This weekly update tracks some of the largest cryptocurrencies by market share: bitcoin and ether. We’ve also included XRP, as it was one of the largest cryptocurrencies when this series began. According to Wikipedia, a cryptocurrency is “a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, to control the creation of additional units, and to verify the transfer of assets.”

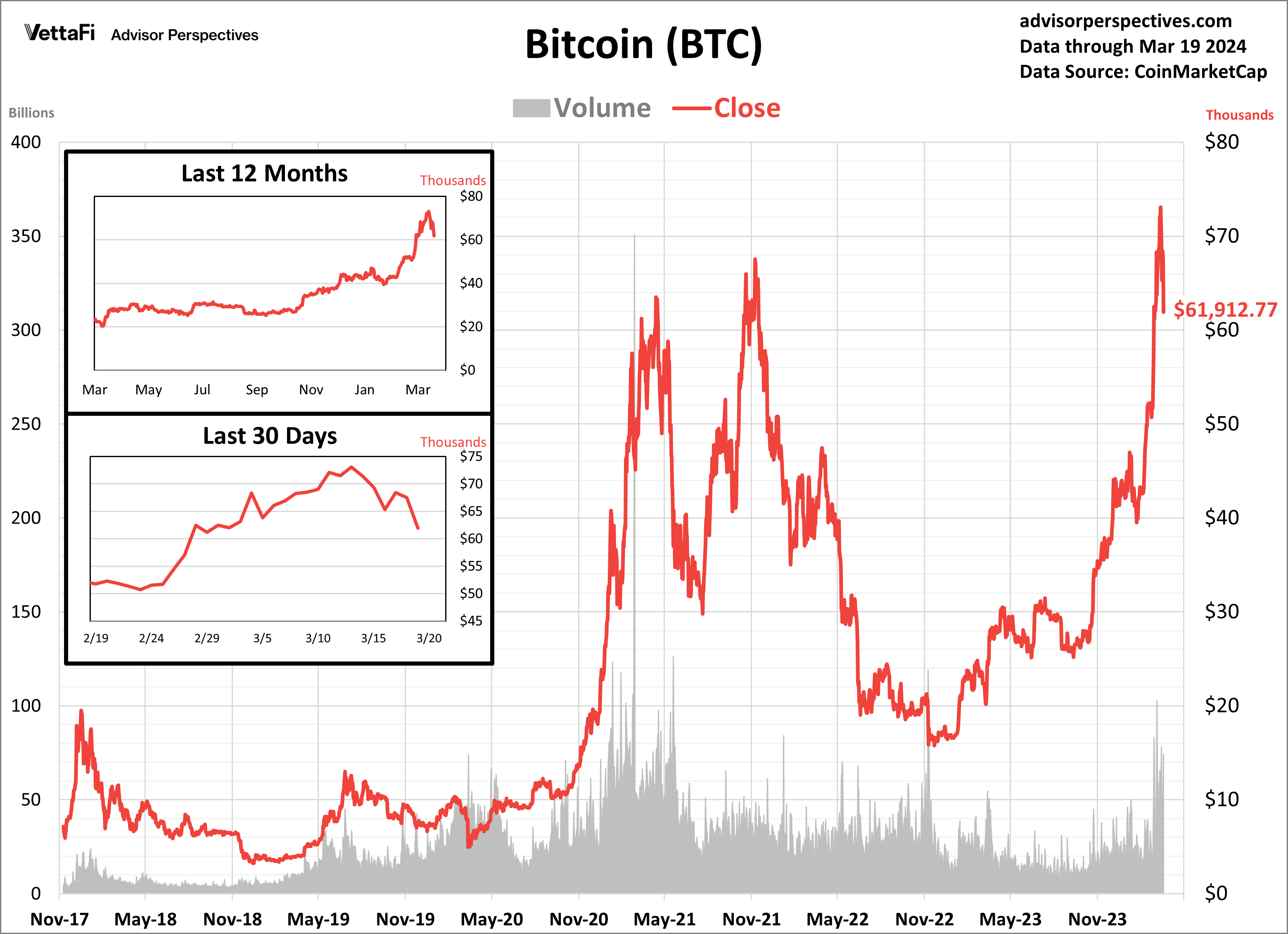

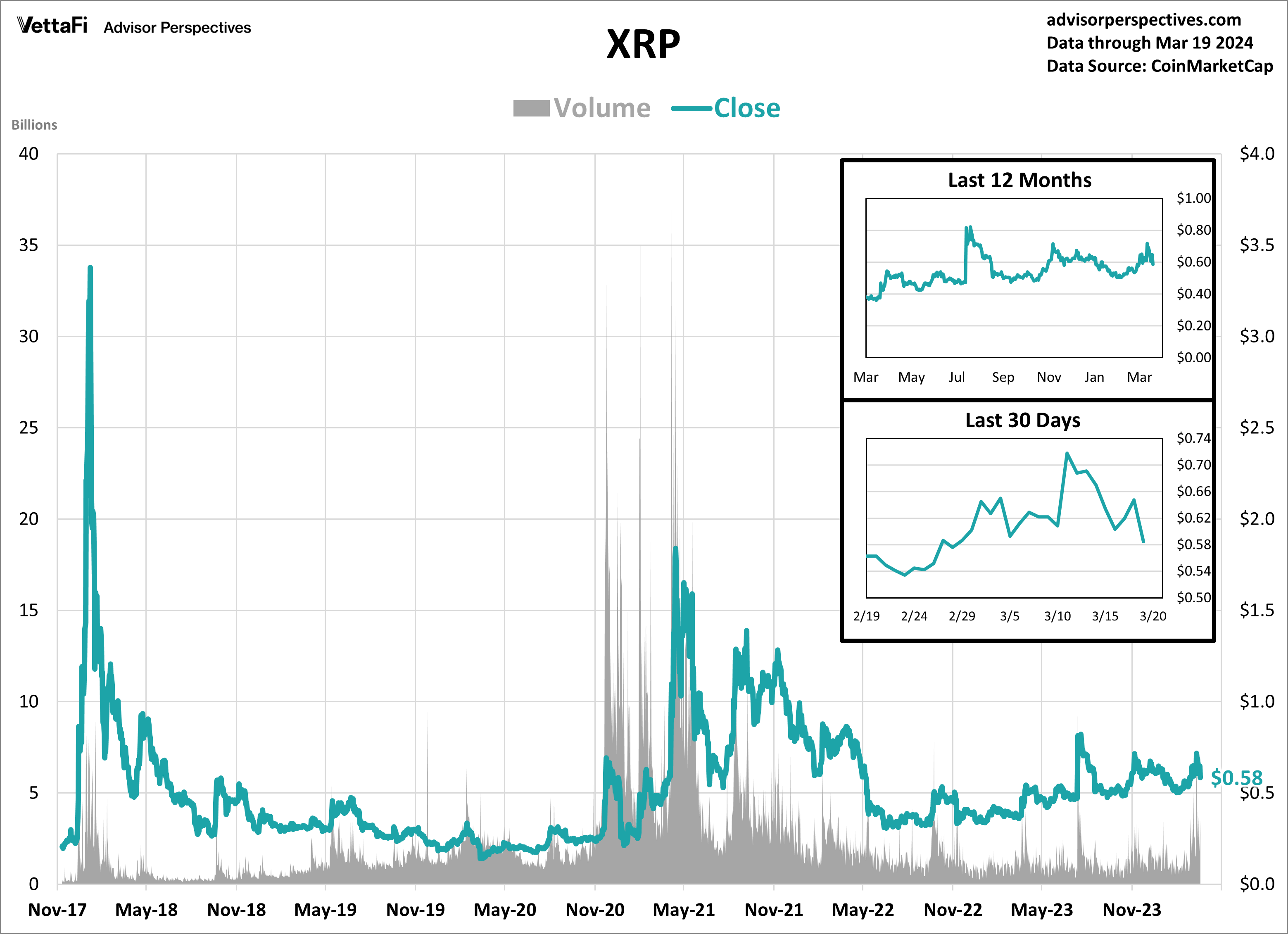

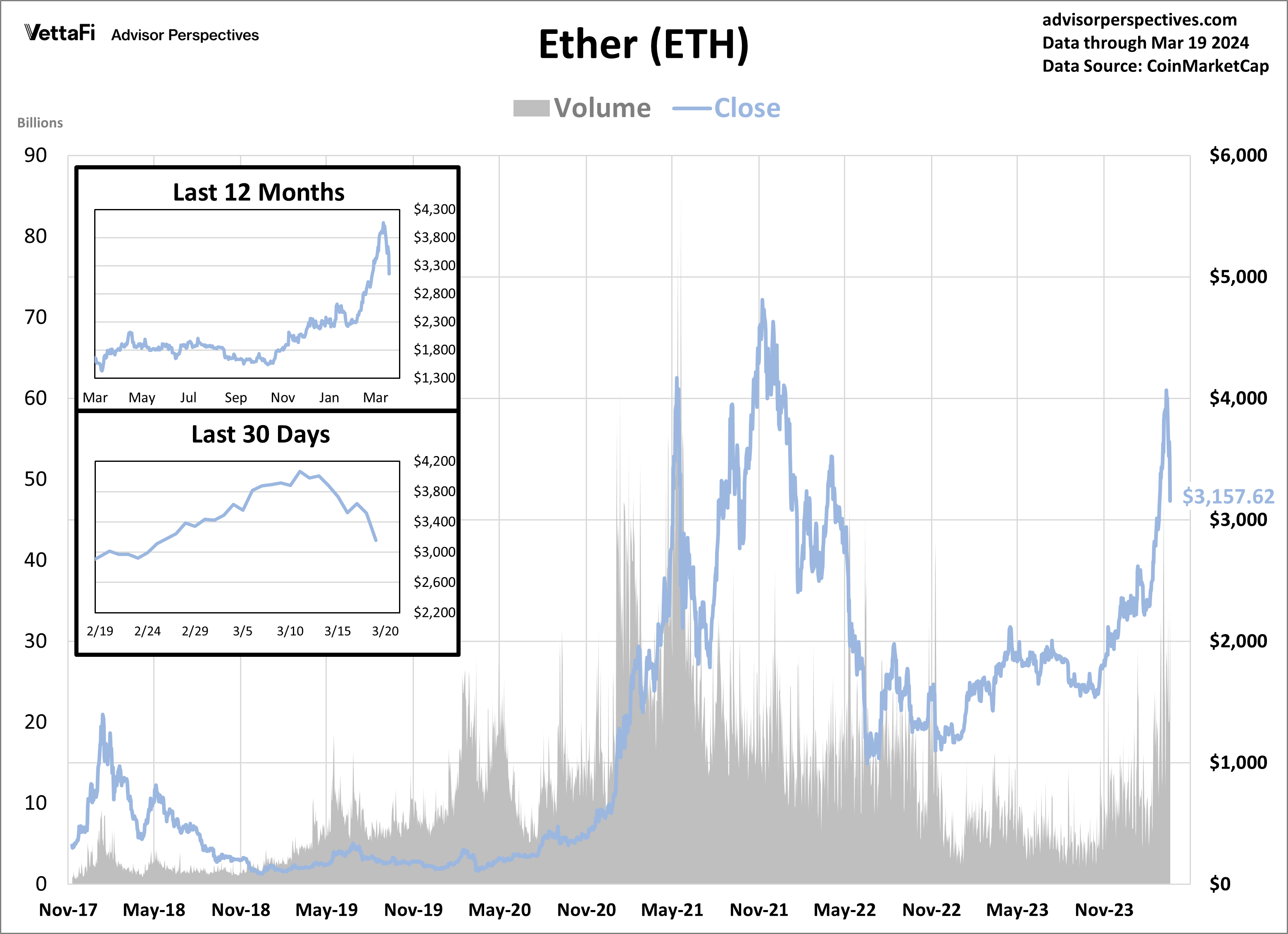

Bitcoin was the world’s first cryptocurrency and decentralized digital currency. The first bitcoin transaction occurred in early 2009 and has since grown worldwide. Ether is another cryptocurrency run on the Ethereum blockchain platform and has the second largest market share, despite being the newest of the three with its launch in July 2015. XRP, which is owned by Ripple and launched in 2012, was one of the larger cryptocurrencies for some time until new coins joined the market. We’ve included it here for reference.

The third-largest market share of cryptocurrency, tether, is a token “backed by actual assets” which includes one US dollar, one euro, or loans to affiliate companies and is controlled by the owners of Bitfinex. It’s a controversial cryptocurrency due to its alleged manipulation of crypto pricing. It is called a “stable coin” because it was designed to always be worth $1.00. We do not chart it because its price rarely changes.

For a better understanding of crypto market cycles, read more here.

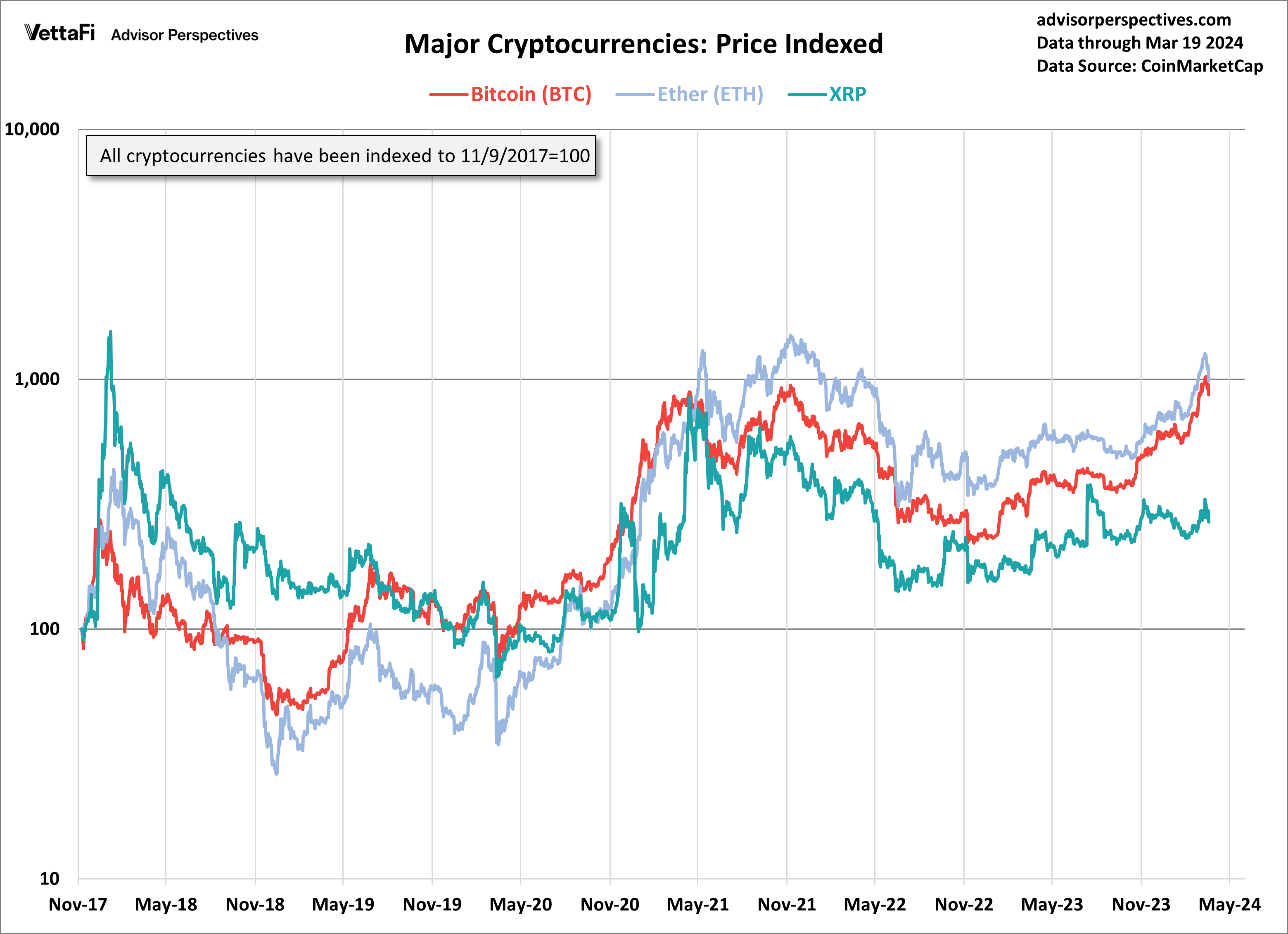

The Latest Crypto Data (through March 19, 2024)

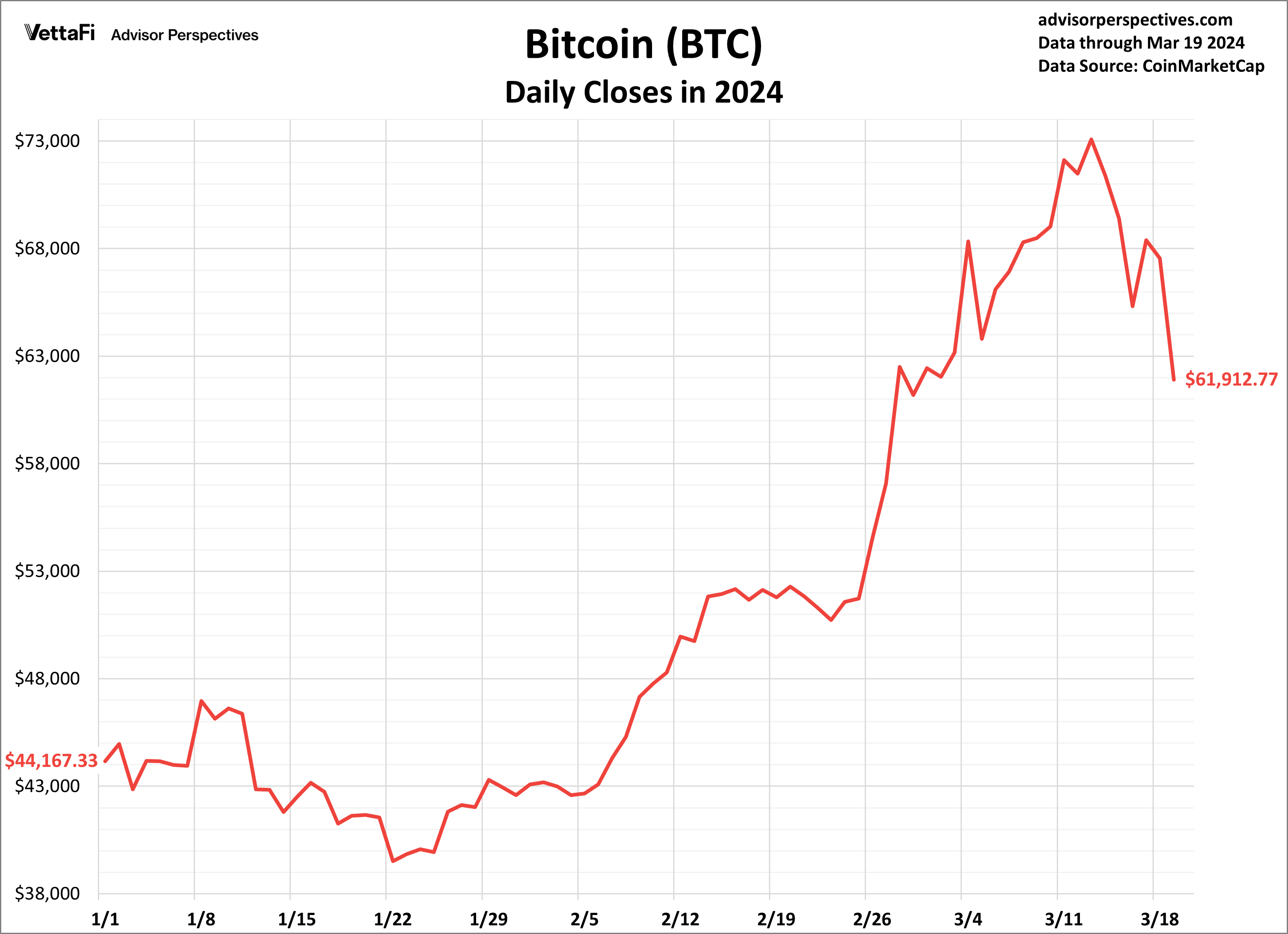

Bitcoin’s price tumbled below $62,000 this week after reaching an all-time high just one week ago. BTC is currently up ~40% year to date.

XRP’s price fell for the first time in six weeks and is now down ~7% year to date.

Ether’s price sharply declined, falling more than 20% from one week ago. ETH is currently up ~34% year to date.

An index has been created in order to chart these three cryptocurrencies together, considering their significantly different pricing histories. Ether tops the chart, i.e., the price of an ether has changed the most out of all three cryptocurrencies.

On January 10th, the SEC approved spot bitcoin ETFs from a range of issuers such as Grayscale Bitcoin Trust ETF (GBTC), iShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB). Here are some of the quick takeaways from the spot bitcoin ETF launch.

Other ETFs associated with cryptocurrencies include: ProShares Bitcoin Strategy ETF (BITO) ProShares Short Bitcoin Strategy ETF (BITI), VanEck Ethereum Strategy ETF (EFUT), and Bitwise Ethereum Strategy ETF (AETH).

Originally published on Advisor Perspectives.

For more news, information, and analysis, visit the Crypto Channel.