While investors await a spot bitcoin ETF, the SEC accelerated its rollout of ether futures ETFs. So far, issuers have launched five ether futures ETFs and four combined ether + bitcoin strategies. One of those four is a strategy conversion. See initial coverage here. On the first trading day (Monday, October 2) these ETFs traded only around $6.5 million total. In comparison, the ProShares Bitcoin Strategy ETF (BITO), the first U.S. bitcoin futures ETF, traded around $550 million on its first day in October 2021. But despite limited fanfare, the launch of ether futures ETFs is still significant for the overall crypto ETF market. The following are major takeaways from the ether futures ETF rollout.

Takeaways:

- Spot vs. futures and BTC vs. ETH are large differentiators. Investors have been hearing for months about the advantages of spot vs. futures ETFs. So the launch of more crypto futures ETFs isn’t the most exciting news. Additionally, despite a weaker crypto market, bitcoin still has significantly more popularity than ether (49.3% vs. 18.4% market dominance, according to CoinMarketCap). That also explains the limited trading activity. Another big difference is that BITO launched near the peak of the crypto bull market in 2021, while the crypto market itself now has significantly less popularity.

- ETH alone is not as attractive. Because ETH is less popular than BTC, it makes sense that a combined strategy could be more interesting to investors. This is probably one of the reasons BTF had more trading activity compared to the pure ether ETFs.

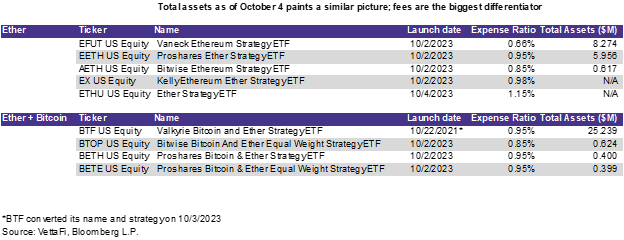

- Fees are important. With so many similar products, fees will be an important differentiator on who can accumulate the most assets. Currently the Vaneck Ethereum Strategy ETF (EFUT) has the lowest fees (0.66%) and has gathered the most assets out of the ether futures ETFs.

- But big names are also important. The ProShares Ether Strategy ETF (EETH) saw the second highest trading volume (shares) and highest trading value out of the pure ether futures ETFs. ProShares is well known for being the market leader in bitcoin futures ETFs with its ProShares Bitcoin Strategy ETF (BITO).

- A step in the right direction. The SEC rolling out ether futures ETFs means it will likely not rescind approval of existing bitcoin futures ETFs (some believed that the SEC may go this route in order to avoid bitcoin spot ETF approvals).

- Despite limited volume, these launches were still significant for the industry. With bitcoin futures ETFs, ether futures ETFs, and Grayscale’s win in court, the SEC has less reason to continue to deny spot bitcoin ETFs.

- Spot bitcoin ETF launches still exciting. Despite little fanfare for ether futures ETFs, when spot bitcoin ETFs are launched, they will likely see much higher trading volume. But there will also likely be a similar issue with too many products launching at once. Fees will also be a big differentiator here.

For more news, information, and strategy, visit the Crypto Channel.