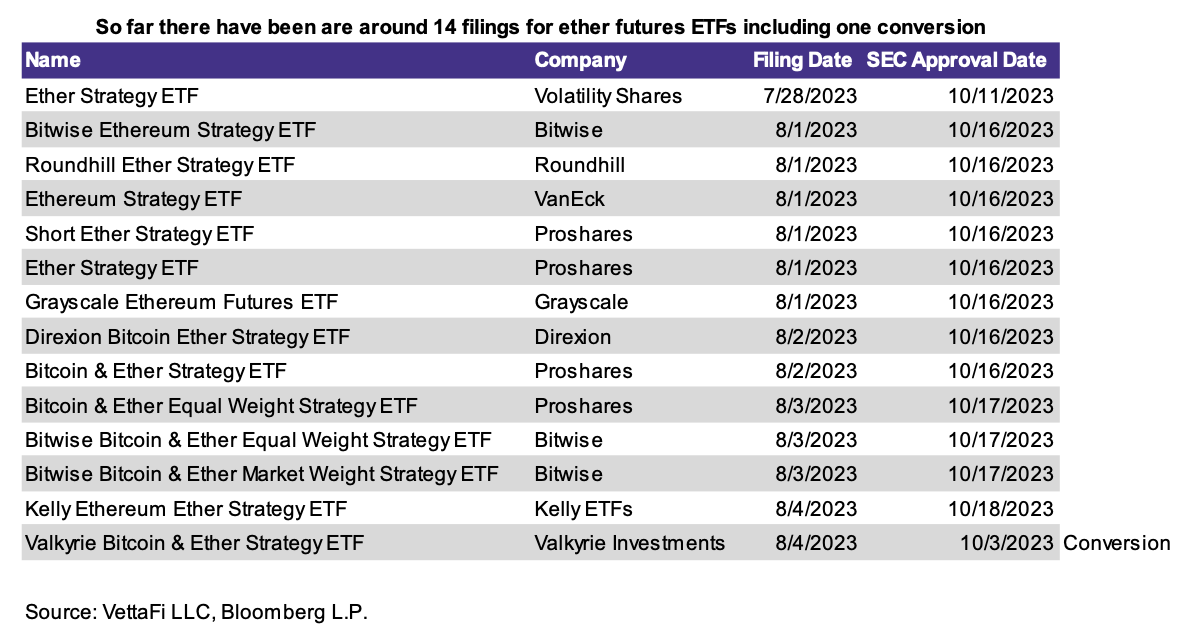

Will the SEC approve ether futures ETF filings?

No one can say for sure whether the SEC will approve ether futures ETF filings. But there seems to be a reversal in the SEC’s stance. Back in May, the SEC told several issuers to withdraw their filings for ether futures ETFs. But since then, the SEC has changed course and said it is ready to publicly consider these products. This doesn’t necessarily guarantee that they will approve them, but I think it’s likely that they will. Still, with few guidelines regarding the SEC treatment of crypto, I wouldn’t be surprised if they still delayed approving ether futures ETFs.

So far, we know that the SEC is more accepting of bitcoin futures vs. spot bitcoin. We also know that the SEC will distinguish a commodity from a security. Bitcoin, for example, has been classified as a commodity and is therefore under the jurisdiction of the U.S. Commodity Futures Trading Commission (CFTC). While the CFTC believes that ether is also a commodity, the SEC has been reluctant to call any cryptocurrency besides bitcoin a commodity. This classification issue could be a challenge in the approval of ether futures ETFs.

But is there even demand for ether futures ETFs?

Not all ETFs are meant to gather significant interest — some are meant to fill a space in the market. I think there is demand for ether-related ETF products. But with the fixation currently on spot crypto ETFs, I’m not sure there will be significant interest in more crypto futures products. I also don’t think that this demand will be nearly as big as the demand BITO saw when it was launched. It was the second most heavily traded ETF at its launch date. Additionally, the general appetite for crypto has still been poor. Even though crypto equity ETFs are currently the highest-performing equity ETFs YTD and investors talk about them often, there are very few investors actually investing in these. I think ether futures ETFs filings haven’t necessarily created more excitement for ether futures ETFs. Instead, it created more excitement for the possibility of spot bitcoin ETF approvals.

What does this mean for spot bitcoin ETFs?

I don’t think the approval of ether futures ETFs will be a direct pathway for spot bitcoin ETF approvals. By that, I mean that the relationship — if ether futures ETFs are approved, then spot bitcoin ETF will be approved—isn’t necessarily true. The comparison is more like a rolling snowball of progressive events that will eventually lead to spot bitcoin ETF approval. Look back at the recent timeline of crypto ETF launches. Blockchain equity ETFs launched in January 2018. But it wasn’t until May 2021 that the first ETF with crypto in its name launched. Then, the first bitcoin futures ETF launched in October 2021 and the first inverse bitcoin futures ETF launched in June 2022. After a brief dry spell with some ETF closures, the first leveraged bitcoin futures ETF launched in June 2023.

Now we potentially see filings for ether futures ETFs and a combined ether futures and bitcoin futures ETF. I believe these will come next and at that point — it would be difficult to think of more excuses to not approve spot bitcoin ETFs.

Bottom Line:

The SEC’s path for approval is still unclear. But the flurry of ether futures filings at the heels of the recent group of spot bitcoin filings proves that institutions still have significant interest in the crypto space. And they do not want to be left behind.

For more news, information, and analysis, visit the Crypto Channel.